Tactic, a startup that helps businesses manage — and simplify — cryptocurrency finances, is emerging from stealth today with $2.6 million in seed funding.

Founders Fund and finance automation startup Ramp co-led the raise for Tactic, an eight-person outfit based in New York City. Elad Gil and Figma co-founder Dylan Field also participated in the funding.

CEO Ann Jaskiw founded Tactic after learning that founders in web3 were handling their accounting in spreadsheets. Existing accounting software providers, she concluded, “were not built to handle crypto transactions.”

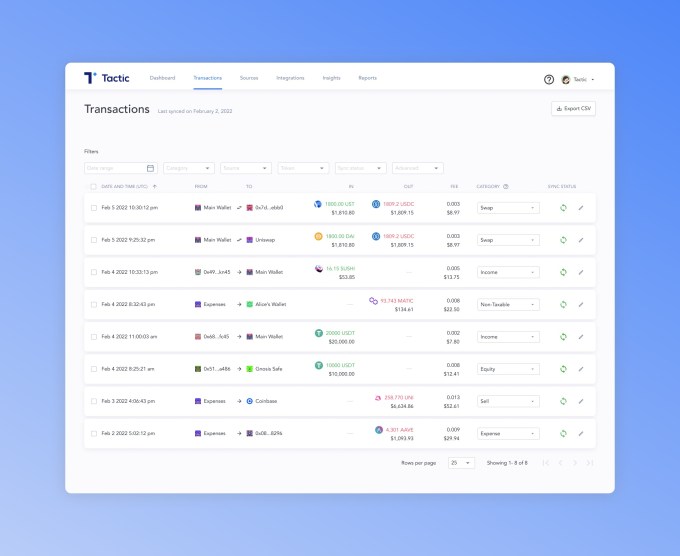

The core of Tactic’s product, said Jaskiw, is to help a CFO or head of finance answer the question, “Where did the money go?” at the end of a quarter.

“Right now for most financial professionals, their audit trail of crypto transactions is a debit transaction from Silicon Valley Bank or whichever bank, into a centralized exchange,” Jaskiw explained. “Like Coinbase tokens leave that central place, and it then becomes a big bit of a question mark. What we’re seeing is people are spending a lot of time in manual spreadsheets, trying to track what transactions happen and trying to calculate their gain and loss. It’s just incredibly cumbersome currently.”

Generally, companies interacting with blockchains struggle to make sense of their fragmented activity, according to Jaskiw.

“They tend to manage multiple wallets across various blockchains and hold funds in centralized exchanges or self-custody solutions like Gnosis Safe,” she said.

This is where Tactic comes in.

Tactic says it is tackling the problem of accounting for a business’s cryptocurrency holdings and on-chain activity by aggregating data across disparate sources to give businesses “a full treasury view of their balances and activities.” Its software, Jaskiw said, helps companies automatically categorize transactions and apply accounting logic such as calculating $USD gain/loss and taxable events. Accountants can then reconcile a business’s crypto-subledger to traditional accounting software like QuickBooks.

“It doesn’t matter what they’re building, it can be any on-chain transaction,” Jaskiw said. “But there’s just no cohesive audit trail if you’re a crypto company. So if you have a normal bank account, you have all your clean inflows and outflows, and you may have more than one bank account but it’s usually in a single spot — whereas crypto transactions can span a dozen different wallets or products.”

After talking to hundreds of companies, Tactic found that decentralized finance or “DeFi” transactions were the most problematic. For example, according to Jaskiw, a single interaction with a smart contract can generate hundreds of “nested transactions,” all of which need to be broken out for accounting purposes.

Tactic, she said, has partnered with accounting firms to help interpret accounting guidelines for DeFi-specific activities such as staking, NFT minting and airdrops.

Since its 2021 launch, Tactic says it has signed up “dozens” of customers, ranging from early-stage startups to billion-dollar enterprises across industries including NFTs, protocols and DeFi. The company is designing its offering to work with businesses that have “hundreds of thousands” in transaction volumes per month.

“This is a pain point for everyone,” Jaskiw told TechCrunch. “The bigger an organization gets, the more complex and worse the problem gets. So that’s where we’re seeing the most excitement about this.”

She also believes that a common misconception about the crypto space is that a lot of people are trying to avoid regulation. Tactic, Jaskiw said, has found the opposite to be true.

“A lot of companies, the private C corps in the U.S. specifically, are really trying to do the right thing, follow the rules and stay compliant,” she said. “They just right now lack some of the tooling and guidance to be able to do that efficiently.”

Image Credits: Tactic

John Dempsey, Tactic’s VP of strategy and ops, says that Tactic makes it “easy” for businesses to transact in cryptocurrency, “knowing they can manage their financial activity in a clean, compliant way.” Dempsey is former VP of product at blockchain forensics firm Chainalysis, a blockchain analysis company that last March closed on a $100 million Series D financing, doubling its valuation to over $2 billion.

But it’s not just web3 companies struggling with the issue.

Crypto is “rapidly penetrating” even non-crypto companies, according to Scott Orn, COO of Kruze Consulting, a CPA firm that serves startups.

“Crypto is quickly becoming part of the financial infrastructure of many startups. We are seeing 5% to 10% of our non-crypto SaaS companies engaging in crypto transactions — those are SaaS companies that have nothing to do with crypto,” Orn told TechCrunch. “Two years ago almost no non-crypto companies were using crypto — that’s pretty amazingly fast growth.”

Meanwhile, he added, crypto introduces a host of accounting issues that should be solved by software, including booking transactions correctly into the general ledger, recording tax planning information and handling smart contract-generated transactions.

Crypto transactions can create taxable events, points out Orn.

For example, a company has a contract to get paid a specific number of crypto tokens, and if those tokens increase in value before the company actually gets paid, that could result in “huge revenue spikes.”

“This could push a startup into profitability, meaning taxes are owed,” Orn added. “And selling crypto assets that have increased in value creates a taxable gain. We’ve seen both of these scenarios, and keeping track of it all manually is difficult in a high-volume situation.”

Founders Fund Principal Leigh Marie Braswell said that Tactic’s product is “already saving crypto accounting teams days each month.”

“We believe Tactic has the potential to become a massive player as more companies move into web3,” she added.

Eric Glyman, Ramp CEO and co-founder, told TechCrunch that his company invested in Tactic based on the belief that there is a need for “simple, intuitive solutions for businesses transacting with crypto.”

“We anticipate that demand will only grow in the future,” he said.

Glyman also saw what he described as “strategic alignment” with Ramp’s long-term vision (Note: The company secured its own funding earlier this year at an $8.1 billion valuation).

“Tactic is built with the intent to save businesses time and it’s unique in that the platform works for companies that have high transaction volumes,” he said. “And everything we do at Ramp is in support of saving businesses time and money.”

Tactic plans to use its new capital to build out its product and team.

“We haven’t had to do any external marketing or running of ads,” Jaskiw said. “We’ve been getting a lot of inbound excitement.”