[ad_1]

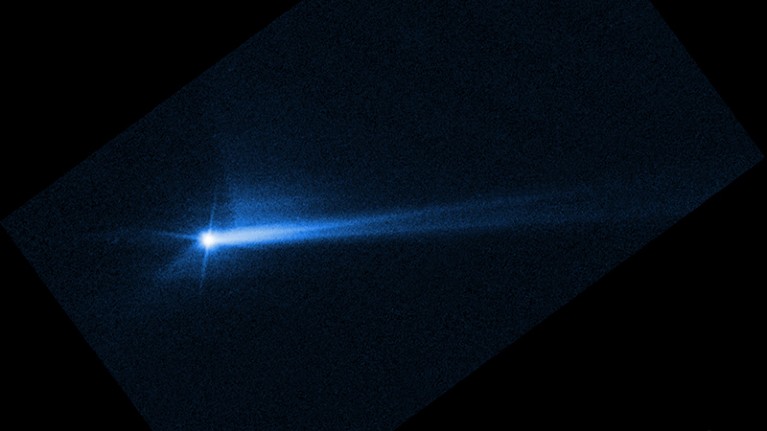

After the DART spacecraft ploughed into the asteroid Dimorphos, the Hubble Space Telescope captured images of the ejected plume of dust and debris that streamed for thousands of kilometres behind the space rock.Credit: NASA/European Space Agency/Space Telescope Science Institute/Hubble

Humanity diverts an asteroid for the first time

Humans have proved that they can change the path of a massive rock hurtling through space. NASA has announced that the spacecraft it slammed into an asteroid on 26 September succeeded in altering the space rock’s orbit around another asteroid — with better-than-expected results.

Agency officials had estimated that the Double Asteroid Redirection Test (DART) spacecraft would ‘nudge’ the asteroid Dimorphos (pictured) closer to its partner, Didymos, and cut the time it takes to orbit around that rock by 10–15 minutes. At a press conference on 11 October, researchers confirmed that DART, in fact, cut the orbital time by around 32 minutes.

Neither asteroid was a threat to Earth, but the agency tested the manoeuvre to prove that humanity could, in principle, deflect a worrisome space rock heading for the planet.

“This is a watershed moment for planetary defence, and a watershed moment for humanity,” said NASA administrator Bill Nelson.

Scientists will continue to observe the asteroid pair in the months to come, hoping to learn more about Dimorphos’s new orbit and whether DART’s impact introduced a ‘wobble’ to the asteroid.

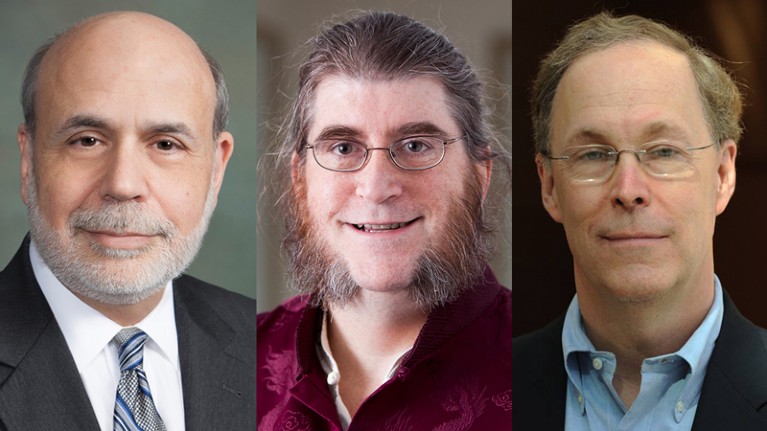

Ben Bernanke, Philip Dybvig and Douglas Diamond, recipients of the 2022 Nobel prize in economic sciences.Credit: The Brookings Institution, Washington University, University of Chicago Booth School of Business

Economists win Nobel prize for showing why banks fail

Three economists have won the 2022 Nobel prize in economics for their pivotal theory of how banks work and how they fail.

Ben Bernanke (pictured left) at the Brookings Institution in Washington DC, Douglas Diamond (right) at the University of Chicago in Illinois and Philip Dybvig (centre) at Washington University in St. Louis, Missouri, share the 10-million-Swedish-krona (US$915,000) award, formally the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.

Their research has helped to explain both why banks exist in the form they do and why they have fragilities that can devastate the economy, as shown in the Great Depression of the 1930s, and in the global financial crisis of 2007–09, when Bernanke was chair of the US Federal Reserve. Insights from their work enabled banks, governments and international institutions to cope with the COVID-19 pandemic without catastrophic economic consequences, the Nobel committee said on 10 October.

In 1983, Diamond and Dybvig presented a mathematical model showing that banks act as intermediaries, smoothing out the incompatibility of savers’ and borrowers’ requirements. Savers want to be able to invest and withdraw on a short-term basis, but borrowers such as businesses need long-term loans and commitments. Not all savers need to withdraw at the same time, so banks can absorb fluctuations to maintain ‘liquidity’ and enable money to circulate, with benefits to society.

The model also showed the weakness of this system. If enough savers are hit by an external ‘liquidity shock’ — an event that makes them want to withdraw their money — this can lead to panic, and to the collapse of banks, although safeguards such as deposit insurance can reduce the risk. “Financial crises become worse when people start to lose faith in the stability of the system,” says Diamond.

Also in 1983, Bernanke showed that this picture of the function of banks is consistent with what happened in the 1930s. He demonstrated that the crash was mostly driven by bank failures, rather than being their cause.

Bernanke’s awareness that factors such as feedback loops and confidence collapse can create instabilities were probably crucial for navigating the 2007–09 crisis, says Jean-Philippe Bouchaud, chair of Capital Fund Management in Paris. “When the crisis hit, I am quite certain he immediately understood what was going on, thanks to his deep knowledge of the 1929 crisis.”

Mixed plastics are difficult to recycle, but a new process shows how it can be done.Credit: China Photos/Getty

Heat and bacteria recycle mixed plastics

Mixtures of plastics, usually a headache to recycle, have been broken down into useful, smaller chemical ingredients in a two‑step process, reported in Science on 13 October (K. P. Sullivan et al. Science 378, 207–211; 2022).

The plastics problem facing the planet is exacerbated by the difficulty of recycling these robust materials. Techniques that chop up their long polymer chains have been difficult to implement at scale, partly because recycling needs to deal with mixtures of plastics.

A team led by Gregg Beckham, a chemical engineer at the US National Renewable Energy Laboratory in Golden, Colorado, developed a two-step process that uses chemistry and then biology to break down a mix of common plastics.

The team first used a catalysed oxygenation reaction to break down the tough polymer chains into oxygen-containing organic-acid molecules.

To turn these molecules into something more easily commoditized, the team used microbes that can be engineered to use different small organic molecules as a source of carbon. The bacteria produced two chemical ingredients that are each used to make high-quality performance-enhanced polymers or biopolymers.

[ad_2]

Source link