Welcome to Startups Weekly, a fresh human-first take on this week’s startup news and trends. To get this in your inbox, subscribe here.

I’ve been thinking a lot about silos, or the lack thereof, within startupland. There’s sometimes an artificial wall that is put up between companies at different stages of growth, when in reality, everyone is in the same room, clinking glasses and tripping over the same rug.

Let me be more precise. As the late-stage market has cooled down for tech companies, many early-stage investors say their portfolio companies aren’t too impacted because they’re years away from an exit and have enough capital to weather uncertainty. The same energy was on display this week at TechCrunch Early Stage. Stellation Capital’s Peter Boyce II coyly told me that, based on the term sheet he wrote yesterday, we’re still definitely in a founder-friendly market, while a pair of entrepreneurs not-so-subtly reminded me that experimental bets are still landing significant funding rounds.

I believe in optimism, and think of this time in early-stage startups as a recorrection, not a reckoning. But, new PitchBook and NVCA data does show that dollars are changing across the board.

For my full take, read my TechCrunch+ column: “Let’s stop pretending there are silos in startupland.” In the rest of this newsletter we’ll talk about social fintech, a new TC-1 on Kindbody and some history about hostile takeovers. As always, you can support me by forwarding this newsletter to a friend, following me on Twitter or subscribing to my personal blog.

Deal of the week

I covered Braid, a social fintech play that wants to make shared wallets with friends more mainstream. The startup recently launched a new twist on consumer payment links: People can set up a Braid Pool around any effort — a fund for this summer’s Italy trip, shared car gasoline expenses, or a kitty to put toward monthly book club snacks — and then send a link to friends who want to put cash in. The money then goes directly into the wallet and the creator can either manage it solo or together with participants.

Here’s why it’s important: Fintech can’t just build for the smartest, most pro-active person in the room, so I like that Braid is the middle ground between the friend that is always on top of splitting the bill at the end of dinner and the one who gets overwhelmed at calculating and dividing up the tip. Ahem, me. Sharing something as emotional as money definitely brings challenges — which I outline in my piece — but it also starts a fascinating conversation.

Honorable mentions:

Image Credits: Olena Poliakevych (opens in a new window) / Getty Images

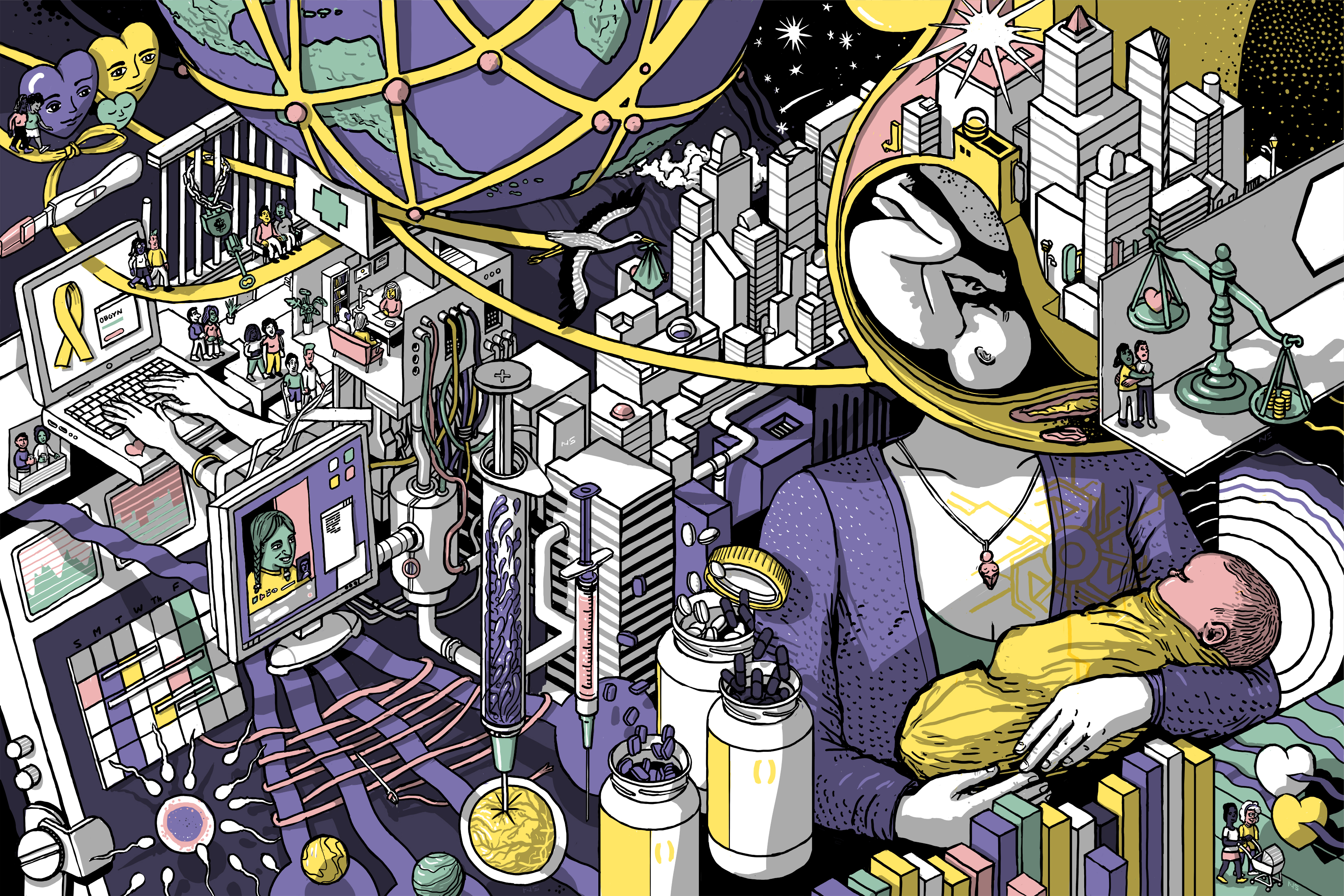

The Kindbody TC-1

Rae Witte dug into the story of Kindbody, a fertility startup that has raised $154.7 million in known venture capital to date with a revolutionary take: it’s important to make patients feel heard, and comfortable.

Here’s why it’s important: We know that “holistic health” is the term du jour for digital health companies, so there’s natural questions around if Kindbody’s take on fertility support is actually impactful. This, from one of the stories, gives me hope:

Fertility patients have diverse needs, and their experience on the portal reflects that. An LGBTQ+ patient won’t be asked the same questions or be given the same information as a heterosexual couple because their fertility journey is biologically different. When patients sign up, they include how they identify and the services they’re leveraging. This personalization continues throughout patients’ journeys, both during visits and through the portal.

The entire series:

Image Credits: Nigel Sussman

Hostile takeover, anybody?

Elon Musk made news, yet again, this week with his fixation on Twitter. This time the billionaire offered to buy Twitter, which sent share prices soaring and TechCrunch digging into the history of hostile takeovers. Put simply, a hostile takeover happens when a company or person tries to take over another company against the wishes of the company’s management. It’s spicy.

Here’s why it’s important: I mean, for anyone who is following the Twitter and Musk saga, it’s important to understand how realistic it is for a takeover to actually happen. As Kyle Wiggers taught me in his piece, these takeovers are usually doomed in some way, thanks to poison pills, and power balances.

If you have no idea what I’m talking about, take a minute:

Image Credits: HANNIBAL HANSCHKE/POOL/AFP / Getty Images

Across the week

- TechCrunch Early Stage 2022 was so damn fun. Thanks to everyone who attended, asked questions and said hello as it was truly a thrill for the team to meet readers in person after far too long. If you missed the event, a recap of all panels will roll out on TechCrunch+ over the next few weeks so stay tuned.

- Snag tickets for next month’s event: TechCrunch Mobility, a two-day hybrid conference featuring top investors, founders and thought leaders of the automotive industry.

- Finally, if you missed last week’s Startups Weekly, read it here: Crypto’s latest disruption may be investor expectations and listen to a podcast about it here: Venture needs crypto more than crypto needs venture.

Seen on TechCrunch

Faraday Future demotes founder as management shakeup continues

Lydia Hylton on why she joined Bain Capital Crypto despite ‘that tweet’

Windmill wants to drag window AC units, kicking and screaming, into 2022

SoftBank shifts LatAm plan with new early-stage spinout, Upload Ventures

Over 14,000 Etsy sellers are going on strike to protest increased transaction fees

Seen on TechCrunch+

Is Stripe cheap at $95 billion?

Why EV startups should’ve hit the brakes before merging with a SPAC

Dear Sophie: I didn’t win the H-1B lottery. What are my next steps?

An inside look at a Ukrainian fintech startup adapting to life during wartime

Mayfield’s Arvind Gupta discusses startup fundraising during a downturn

Until next time,