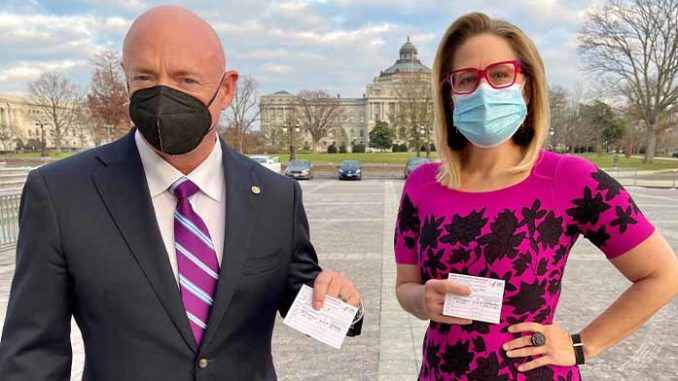

A taxpayer watchdog group is urging Arizona Senators Kyrsten Sinema and Mark Kelly to reject a spending package unveiled by Senate Democrats on July 27th. The group, Taxpayers Protection Alliance, says the package includes $15 million that would “pave the way for an unprecedented expansion of the IRS that would give the agency more control over U.S. taxpayers and their finances.”

The group cites recent polling data that shows that 78% of voters in Arizona oppose policies that would make the IRS their accountant.

Additionally, the poll found that 58% of Arizona voters would be less likely to support elected officials who want to expand the size and scope of the IRS.

“With all the real challenges Americans are facing – from high gas prices to empty grocery store shelves – it’s unfathomable that Congress thinks giving the IRS more control over taxpayers is a priority. It’s no wonder that 78% of Arizonans oppose this provision,” said Taxpayers Protection Alliance President David Williams. “Senators Sinema and Kelly have been commonsense champions for taxpayers, and I urge them to reject a proposal that would make tax season even more difficult for millions of hardworking families and small businesses that already struggle dealing with the bureaucracy of the IRS.”

The Taxpayers Protection Alliance is running an ad campaign urging Senators Sinema and Kelly to oppose a government run tax preparation system because the group says it would:

- Represent a massive conflict of interest for the IRS to prepare tax returns while also collecting revenue.

- Add immense responsibilities to the IRS even though the agency can’t fulfill its existing mandate and has not asked for this expanded authority.

- A report from The Washington Post found that only one out of every 50 calls to the agency’s help line made it to a human representative.

- As of March, the IRS was still working to eliminate a backlog of more than 20 million unprocessed tax returns from 2021.

- Unnecessarily add billions to the federal deficit for a program that a former Obama Administration official called “operationally impractical, prohibitively expensive, and legally questionable.”

- A recent study found that the costs for a potential IRS-run system would rival the costs of Healthcare.gov.

- Give the IRS more authority to target vulnerable or minority populations with additional security months after it was revealed the IRS was five times more likely to audit poorer households.

- A report from CNBC found that this proposal would make it harder for taxpayers to claim critical credits including the earned income tax credit, the child tax credit, the child and dependent care credit and more.