[ad_1]

US stocks on Wednesday suffered their sharpest fall since the early months of the coronavirus pandemic as weak results from consumer bellwethers stoked concerns about the impact of inflation and choked-up supply chains on corporate earnings.

The benchmark S&P 500 share index fell 4 per cent, its biggest loss since June 2020, with 98 per cent of stocks in the index declining on Wednesday.

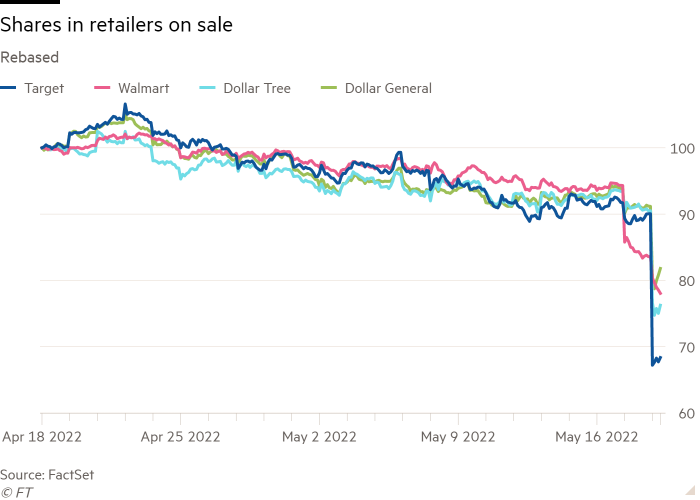

Target, the retailer, led the declines, plunging 25 per cent after it said higher freight, wage and fuel costs and disrupted logistics would hit its profit margins. The warning came a day after Walmart, the world’s largest bricks-and-mortar retailer, cut its earnings guidance and said it had also been wrongfooted by broad inflationary trends.

The lacklustre quarterly reports sparked selling across US exchanges as investors, fearing an economic slowdown, cut positions across their portfolios. Tech giants including Apple, Nvidia and Amazon all dropped more than 5 per cent, with the tech-dominated Nasdaq Composite down 4.7 per cent.

“There’s a beginning of a deterioration in the [economic] growth story,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “And it’s started to get picked up in [corporate] earnings.”

Target’s share-price fall was its worst daily decline since 1987, a gloomy milestone also reached by Walmart in the previous session. Walmart slipped further on Wednesday, while fellow retailers including Dollar Tree, Costco and Best Buy all tumbled more than 10 per cent.

“The Walmart [and] Target numbers are very concerning, as they show the consumer is reducing discretionary purchases while company margins return to pre-pandemic levels,” said Eric Johnston, the head of equity derivatives and cross asset at Cantor Fitzgerald. “These are two big aspects of our bearish thesis.”

The flight from risky assets prompted rallies in government bonds and other assets perceived as safe havens. The yield on the 10-year US Treasury dropped 0.09 percentage points to 2.89 per cent. Yields fall when prices rise. The dollar index, which measures the buck against a basket of peers, also halted its recent slide to climb 0.5 per cent.

The S&P had climbed 2 per cent on Tuesday, in a shortlived rebound after the worst streak of weekly losses for global equities since 2008.

Analysts cautioned that Tuesday’s jump was a bear market rally, where downtrends in equity markets are punctuated by short bursts of relief, as investors remained nervous about rising interest rates compounding a global economic slowdown.

The dour mood in markets has come as leading central banks, which had pinned borrowing costs close to zero and bought government bonds at unprecedented rates at the start of the pandemic, reverse their supportive policies. The Federal Reserve has raised interest rates by 0.75 percentage points since March and signalled further sharp increases on the horizon.

“Stock market weakness has mainly been driven by tighter financial conditions, but what has not yet been priced in is the potential for a moderation in growth and, accordingly, earnings,” said Candice Bangsund, portfolio manager at Fiera Capital.

“We’ve been of the view for some time that earnings expectations are overly optimistic given the inflationary environment, which is likely to squeeze profit margins.”

Elsewhere in equities, Europe’s regional Stoxx 600 share index fell 1.1 per cent. Hong Kong’s Hang Seng index added 0.2 per cent, while Tokyo’s Nikkei 225 closed 0.9 per cent higher.

Sterling fell 1.1 per cent against the dollar to just under $1.23 after data showed UK inflation hit a four-decade high of 9 per cent in April, increasing worries about the weakness of the economy.

Brent crude, the oil benchmark, slipped 2.5 per cent to $109.11 a barrel.

[ad_2]

Source link