Within hours of launching bids for the Conservative party leadership following Boris Johnson’s resignation last week, senior candidates pledged sweeping tax cuts that threaten to leave a black hole in the UK’s finances.

The economy is set to be a defining issue in the race to become the UK’s next prime minister, with a dividing line already emerging between contenders focused on maintaining the Johnson government’s approach of investing in public services and those who wish to pursue supply side reform.

Rishi Sunak, the former chancellor and current favourite, made a coded attack on Tories putting forward unrealistic pledges, which he described as “comforting fairy tales”. In the video launching his campaign, he asked: “do we confront this moment with honesty, seriousness and determination?”

Sunak has yet to set out his full economic platform but is expected to argue that, as chancellor, his approach was responsible. His campaign said that “he will tackle inflation, get our economy growing, and cut taxes. He wants to use the newfound freedoms Brexit has given us, and the new mentality it can give us, to unleash growth”.

But several other contenders are proposing significant divergence from Sunak’s policies, notably former health secretary Sajid Javid, former health secretary Jeremy Hunt and foreign secretary Liz Truss, who is expected to formerly launch her campaign on Monday.

Other candidates, such as chancellor Nadhim Zahawi, foreign affairs select committee chair Tom Tugendhat and attorney-general Suella Braverman, have spoken of the need to reduce taxes but have not set out plans.

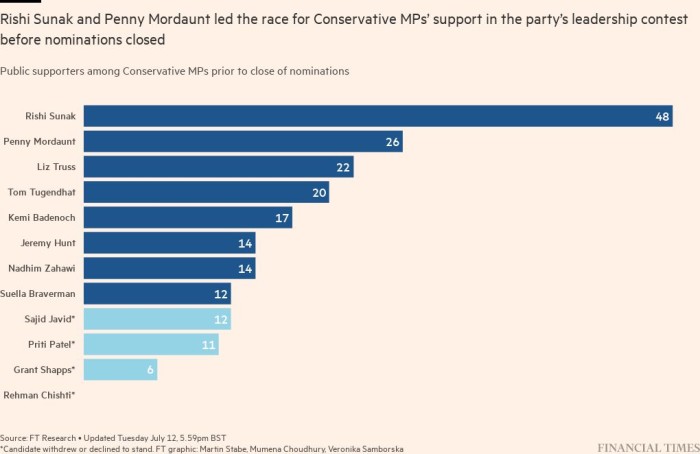

The pledges to cut taxes are designed to appeal to the 358 Tory MPs who will begin to choose a shortlist of candidates on Wednesday before the final two contenders are voted for by the party membership.

Research by The UK in a Changing Europe think-tank suggests that Conservative MPs are significantly to the right of Tory party members on economic issues, such as inequality and taxes, and are further to the right of voters.

Paul Johnson, director of the Institute for Fiscal Studies think-tank, said the scale of the pledges by several of the candidates would not be straightforward to fund. “Everyone would like lower taxes but [the candidates] need to be clear about consequences,” he said.

He added that the contenders would face two difficult choices to fund their pledges. “Using that headroom on tax cuts almost certainly means big real terms cuts in public pay, for example,” he said. “An alternative of course is to borrow more, contrary to the Conservative manifesto. It may be risky in a highly inflationary environment,.”

Financial Times analysis of pledges from the leading candidates shows how much each would cost.

Javid, whose promises would cost £49.4bn, has adopted the most expensive set of tax cuts of any of the candidates so far. The former chancellor proposes to cut the corporate tax rate by 1 percentage point a year until it was 15 per cent. As chancellor, Sunak planned to raise the rate from 19 per cent to 25 per cent next April.

The cost of a 15 per cent corporate tax rate compared with a 25 per cent corporate tax rate would be £34bn a year, according to HM Revenue & Customs ready reckoner tables, which give estimate of the broad costs of tax cuts.

Javid has also pledged to reverse the government’s planned rise in national insurance, which will raise £18bn a year by 2025-26, although the cost would be lower — £13bn a year by 2025-26 — if he also reversed the increased threshold for paying contributions.

His other proposals include bringing forward the income tax cut planned for 2024 to next year, costing £6bn a year until 2024-25, and further fuel duty reductions, which would cost £2.4bn for every 5p duty cut from a litre of petrol or diesel.

Assuming the fuel duty and income tax proposals are temporary, the total cost of the Javid package of tax cuts would be between £47bn and £52bn a year, or around 2 per cent of gross domestic product.

In an interview with the Sunday Telegraph, Javid defended his approach. “There are some that say you can’t have tax cuts until you’ve got growth. I think that’s wrong. I think that is fundamentally flawed analysis. I think you can’t have growth until you’ve got the tax cuts.”

Hunt did not go as far as Javid when he made his bid for leadership, with proposals costing a total of £39bn. He proposed an immediate cut in corporation tax to 15 per cent, costing £34bn, alongside a five year business rates holiday in the most deprived parts of the country. The cost of this would be determined by how the areas were defined.

An ally of Hunt said his tax cut plan would “unleash the growth that’s been missing from our economy for too long: Ireland’s big corporation tax cuts in the 90s created the ‘Celtic tiger’ economy; Jeremy’s will do the same for the UK.”

However, by lowering corporation tax to 15 per cent, the effective average rate, once allowances have been taken into account, would leave the UK in breach of the new OECD-agreed minimum global corporation tax rules.

This would enable other countries to collect the tax revenue earned from profits made in the UK, effectively eliminating any incentive for foreign investment from the lower rates while losing money for the exchequer.

Dan Niedel, founder of think tank Tax Policy Associates, said the UK tax reductions would be “utterly pointless” because London would be “giving up tax revenues to other countries”.

Truss has not yet pledged corporate tax cuts, but she has promised to reverse the government’s national insurance increase, which would cost between £13bn and £18bn a year by 2025-26, depending on whether the thresholds for payment were also reversed.

One ally of Truss said her pitch would “offer a departure on the economy. She will do a quick and smart spending review, among others things. Liz’s second and third priorities are economic growth. She would be bold on supply side reform, which is something Tory governments have promised for a long time but Liz would deliver.”