[ad_1]

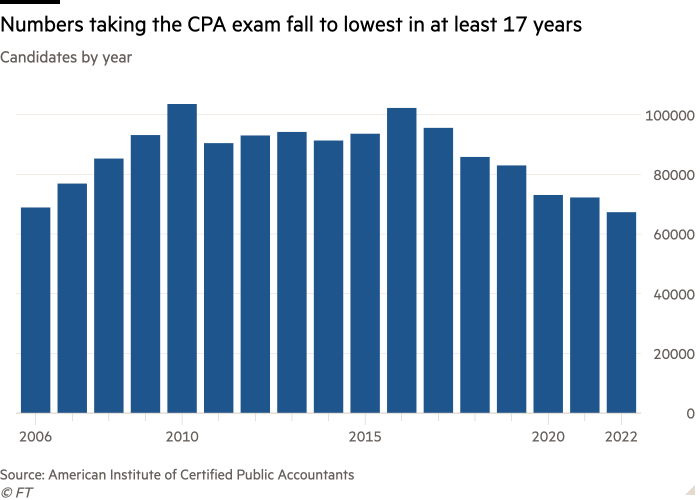

Accounting firms in the US are being urged to revamp their business models to attract more young people after the numbers taking exams to enter the profession plunged to the lowest level in at least 17 years.

New figures from the American Institute of Certified Public Accountants showed the shortage of CPA candidates that has plagued the profession in recent years worsened in 2022, dashing hopes for a quick rebound from the pandemic.

The shortage of new entrants comes at the same time as a wave of baby boomer retirements and threatens to weaken firms’ ability to perform the accounting, tax and auditing work that companies and individual clients rely upon.

The number of people taking CPA exams in 2022 was just over 67,000, down from 72,000 in 2021 and short of the institute’s forecast of 74,000, according to a note in AICPA’s annual report published this month. That was the lowest level since the beginning of records for the modern exam in 2006.

Details shared among the AICPA’s governing council showed that even that figure was flattered by candidates from overseas. The number of CPA exam modules being sat by US candidates fell more than 10 per cent year on year.

The Institute of Management Accountants, which runs an alternative certification for those going into company finance departments, told the Financial Times that it had also seen a decline in candidates in the US last year that totalled 5 per cent.

“It is becoming a crisis, and not just for accounting firms but for companies,” said Dennis Whitney, senior vice-president at the IMA. “Accountants are the backbone of companies not just for financial reporting purposes but for helping them make decisions.”

The AICPA said it had seen an uptick in new candidates in the early months of 2023 and was predicting a 10 per cent rise overall this year, in part spurred by upcoming changes to the exam. But this would still mean numbers are running 20 per cent lower than the average last decade.

Wayne Berson, the head of BDO USA, told the FT earlier this month that his firm planned to double its overseas staff and shift more work offshore because of the shortage.

The pipeline of new candidates has thinned because university accounting courses have become less popular in the US. Graduates’ starting salaries can also be at least one-fifth higher in finance or technology, and those careers may not require such an expensive professional qualification.

“With the length of time it takes to become a partner, the length of time it takes to achieve financial success, the financial model of CPA firms is archaic,” said Alan Whitman, who ran the accounting firm Baker Tilly for seven years until March.

“Firms need to work on improving the attractiveness of the profession through a variety of ways, the most important being reimagining the operating model and career progression,” he said.

The AICPA said it was increasing scholarships to help candidates and encouraging firms to offer competitive salaries. “You’ve got a generation that is looking for a shorter ROI,” said Mike Decker, AICPA vice-president.

[ad_2]

Source link