Since December 2021, gas prices have soared, and businesses face substantial increases in their gas renewal quotes. Our business gas experts are often asked, what costs are actually included within my business gas bill, and why have they gone up so substantially?

Our explainer looks at the costs involved in providing your commercial property with a gas supply.

Business gas rates explained

The most common gas tariff paid by businesses is a fixed-rate contract to supply gas for one to three years at a fixed rate per unit kWh plus a daily standing charge.

To find the different gas tariffs available to your business, use the AquaSwitch business gas comparison service.

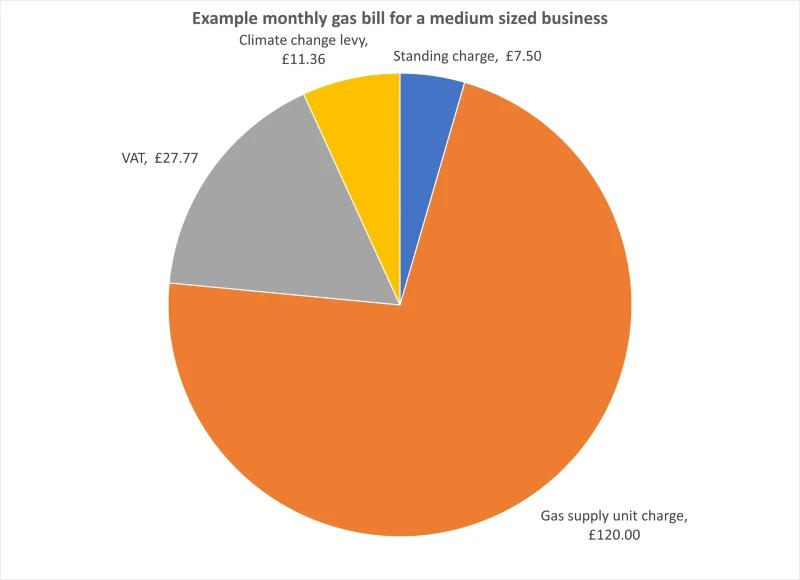

Let’s look at the business gas bill of a typical medium-sized business with the following tariff:

Tariff: Fixed-Rate

Unit rate: 6.00p

Daily standing charge: 25p

In a month where the business consumes 2,000 kWh of gas, the business gas supplier will issue a bill for £166.63 broken down into:

For more information on commercial gas bills, check out our guide on understanding your business energy bill.

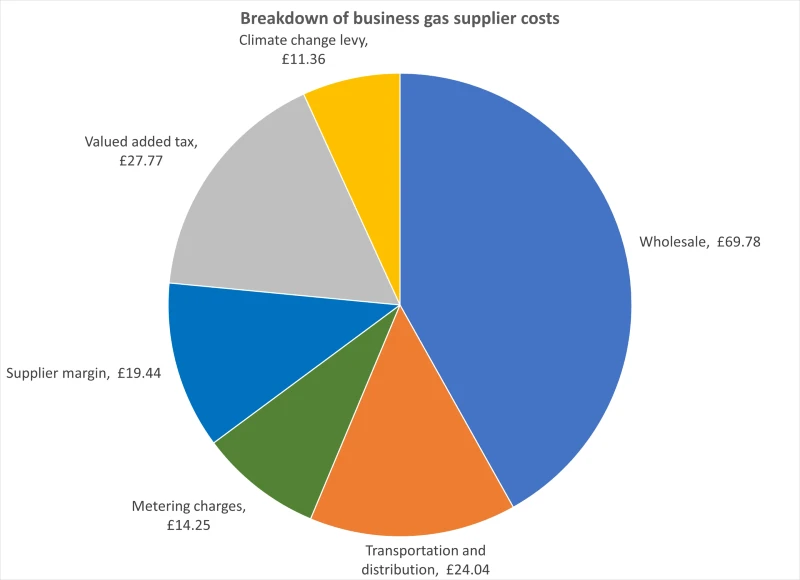

What costs make up a business gas bill?

The gas industry is complex, with many organisations working to provide your commercial property with a reliable natural gas supply.

Here’s a breakdown of the costs typically included within the same medium consumption gas bill above.

Let’s take each of these costs in turn:

The wholesale cost of gas

The majority of business gas rates come from the wholesale purchase of natural gas. Natural gas is a fossil fuel extracted from underground gas reserves. About half of the natural gas used in Britain comes from Scotland’s North Sea reserves, with the rest imported from gas-producing nations like Norway, Sweden and Russia.

A business gas supplier purchases natural gas in bulk from the wholesale market to meet the supply needs of its customers. The wholesale cost of gas is paid to the operators of the North Sea gas fields or to gas importers.

Wholesale costs are the most significant component of all commercial energy bills. Wholesale gas prices are volatile and rise and fall significantly depending on the state of the market. Discover the latest wholesale gas market trends with the AquaSwitch business energy price update.

Transportation and distribution costs

The national gas grid is a network of pipes that moves gas from the North Sea to the properties that use gas. Business energy suppliers incur costs for moving the gas to your business property, including:

- A system operator capacity charge – A charge paid to the national grid to cover the cost of making gas capacity available to each supplier.

- A shaping charge – A risk management charge the suppliers need to pay for using the national grid to transport gas.

- Unidentified gas losses charge – A charge shared among all users of the national gas network that covers losses in the network from illegal extraction and unregistered supply points.

Metering charges

The gas used by commercial properties is measured using a gas meter. Your business gas supplier incurs the following metering costs:

- Meter rental charge – A meter asset management company owns commercial gas meters. Your business gas supplier pays this company to rent your meter during the period they are supplying gas to your property.

- Meter reading charge – Business gas meters are periodically read and checked by your business energy supplier. Employing the metering team is a significant cost incurred by your supplier.

Where your property has a smart energy meter, your business energy supplier will also incur additional costs for the communication system that provides automatic meter readings.

Business gas supplier margin

Business gas suppliers are for-profit companies that seek to earn a margin on top of all their costs. Business gas suppliers compete with each other to offer the most competitive tariffs.

Find the best deals for your business with our business energy comparison service.

Value-added tax

VAT is a consumption tax that the UK government levies on the sale value of goods and services. Most businesses pay 20% VAT on all elements of their business energy bills.

Check out our complete guide to VAT on business energy bills to find out if your business can apply to pay VAT at a reduced rate on energy bills.

Climate change levy

The climate change levy is an additional tax paid by businesses that consume electricity or gas. The tax is a part of the government’s approach to encouraging companies to reduce their greenhouse gas emissions.

The climate change levy is charged per kWh of gas consumed. Find out the latest rates in the AquaSwitch guide to the climate change levy.