[ad_1]

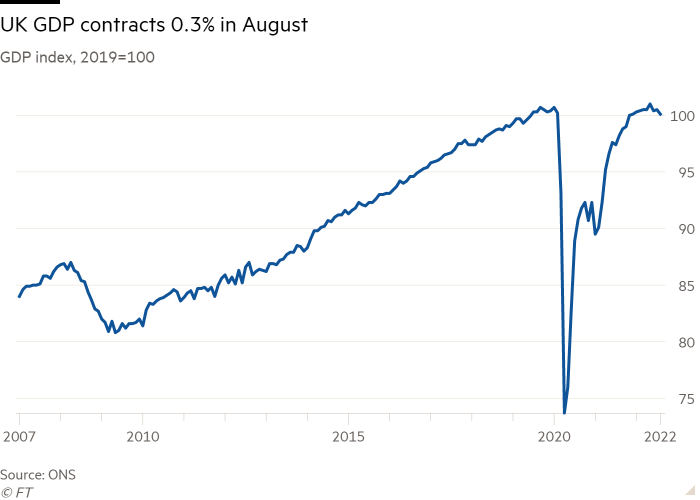

The UK economy disappointed expectations and shrank in August as the cost of living crisis hit household budgets and business activity.

Gross domestic product fell 0.3 per cent between July and August, according to data published on Wednesday by the Office for National Statistics.

Economists polled by Reuters had expected no month-on-month change.

In the three months to August, output was down 0.3 per cent compared with the previous three months, also lower than analysts’ expectations.

Industrial production contracted 1.8 per cent between July and August and services registered a 0.1 per cent fall.

Grant Fitzner, ONS chief economist, said part of the contraction in industrial output was due to the fall in oil and gas production caused by North Sea summer maintenance.

He added that health also contributed to the GDP decline, with a drop in the number of hospital consultations and operations.

Sports events also had a slower month after a strong July, while many other consumer-facing services struggled, with retail, hairdressers and hotels all faring relatively poorly.

Commenting on the GDP data, chancellor Kwasi Kwarteng highlighted soaring energy prices caused by Russia’s invasion of Ukraine, and expressed confidence that the government’s plan would “grow our economy”.

On Tuesday, the International Monetary Fund downgraded the UK economic outlook, forecasting a 0.3 per cent expansion next year, down from 3.6 per cent this year.

Brian Coulton, chief economist at the rating agency Fitch, expects a more severe downturn, with the economy shrinking by 1 per cent in 2023, reflecting market turmoil and the prospect of higher interest rates following the government’s large unfunded tax cuts announced last month.

Robert Alster, chief investment officer at the investment management company Close Brothers Asset Management, said that “a lot will depend on what the chancellor says in the Budget next month”, when the Treasury will seek to bolster confidence in the UK’s debt sustainability.

“Unless they succeed, financial conditions will remain tight, and are likely to weigh on growth,” he added.

[ad_2]

Source link