Western banks are steeling themselves for a $10bn hit on their forays into Russia, as they prepare to pull out of the country because of its invasion of Ukraine.

International sanctions have forced banks to consider turning their backs on a country that some lenders first entered more than a century ago.

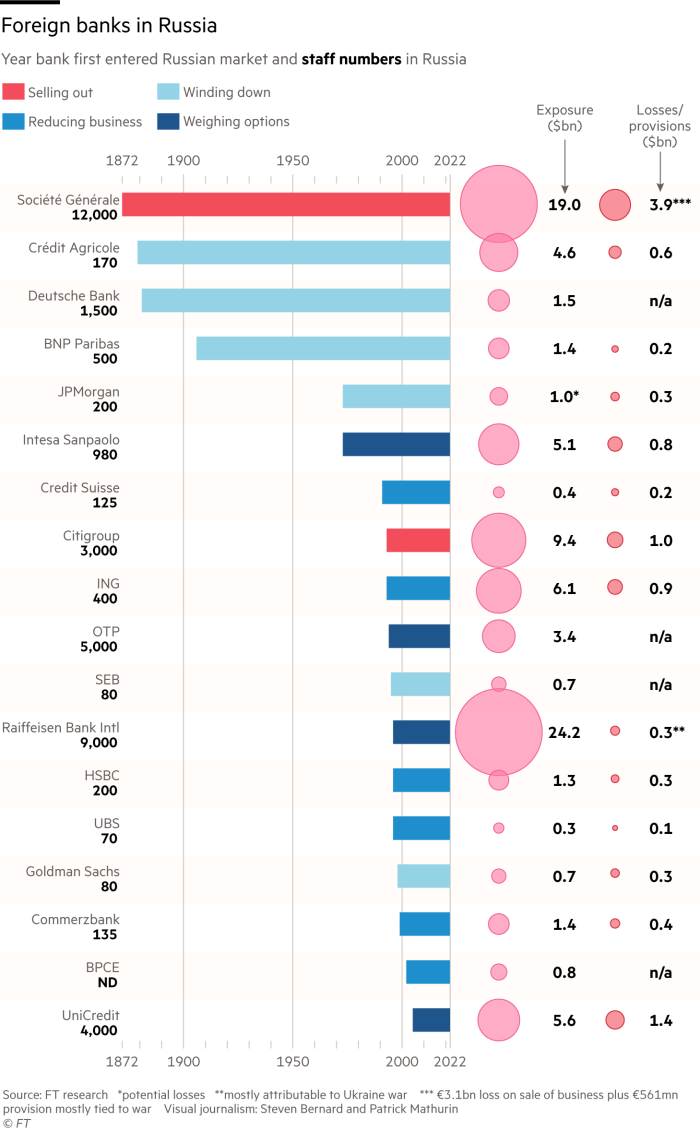

This week a string of European banks set aside billions of euros in provisions ahead of the closure of their Russian operations, following similar moves by US lenders last month. Western banks collectively have $86bn of exposure to Russia — with close to 40,000 staff — and are setting aside more than $10bn in expectation of losses on their ventures, according to Financial Times calculations.

Italian lender UniCredit this week set aside €1.3bn to cover potential losses, warning that it could face a loss of €5.3bn if its entire Russian business was wiped out. “I’m sure you have noticed the speed of change in terms of . . . waves of sanctions,” said UniCredit chief executive Andrea Orcel.

The bank, which has 4,000 workers and 2mn customers in the country, has been in Russia for 17 years.

Société Générale, the French lender that first entered Russia 150 years ago, has set aside €561mn of provisions for the first quarter, mainly tied to the war in Ukraine.

The bank said last month that it had agreed to sell its Rosbank subsidiary to an investment company founded by billionaire Vladimir Potanin and expects to take a €3.1bn ($3.3bn) hit on the sale. The French lender has 3.1mn retail customers in Russia and €18bn of exposure to the country. Rosbank employs 12,000 people.

Fellow French bank Crédit Agricole on Thursday announced a €389mn provision for its Russian exposure and said it was writing down €195mn for the total equity value of its Ukrainian business.

Austria’s Raiffeisen has 4.2mn customers and 9,400 staff in Russia, with €22.9bn of assets in the country — the most exposed of any foreign bank. Its €319mn of provisions for bad loans in the first quarter were mostly tied to the Ukraine war.

Credit Suisse last month said it had lost SFr206mn ($211mn) related to Russia’s invasion of Ukraine, with SFr148mn of trading losses and SFr58mn of credit losses.

Chief executive Thomas Gottstein said most of the bank’s 125 staff in the country were currently on paid leave as the bank weighs up how deeply to cut its operations. Around 4 per cent of the group’s wealth management assets, or SFr28bn, are linked to Russian clients.

Fellow Swiss lender UBS said it had cut its risk exposure by a third to $400mn since the start of the year, but this had brought $100mn of costs.

UBS added that EU and Swiss rules that prohibit accepting deposits of more than €100,000 from Russians not entitled to live in the European Economic Area affected 0.7 per cent of assets in its wealth management division.

Among US lenders, Citigroup has disclosed the largest direct exposure to Russia, warning of up to $3bn in potential losses linked to its operations in the country. The bank last month set aside $1bn for its Russian exposure.

Citigroup has been trying to divest its Russian consumer bank since last year and said in March it would expand its exit from Russia to include other operations.

JPMorgan Chase said it had provisioned roughly $300mn to cover markdowns on loans associated with Russia, although chief executive Jamie Dimon had warned investors at the start of April that the bank could lose up to $1bn on its exposure to the country.

Goldman Sachs as of March had $260mn in credit exposure, down from $650mn in December. The bank said in first-quarter earnings it had suffered a net loss of about $300mn on investments related to the country and Ukraine. Goldman has also said it is “winding down” its business in Russia while JPMorgan Chase has “been actively unwinding Russian business”.

Morgan Stanley said it had a “limited” direct exposure to Russia after giving up its banking licence in the country years before the invasion.