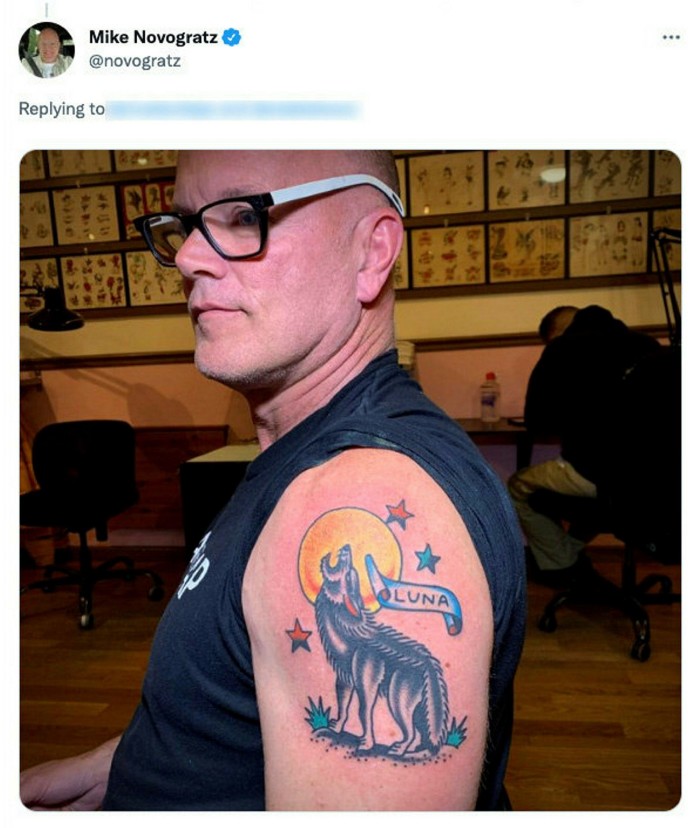

In January, Mike Novogratz — hedge fund rock star turned crypto heavy hitter — tweeted a picture of a sizeable new tattoo on his left shoulder. It featured the image of a wolf howling at the moon and a banner saying “Luna”, a cryptocurrency then trading at $78.

“I’m officially a Lunatic!!!” enthused the one-time macro investor at the Fortress hedge fund group, and now founder and CEO of Galaxy Digital, an investment management firm with ambitions to be “the Goldman Sachs of crypto”. By the start of April, luna peaked at $116 after being snapped up by buyers including enthusiastic retail investors.

But this week, luna lost it all. Its value slid to zero after terraUSD, a sister token, collapsed in value, despite being designed to track the value of the US dollar.

It is unclear what Novogratz will do about his tattoo. The CEO of Galaxy, which invested in the company behind the tokens, did not respond to several requests for comment. But the demise of luna and terra has left a mark on the global $1.3tn cryptocurrency market. Coins come and go — thousands have died since bitcoin was invented in 2009. But terra’s failure has cut through. It was designed to be a so-called stablecoin — a staid, boring token that simply tracks the dollar.

Its sudden death, at a time when crypto valuations were already sliding, has sparked serious questions over the functioning of the entire crypto market. In just one week, the valuation of exchange Coinbase has crashed, bitcoin prices have slumped below $30,000 for the first time since last summer and tether — the largest stablecoin akin to the Federal Reserve of crypto — failed to keep up its dollar peg.

Many financial markets have fallen sharply in recent weeks, as investors have been spooked by surging inflation and the prospect of sharp rises in interest rates. But the collapse in cryptocurrencies has been even more dramatic.

Their performance has undermined claims that crypto assets can provide a hedge against inflation or behave as a form of digital gold — let alone the grander boasts of crypto partisans about the potential for digital tokens to become the pillar of a new global financial system.

Research firm CryptoCompare said luna was “the largest destruction of wealth in this amount of time in a single project in crypto’s history”.

Luna’s failure is “one of the greatest catastrophes crypto has ever seen,” argues Ran Neuner, a prominent crypto trader and outspoken enthusiast for the tokens. It is a “real wake-up call” that crypto prices can fall to zero, he said in an online broadcast to thousands of digital asset traders on Friday.

Falling back to terra

Many of those faithful to the crypto project — its supposed potential to replace the dollar in global trade, its libertarian schism from the traditional financial establishment — will always believe. “On average, a government will destroy their currency every 27 years,” Michael Sonnenshein, chief executive at crypto investment firm Grayscale, said at an FT event in late April. “Investors or citizens are waking up and seeing their purchasing power eroded overnight, sometimes 10-plus per cent.”

But the turmoil of recent days has highlighted how those seeking to make a fortune from cryptocurrencies are taking a dicey punt.

TerraUSD’s model was experimental. Typically, operators of stablecoins say they are backed one-for-one with dollar-based-reserves. Terra, by contrast, was backed by an algorithm linked to its sister-token, luna, to keep its dollar peg in check. But terra’s $1 value started slipping on Monday when faith in that model evaporated, ending the day at around 90 cents. It fell further until it reached under 15 cents on Friday. Various rescue efforts by the backers failed, and on Thursday, the Terra blockchain was temporarily halted, though backers still harbour hopes that it can be revived.

The price of the oldest and largest cryptocurrency, bitcoin, fell 11 per cent on Monday, 12 per cent this week and has dropped by over 50 per cent since November 2021. The broader market sell-off is one reason for the fall in its value. But the failure of terra, once a top-five stablecoin, has also hurt.

Terra’s relatively small size means its demise is not systemic to the broader crypto market. What matters more is that the episode has renewed concerns about potential cracks in other stablecoins, including the biggest of them all, tether, calling in to question the foundations behind the crypto industry.

On Thursday, tether’s one-to-one dollar peg also stumbled, with the token’s price falling to 95.11 cents. Tether differs from terra in an important respect: rather than being based on an algorithm, its operators say its dollar peg is maintained through dollar-based reserves — enough to match the tokens in circulation.

“Cash is supposed to be cash. When it’s not, like when money markets froze during the financial crisis, sheer panic ensues,” says Andrew Beer, managing member at US investment firm Dynamic Beta.

“Terra was like putting your cash in an Iranian bank that offered a 20 per cent interest rate then suddenly shut its doors,” he adds. “Good luck getting your money back or even figuring out what happened.”

Tether chief technology officer Paolo Ardoino has sworn to defend the dollar peg “at all costs”. He said this week that he was prepared to sell some of the “ton” of US government debt that Tether has amassed in this effort. But details on the make-up of these reserves are thin. Ardoino declined this week to tell the FT more about his $40bn in US government debt holdings, saying he wanted to protect the company’s “secret sauce”.

A deeper failure in the tether peg would likely be catastrophic for the wider crypto market, as some estimates suggest as much as 70 per cent of bitcoin purchases are made using this blockchain-native dollar alternative.

“If Tether would stop redeeming one tether for one dollar — that is, the peg breaks — this would have a huge impact on all markets traded against tether,” says Ingo Fiedler, an affiliate professor at Concordia University in Montreal who runs Blockchain Research Lab.

But Ilan Solot, partner at crypto hedge fund Tagus Capital, says the crypto market has this week faced undue criticism. “What bothered me was the whirlwind of unfounded accusations . . . conspiracy theories . . . and dirt-digging,” he says.

He believes tether is more robust than its failed rival. “Tether has more of that potential . . . to be like a Lehman moment, a cascade of consequences that would be so wide,” he said. “[But] it’s far less likely for tether to go to zero than terra.” Even so, he said the potential for “systemic risk” stemming from tether is a valid point of concern.

Bitcoin city

It is not only wobbles in coin prices and stablecoin pegs that have afflicted the market of late.

Europol offered a reminder this week of the scams and fraud that have peppered through the market, when it placed Ruja Ignatova, the inventor of onecoin, on its “most wanted fugitives” list, saying she had “induced investors all over the world to invest in [an] actually worthless ‘currency’.” Losses on her scheme probably amount to several billion dollars, Europol said.

On Tuesday, crypto exchange Coinbase said in its first-quarter earnings report that monthly transacting users, trading volume and assets on the platform had all declined from the previous quarter, suggesting weaker crypto prices are not pulling retail investors to the extent they have done in the past.

Coinbase shares have now lost around three-quarters of their value since the market debut last year, and have dropped by 32 per cent this week to $72 on Friday. “We’re not sure that this stock is worth more than the cash on its books or $33 per share,” says David Trainer, chief executive at investment research firm New Constructs.

Coinbase is far from alone. The tech-heavy Nasdaq index has fallen 27 per cent this year and other once high-flying non-crypto stocks such as Netflix and Peloton have dropped 71 per cent and 63 per cent, respectively.

Some of the simultaneous slide in crypto prices and tech stocks may be self-reinforcing. “A lot of crypto holders also own tech stocks and have lost a lot of money. These guys are selling some of their holdings in panic, and that is what is driving the market down,” says Edouard Hindi, chief investment officer of digital asset manager Tyr Capital.

The slide in crypto prices is also hurting large holders. Perhaps most notable among them is the government of El Salvador, whose crypto enthusiast president, Nayib Bukele, introduced bitcoin as legal tender last year. This week, he shared images on Twitter of his golden scale model of a planned crypto-funded Bitcoin City.

Even in the teeth of a slide in bitcoin prices this week, Bukele stocked up on more of the cryptocurrency, making the government’s most recent purchase of 500 bitcoins at an average price of $30,744 each. “I could sell [these] coins right now and make almost a million dollars in just 11 hours, but of course not,” he tweeted, a day later.

Bitcoin became legal tender in September. According to FT estimates, El Salvador has spent over $100mn on bitcoin and, by this week, the country’s crypto reserves had fallen to approximately $72mn.

“Is this bet going to be worth it? At the moment, we really don’t know,” says Hector Torres, senior partner at Torres law firm in El Salvador. “Why are you investing in bitcoin when there are schools failing, or roads that haven’t been built, or bridges that have to be fixed?” he adds. “That’s the standard comment of the people that are against the president’s decision.”

Crypto markets have demonstrated extraordinary staying power, and have survived several apparent near-death experiences in the past, including a 30 per cent drop in a day last year in reaction to a regulatory crackdown in China.

Nonetheless, the latest volatility is unlikely to convince already reticent institutional investors to jump in. “The case for institutional adoption seems to be receding by the day, with the space affording no safe haven and only negative diversification via idiosyncratic risks,” analysts at UBS said this week.

The latest volatility suggests that instead of forging a path towards building a new, decentralised financial system, cryptocurrencies are likely destined to remain get-rich-quick bets for highly risk-tolerant investors.

“We believe that crypto will find it very hard to sustain the future monetary system,” Hyun Shin, who leads the Bank for International Settlements’ Monetary and Economic Department, said last month. “I think [crypto] has more of the attributes of the speculative assets.”

Additional reporting by Laurence Fletcher and Adam Samson