[ad_1]

US equities were mixed on Monday, with bank stocks buoyed by investors looking beyond the turmoil that has rocked the sector in recent weeks.

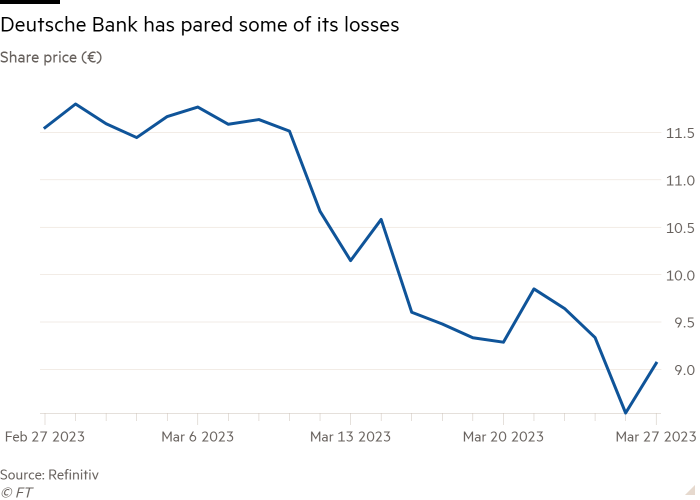

The KBW Nasdaq Bank index rose 2.5 per cent, while JPMorgan Chase was up 2.9 per cent, Citigroup up 3.9 per cent and Wells Fargo 3.4 per cent higher at the close. The moves echoed gains in Europe, where a 6.2 per cent recovery in Deutsche Bank’s shares following Friday’s sharp declines led markets higher.

The gains in US bank shares came as regulators confirmed First Citizens Bank would buy much of the collapsed Silicon Valley Bank, although it would lead to $20bn of losses for a deposit insurance fund paid for by US lenders. The deal sent shares in First Citizens up 53.7 per cent.

Meanwhile, the US lender First Republic’s shares rose 11.8 per cent in the wake of reports that regulators were considering expanding an emergency lending facility for banks.

Still, broader equity markets were uneven, as the gains among banks were partially offset by a decline in tech stocks that left the blue-chip S&P 500 index up 0.2 per cent and the Nasdaq Composite down 0.5 per cent.

“In the short term the market is trying to stabilise and consolidate,” said Antonio Cavarero, head of investments at Generali Insurance Asset Management. “The threat is another accident in the financial space; one can happen, two can be a coincidence, but any more would be a trend, so the market is hoping there won’t be another accident.”

In government debt markets, yields on two-year US Treasuries — which are most sensitive to interest rates — rose 0.25 percentage points to 4.02 per cent and yields on 10-year notes climbed 0.16 percentage points to 3.54 per cent.

In Europe, the region-wide Stoxx 600 closed up 1.1 per cent, Germany’s Dax also rose 1.1 per cent, France’s CAC 40 added 0.9 per cent and the UK’s FTSE 100 gained 0.9 per cent.

Yields on two-year German Bunds rose 0.17 percentage points to 2.57 per cent, while 10-year contracts rose 0.5 percentage points to 2.27 per cent.

After sustaining heavy losses in the previous session, there were gains for European banking stocks, with the Stoxx 600 banks index, which comprises the region’s biggest lenders, rising 1.5 per cent.

Deutsche’s slide on Friday came after its five-year credit default swaps climbed to 200 basis points as investors bet on which bank might be next to encounter difficulties after the failure of Credit Suisse. Deutsche’s CDS eased to just over 180bp on Monday, per Markit prices quoted by Refinitiv.

“The recovery could reflect investors having a few days to reassess and decide things aren’t as bad as they seemed,” said Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics.

Despite concerns that their rate-raising agendas might dent financial stability, central banks on both sides of the Atlantic focused on their fight against inflation by increasing interest rates last week.

Economists are betting that the US Federal Reserve will pause its rate-raising cycle at its next meeting in May before cutting rates in September, while they are expecting a 0.25 percentage point increase from the European Central Bank and no cuts in 2023.

Morgan Stanley’s global chief economist Seth Carpenter said: “Ideally, central banks would separate the issues, using different tools to deal with macroeconomic issues versus financial stability, but they know an interaction exists. So, they are watching developments in the banking sector to see if continued rate hikes have an outsized or non-linear effect on financial conditions. To date, their conclusion has been no.”

On Friday, investors will get an update on the core personal consumption expenditures price index, the Fed’s preferred inflation gauge, along with consumer price index data for the eurozone.

Stocks fell in Asia after Chinese industrial profits were much weaker than expected, slumping by 22.9 per cent. The CSI 300 fell 0.4 per cent and the Hang Seng index lost 1.8 per cent.

Oil prices surged, with international benchmark Brent crude rising 4.2 per cent to $78.12 a barrel, its largest daily increase since December. West Texas Intermediate, the US equivalent, increased 5.1 per cent to $73.08, on pace for its largest daily rise since July.

[ad_2]

Source link