401(k) restrictions

The 401(k) isn’t tax-free, though. There are a few restrictions.

- First, the government has to get its tax revenue sometime, so you’ll pay ordinary income tax on the money you withdraw around retirement age. (Remember, though, that all that money has been growing “tax-deferred” for ~30 years.)

- Second, you’re currently (in 2015) limited to putting $18,000/year in your 401(k).

- Third, and this is important, you’ll be charged a big penalty of 10% if you withdraw your money before you’re 59.5 years old.

This is intentional: This money is for your retirement, not to go out drinking on Saturday.

You can call up your HR representative on Monday and get enrolled in your 401(k).

Start an automatic-payment plan so money is taken directly from your paycheck.

Mastering your Roth IRA

If you want real wealth in your retirement, you absolutely need a Roth IRA. It’s another type of retirement account.

And every person should have a Roth IRA. It’s simply the best deal out there for long-term investing.

Remember how your 401(k) uses pre-tax dollars and you pay income tax when you take the money out at retirement?

Well, a Roth IRA is different than a 401(k). A Roth uses after-tax dollars to give you an even better deal.

Here’s how it works:

When you make money every year, you have to pay taxes on it. With a Roth, you take this aftertax money, invest it, and pay no taxes when you withdraw it.

If Roth IRAs had been around in 1970 and you’d invested $10,000 in Southwest Airlines, you’d only have had to pay taxes on the initial $10,000 income.

When you withdrew the money 30 years later, you wouldn’t have had to pay any taxes on it. Oh, and by the way, your $10,000 would have turned into $10 million.

Think about it.

You pay taxes on the initial amount, but not the earnings. And over 30 years, that is a stunningly good deal.

Roth IRA Restrictions

Again, you’re expected to treat this as a long-term investment vehicle.

You are penalized if you withdraw your earnings before you’re 59.5 years old. (Exception: You can withdraw your principal, or the amount you actually invested from your pocket, at any time, penalty-free. Most people don’t know this.)

There are also exceptions for down payments on a home, funding education for you/partner/ children/grandchildren, and some other emergency reasons.

And there’s a maximum income of $181,000 to make full contributions to a Roth. But you can read about those later.

What’s the big takeaway from all those restrictions and exceptions? I see 2 things:

First, you can only get some of those exceptions if your Roth IRA has been open for 5 years. This reason alone is enough for you to open your Roth IRA on Monday.

I want you to research it this weekend, and I want your Roth IRA opened by next week.

Second, starting early is crucial. I’m not going to belabor the point, but every dollar you invest now is worth much, much more later. Even waiting two years can cost you tens of thousands of dollars.

Currently, the maximum you’re allowed to invest in your Roth IRA is $5,500 a year (updated in 2008). I don’t care where you get the money, but get it. Put it in your Roth and max it out this year.

These early years are too important to be lazy.

Open your Roth IRA

It’s easy. You can go through your current discount brokerage, like E*Trade or Scottrade.

I created a video to help show you how to choose a Roth IRA

Next, call them up, tell them you want to open a Roth IRA, and they’ll walk you through it. Special note: These places have minimum amounts for opening a Roth IRA, usually $3,000. Sometimes they’ll waive the minimums if you set up an automatic payment plan depositing, say, $100/month.

Shop around though.

Once your account is set up, your money will just be sitting there. You need to do things then:

First, set up an automatic payment plan so you’re automatically depositing money into your Roth. How much? Try doing as much as you’re comfortable with, plus 10%.

Second, decide where to invest your Roth money. I recommend low-cost, diversified index funds as the best option or target date funds.

401(k) or Roth IRA?

The simple answer is both: These accounts, while conceptually different, work together pretty well.

Here’s how I think about it.

First, I would max out any 401(k) match that my company provides. Second, I’d max out the $5,500 for my Roth IRA. Third, I’d max out the rest of my 401(k), up to $15,000. Finally–if your employer doesn’t offer a 401(k), you’re not employed yet, or you still have money left over–I’d open a regular, taxable investment account and put money there in stocks, index funds, etc.

Why max out your Roth IRA before your 401(k)?

Well, there’s a lot of dorky debate in the personal-finance world, but the basic reasons are taxes and tax policy: Assuming your career goes well, you’ll be in a higher tax bracket when you retire, meaning that you’d have to pay more taxes with a 401(k). Another common reason for the Roth is that tax rates are considered likely to increase.

Remember: Your 401(k) money is taxed at the end, while Roth IRA money is taxed right away and then grows tax-free.

What to do today

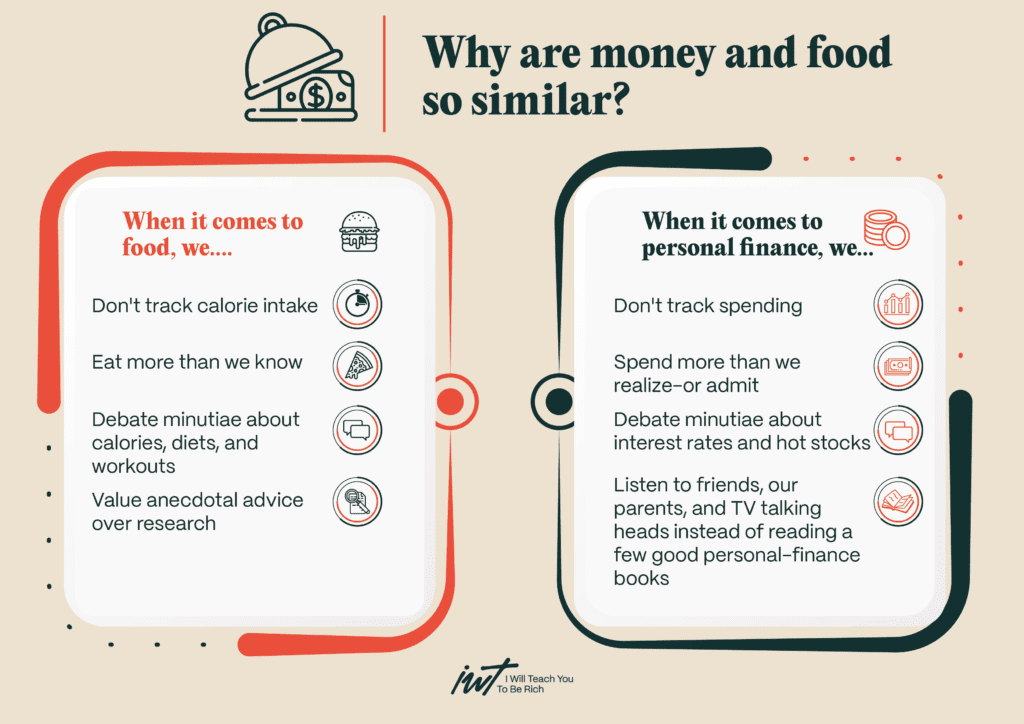

When it comes to money, it’s very easy to end up like most people – just doing nothing.

So let the fools debate. For you, just get your accounts open.