[ad_1]

When Mark Newman walked into the lobby of a Tokyo hotel for a customer conference late last year, the chief executive of the US chemical giant Chemours had the rare experience of being mobbed.

“I felt like I was a rock star,” Newman recalls. “I was swarmed by people saying: we need more.”

The “more” in question is a class of chemicals known as PFAS (per- and polyfluoroalkyl substances), critical to the production of everything from smartphones and firefighters’ suits to aircraft and electric vehicles — but especially to microchips. Anyone trying to secure supply for this year was going to be disappointed. One key PFAS, Newman says, “was completely sold out”.

But the chemicals so instrumental to chipmakers and to the development of the world’s data-led economy also have the potential for significant health and environmental impacts.

Policymakers are increasingly concerned over the risks of these “forever chemicals”, so called because they do not break down easily in the environment. The chemicals have been linked to fertility issues, reduced foetal growth, liver disease and increased risk of cancer in humans.

In March, the EU began a public consultation on proposals to ban the whole class of up to 10,000 chemicals, with a 13.5-year “transition” period for the chip industry. If implemented it would be “the broadest restriction [of chemicals] . . . in history,” according to Frauke Averbeck, who leads the proposal for Germany, one of the five European nations behind the campaign for a ban.

Some chemicals companies are not waiting around for regulation. In December, 3M announced it would halt PFAS production by 2025, reasoning that the risks were not worth the potential profit. It was already facing multiple lawsuits over past pollution.

The moves have set off alarms in the headquarters of the world’s top chipmakers and their suppliers, a long list of leading industrial companies including Intel, Infineon, TSMC, STMicroelectronics, BASF and many others.

After 3M’s decision, Intel and TSMC summoned suppliers to meetings. “They want to make sure chip production can continue and won’t be affected because of the 3M exit,” says one US chip equipment supplier to TSMC and Intel. Suppliers were also quizzed on the implications of a European ban and growing restrictions in the US.

Even with the EU’s proposed transition period, chipmakers and their suppliers will need to develop a whole new class of chemicals and overhaul production processes across multiple sectors. Many industry insiders think it is not possible in such a timeframe.

But a ban with no substitute chemicals to take the place of PFAS could threaten Europe’s heavily subsidised ambition to snare 20 per cent of the global chip market by 2030 — and send ripple effects across a much broader swath of industries, from cars to energy. The quandary demonstrates the difficulty of meeting the demands of modern technology without ruining human health and the environment.

“Without some PFAS, semiconductor manufacturing is simply not possible,” says a leading European chip executive. “There are no alternatives in the market yet.”

‘Wonder’ materials

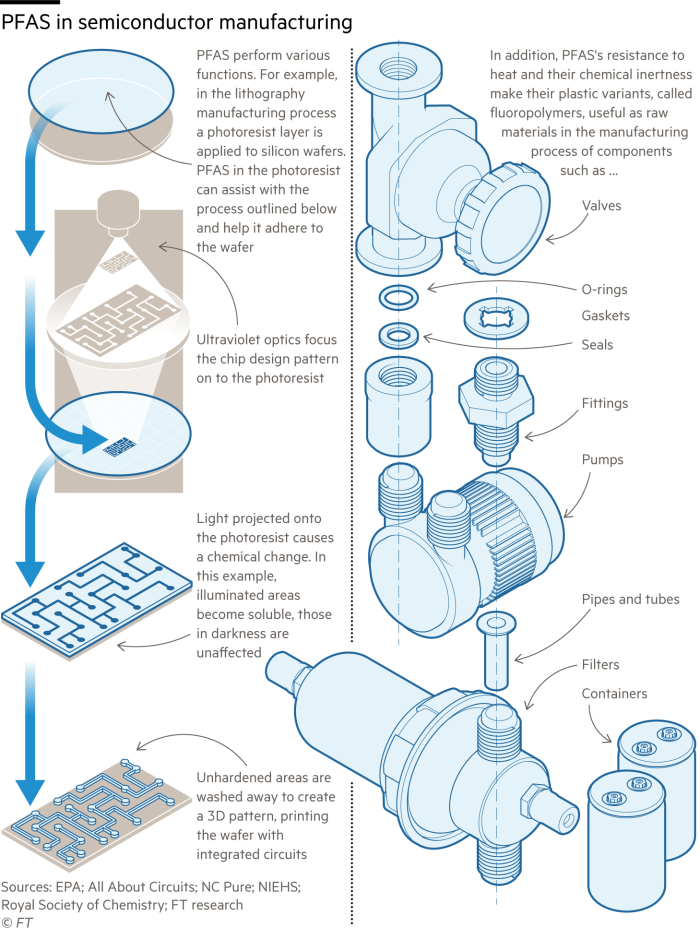

Built on a chain of linked carbon and fluorine atoms, PFAS contain one of the strongest bonds in organic chemistry, making materials derived from them highly resistant to water, oil and heat.

Companies such as Chemours, Daikin of Japan and European chemicals makers Arkema and Solvay are leaders in production of these wonder materials.

In chipmaking, components made of or coated with PFAS are highly resistant to the corrosive chemicals used, guaranteeing the purity of the manufacturing processes and underpinning the quality of cutting-edge chips.

But the bonds are so strong that PFAS molecules in discarded materials do not break down easily, and instead accumulate in the environment and human organs. Scientists are increasingly concerned about severe health consequences. Studies have found PFAS in the blood of 99 per cent of Americans and unsafe levels in the drinking water and soil of both US and European citizens. The US Environmental Protection Agency has warned that even near-zero levels of PFAS could pose a threat to human health.

According to the Nordic Council of Ministers, European PFAS-related health costs could reach up to €84bn a year for the treatment of diseases linked to exposure such as liver damage, kidney cancer and thyroid disease. The cost of reversing environmental and health damage could be as high as €2.4tn per year, says Chemsec, a non-profit partly funded by the Swedish government. At present, there is not an effective way to clean the environment of PFAS on a large scale.

But replacing PFAS is no simple task. Fluoropolymers, the hard plastic type of PFAS, are viewed by many chip and chemical executives as the most challenging to substitute. They are used to make critical coating materials and chemical-resistant parts in the chip supply chain, such as in factory pipes, pumps and seals. The semiconductor sector consumes 45 per cent of the fluoropolymers used in the electronics industry, according to the European Chemicals Agency.

One leading chemicals supplier experimented with replacing some of the 153,000 PFAS-based gaskets used in its German manufacturing plant. “We tested many different materials, including . . . the plastics that Lego bricks are made of. But the leakage of chemicals . . . were 1,000 times higher than the PFAS-based ones. That makes our plant not safe at all,” the executive says.

A number of PFAS producers — Chemours, Daikin, 3M, AGC, Arkema, Solvay and Shandong Dongyue — control about 60 per cent of the global fluoropolymers market. Only two — Chemours and Japan’s Daikin — produce the specific high-end plastic that can be turned into the equipment needed in advanced chipmaking, FT checks confirmed.

The regulatory uncertainties are hindering plans to expand capacity to meet rising demand from the chip sector, says Chemour’s Newman. The prospective EU ban would sabotage Europe’s semiconductor plans, pushing investment out of the bloc and, he adds, would be “unenforceable”.

Many of the chemicals companies, such as Bayer, Arkema and Solvay, argue the EU should take a “differentiated” approach to regulating PFAS. Those not proven to be unsafe, and which are critical to key industries, should be allowed, several executives argue.

But Chemtrust, an environmental charity, estimates it could take thousands of years to determine the safety of every compound because there are so many of them. It took several years to get global agreement on the elimination of just two types of PFAS under the Stockholm Convention on Persistent Organic Pollutants.

“Differentiated” has been tried before. When certain chemicals were restricted in the past, says Professor William Dichtel, part of a team at Northwestern University that has developed a method to break down PFAS, “they just replaced them with other PFAS which now show evidence of being just as bad or even potentially worse.

“By regulating them you create a tremendous financial incentive . . . to provide solutions that are safer.”

The clock is ticking

Some chemists and environmentalists believe that the semiconductor industry has simply not tried hard enough to find safer solutions.

Yet companies insist they have tried to find alternatives. TSMC — the world’s biggest contract chipmaker with Apple, Nvidia and Qualcomm as clients — has been working on substitutes since 2006 and says it has “made progress” in photolithography, which places precise integrated circuits on silicon wafers.

While TSMC says it wants to cut out PFAS in the future, it will not say when. “It will take time to verify new chemicals and materials that we are using in the manufacturing processes,” it says.

Bosch, the German engineering company which supplies chips to the car industry, also says that more time for change is needed, echoing the view that a legal rule to ban PFAS “too early” will endanger Europe’s competitiveness.

Kevin Gorman, senior vice-president at German pharma giant Merck, a key supplier to the chip industry, says the company’s scientists have been working on PFAS-free alternatives since 2020. “More work is required to bring them to the level needed for commercial use,” he says. “We are still several years away.”

But it is clear the clock is ticking. Apple, as one of the tech industry’s biggest users of the chemicals, late last year committed to phasing them out over the long-term.

Such pledges have opened up opportunities for potential disrupters. Massachusetts-based Impermea Materials is working on PFA-free solutions for food packaging and textiles, and is now venturing into tech.

“No one was willing to make the switch to non-PFAS materials because their argument was that PFAS is working tremendously better than all the alternatives,” says David Zamarin, Impermea’s founder and CEO. “But now with so many regulations, things could change.”

But customers will have to accept that the newer products will initially cost more. “Our solutions, in one case for an electronics coating, could be three times more expensive than what our potential clients are looking for,” says Zamarin.

Even those who believe that PFAS should be banned agree with the industry, however, that alternatives will not be available soon. Zhanyun Wang, a PFA specialist and researcher with Empa, Swiss Federal Laboratories for Materials Testing and Research, estimates it will take more than 10 years for any new chemicals to be adopted widely.

“In some use areas, such as the semiconductor industry, a lot of research will be needed to phase out PFAS. It’s a big challenge but we need to start the exploration now,” says Juliane Glüge, an environmental scientist and PFAS expert with Switzerland-based ETH Zurich.

The case for regulation

The FT contacted more than 20 chip suppliers in Europe, the US and Asia, to ask about their PFAS plans.

Only a few, including TSMC, Merck and Bosch, said they had a long-term reduction plan to eliminate the chemicals. Intel has pledged no “new” PFAS use in its supply chain.

Companies such as Samsung, Nvidia, Qualcomm, Broadcom, Texas Instruments, GlobalFoundries, ADI, ASML, NXP, Infineon, STMicroelectronics, Lam Research, Applied Materials and BASF declined to respond, or directed questions to industry associations and lobby groups.

One of those associations is the Sustainable PFAS Action Network, based just outside Washington DC, which claims that any restrictions on PFAS could affect US industries that support 6.2mn jobs and contribute more than $1tn towards US gross domestic product.

The industry has also enlisted advisers to petition Brussels hoping to delay the ban or gain exemptions. A quarter of companies spending more than €3mn a year on lobbying the EU are leading chemical producers: Bayer, Dow Europe and BASF.

According to LobbyFacts, a tool for investigating lobbying at EU institutions, together they spent €12mn in 2022, with either PFAS or the EU framework to regulate toxic chemicals, called Reach, listed as areas of focus.

The European Chemical Industry Council spent €10mn last year on EU lobbying generally and had at least five high-level meetings with EU officials in the second half of 2022 on the EU PFAS framework specifically.

“The sector has consistently been able to water down or postpone regulation aimed at protecting human health and preventing environmental pollution,” says Vicky Cann, a Corporate Europe Observatory researcher.

Regulation is needed to level the playing field for companies anxious about competitive disadvantage, says Mikael Kahn, a PFAS expert at Suez, one of the world’s leading waste and water groups based in Paris.

“It will take billions of dollars of investment from the chip and electronics industry every year to tackle PFA pollution,” Kahn says. Companies are being pursued in the courts over the pollution they have caused; when 3M was sued by the Belgian government in 2022 it had to pay $581mn for clean up costs. Chemours sets aside hundreds of millions of dollars every year to clean up past pollution.

“If there are no regulatory pressures, no chipmaker or tech company would want a significant cost hike or to spend a lot of money if they are the only ones to shoulder the cost,” Kahn adds.

Some chemical industry lobbyists admit that companies will need to accept the inevitability of tighter restrictions.

Instead of fighting a ban, “the better approach might be seeking unlimited time for [exemptions to the ban] for some vital industrial applications after the restriction goes ahead”, says Andreas Geiger, managing partner of Brussels-based Alber & Geiger, an EU government relations law firm.

That does not mean that the chip industry should continue with the status quo, say PFAS critics.

Martin Mulvihill, a chemist and founder of Safer Made, a cleantech venture capital firm, believes the chemicals are overused. Not every task requires the high levels of performance offered by these materials.

“We have already seen in certain sectors like food and textile that we absolutely have been able to eliminate PFAS,” Mulvihill says. “I’m not saying we can get to 100 per cent elimination (for the chip industry) but I bet we can get rid of 70-80 per cent.”

Additional reporting by Peggy Hollinger

Graphic illustration by Ian Bott

[ad_2]

Source link