[ad_1]

The biggest US banks are set to report bumper earnings from lending, benefiting from Federal Reserve interest rate rises even as they prepare for a potential recession.

In second-quarter earnings starting this week, analysts expect JPMorgan Chase, Bank of America and Citigroup to see growth in net interest income — the difference in what banks pay on deposits and what they earn from loans and other assets.

“Main Street banking has been incredibly pressured for the past decade, due to zero interest rates during most of that time. So now it’s finally going back directionally to a more normal interest rate environment compared to the last decade,” said Mike Mayo, banking analyst at Wells Fargo.

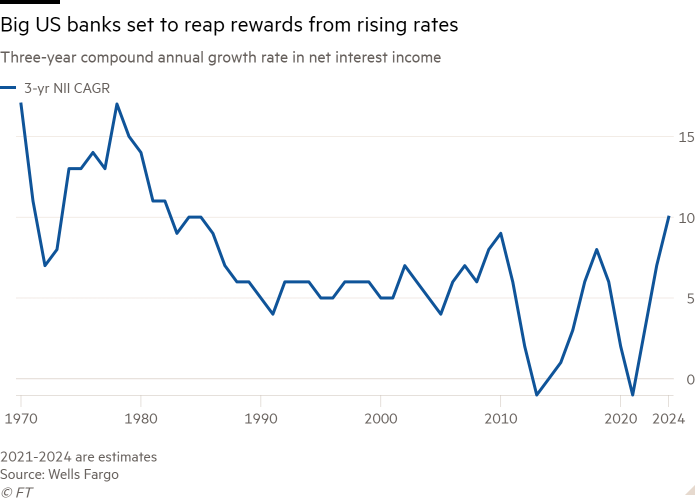

Banks tend to benefit from rising rates because they are able to increase charges for loans more quickly than they lift payouts for deposits. Mayo forecasts that the growth rate in net interest income from 2022 to 2024 will be the highest since the 1980s as the Fed continues to lift rates this year to combat inflation.

Demand for loans is also on the rise, especially in commercial and industrial lending and credit card loans, according to Fed data.

JPMorgan will be the first bank to disclose earnings on July 14, followed by Citi the following day, then BofA on July 18. Morgan Stanley and Goldman Sachs, whose businesses skew more towards investment banking and trading, report earnings on July 14 and July 18, respectively.

While banks benefit from higher rates, the speed at which the Fed is lifting rates is fuelling concerns of a US recession in the next 18 months.

Bank stocks typically are among the worst affected during downturns and analysts expect lenders will react to the darkening economic outlook by setting aside more capital to prepare for the risk of loans going bad.

“The real question then becomes, how aggressively do they build up the reserve in anticipation of an economic slowdown or a possible recession in the next 12 to 18 months?” said Gerard Cassidy, a research analyst at RBC.

So far, banks have said credit quality of borrowers has been strong, with many companies and retail clients still sitting on funds from stimulus programmes during the pandemic. Investors are watching for signs that this might turn.

“It’s nice to see a good quarter of loan growth and good indicators, but the focus will probably be more, how much longer can it persist if we’re actually heading into a recession?” said Jeff Harte, research analyst at Piper Sandler.

More proactive provisioning for loan losses is a feature of new accounting known by the name of “current expected credit losses” or “CECL”, which came into force in 2020.

“This is a quarter where banks either put up or shut up as it comes to reserves for problem loan losses,” Mayo said.

The growing recession risk comes amid a slowdown in investment banking activity, especially in equity capital markets from deals like initial public offerings.

On average, JPMorgan, BofA, Citi, Goldman and Morgan Stanley are expected to report a year-on-year drop of almost 40 per cent in investment banking fees, according to estimates compiled by Bloomberg. Analysts are forecasting overall revenues at those banks to fall by an average of around 4.6 per cent.

Trading revenue from volatile financial markets is expected to pick up some of that slack.

“You should see pretty strong trading activity offset by weak banking activity,” said Christian Bolu, a banking analyst at Autonomous Research.

[ad_2]

Source link