In the end, the survival instincts of his political party trumped Boris Johnson’s determination to survive. This is good news. Yet he has still been an immensely significant political leader, albeit a disastrous one. He has shifted the debate on core issues from solutions to symbols. This is true, above all, of Brexit, his enduring legacy. Johnson’s insistence on the trappings of sovereignty delivered almost the hardest possible Brexit. If the threat to break the Northern Ireland protocol survives him, as it might, yet worse could ensue.

Brexit is not the most important challenge confronting British policymakers. What is most important is simple to describe and hard to solve. This is the longer-term stagnation in productivity and real incomes. If the country cannot solve this, it is unlikely to solve much that matters. Even the current cost of living crisis is so bad because of the dreadful longer-term performance.

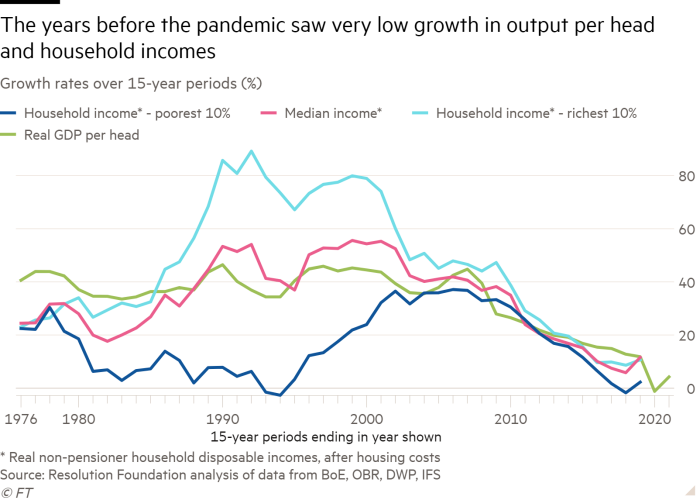

As the Resolution Foundation notes in its latest Living Standards Audit, the 15 years between 2004 and 2019 — pre-Covid and pre-Brexit — were the weakest for growth in gross domestic product per head since the years between 1919 and 1934. Low growth in GDP per head caused low growth in household real disposable incomes: those for non-pensioners rose by 12 per cent between 2004-05 and 2019-20. This can be compared to an average rise of 40 per cent every 15 years since 1961.

Also significant have been changes in income distribution. Between 1980 and 1995, median non-pensioner household real disposable incomes rose by 37 per cent, but by 67 per cent for the top decile and only 3 per cent for the bottom one. Between 1992 and 2007, incomes rose by 41 per cent, 47 per cent and 37 per cent, respectively: growth then was both fast and widely shared, which was surely far better. But then, between 2004 and 2019, as median incomes rose by a mere 12 per cent, the top decile’s rose 11 per cent and the bottom’s 2 per cent: that was stagnation all round. In 2018, the distribution of disposable incomes was the most unequal in high-income democracies, after just the US.

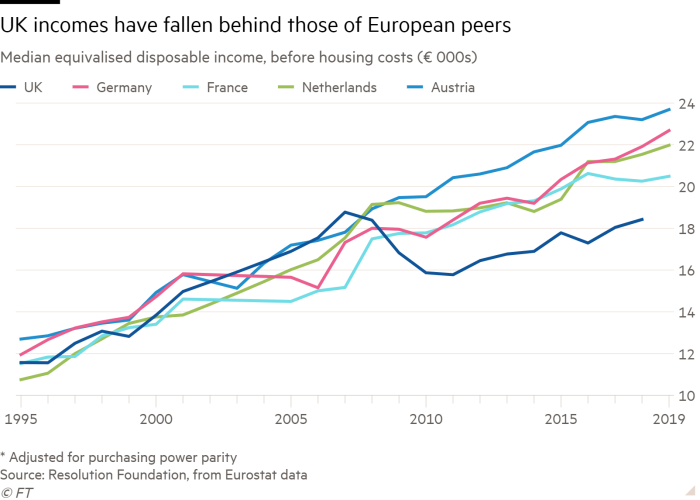

The performance since the financial crisis is not just bad by the UK’s historical standards. It is also bad in comparison with those despised European peers. According to the Resolution Foundation, between 2007 and 2018 real median household disposable incomes, adjusted for purchasing power, fell by 2 per cent in the UK. Over the same period, they rose 34 per cent in France, 27 per cent in Germany and 23 per cent in the Netherlands. As a result, UK median disposable household incomes were well below those of its western European peers: 9 per cent below those of France, for example, and 16 per cent below those of Germany (despite the heavy costs of unification).

This poor relative performance can also be seen in other areas. According to the Conference Board, UK output per hour fell from 84 per cent of German levels in 2007 to 81 per cent in 2015 and 79 per cent in 2021. The UK’s relative GDP per head has also fallen, from 92 per cent of German levels in 2007, to 87 per cent in 2015 and 82 per cent in 2021.

Things are even worse than these numbers suggest. Rising employment has offset stagnant productivity and supported incomes of the poor. But this is unlikely to help as much in future. Prosperity will depend even more on productivity.

Some will argue that income stagnation does not matter much, if at all. They say that policymakers should focus on wellbeing instead. There are indeed good reasons for governments to spend on mental health, wellbeing in schools, social care and climate change, as the World Wellbeing Movement recommends. But a necessary condition for such spending is likely to be a widely shared rise in prosperity. Indeed, the rise of populist politics itself seems a natural, albeit disastrous, outcome of the UK’s high inequality and stagnant real incomes. “Let them eat Brexit” is the ploy. That meal may have seemed enticing. But it will prove quite indigestible in the longer run.

The big question in UK economic policy is how to end the stagnation. The answer will not be tax cuts: taxes are already lower than in our European peers. Nor will it be deregulation: the UK economy is relatively deregulated, except in the use of land. It will depend on higher investment and bringing lagging firms and regions to the frontier. It will depend on improvements in corporate governance and capital markets, which encourage investment and innovation. It will depend on exploiting the energy revolution, to accelerate growth and lower emissions.

Candidates for the highest office must offer serious answers to these big challenges. And they must make those answers credible, despite the handicap of Brexit. Will they do so? I doubt it.