[ad_1]

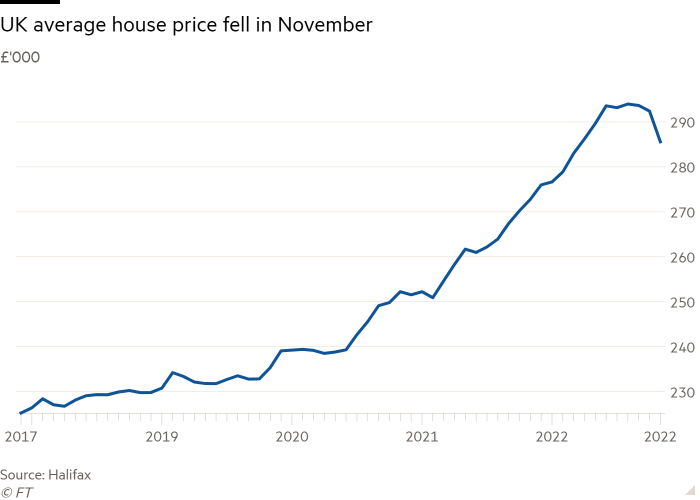

UK house prices fell for a third consecutive month and at the fastest pace since the financial crisis 14 years ago as rising borrowing costs squeezed the market, according to the mortgage provider Halifax.

Average house prices contracted 2.3 per cent between October and November, the largest monthly drop since October 2008, data released on Wednesday showed. This follows a 0.4 per cent drop in the previous month and a 0.1 per cent fall in September.

The annual rate of house price growth slowed to 4.7 per cent, down from 8.2 per cent in the previous month and the slowest pace since July 2020.

This month’s fall reflects “the worst of the market volatility over recent months”, said Kim Kinnaird, director at Halifax Mortgages.

“Some potential home moves have been paused as homebuyers feel increased pressure on affordability,” she added. “Industry data continues to suggest that many buyers and sellers are taking stock.”

Mortgage rates reflect expectations of higher borrowing costs as the Bank of England faces the fastest inflation rate in 40 years.

The typical property price fell to a nine-month low of £285,579 and was down from a peak of £293,992 registered in August. The rate of annual growth slowed in all but one region, the North East, during November.

Last week, the mortgage provider Nationwide reported the largest monthly fall since June 2020.

Andrew Wishart, senior property economist at Capital Economics, expected UK house prices to decline 12 per cent by mid-2024, with London and the south of England posting “the largest falls in house prices, while Scotland and Northern Ireland may prove most resilient”, he said.

[ad_2]

Source link