Several groups have joined together to oppose a November General Election ballot measure to repeal South Dakota’s sales tax on “anything sold for human consumption.”

Retailers Association Executive Director Nathan Sanderson says while Initiated Measure 28 does exclude alcohol and prepared food, it would remove sales tax from items such as tobacco, CBD, mouthwash, vaping products, toothpaste, beverages and a host of other items.

“The language in IM-28 was chosen for one of two possible reasons; to eliminate sales taxes on many items to set up South Dakota for a state income tax, or it was drafted improperly. Either way, it’s bad for South Dakotans and voters should vote no on IM-28.”

South Dakota is one of only seven states without a state income tax. The other states are Alaska, Florida, Nevada, Texas, Washington and Wyoming.

Rapid City businesswoman Erin Krueger says eliminating the sales tax on anything for human consumption would result in funding cuts to essential government functions or lead to new tax increases.

“Eliminating the sales tax on anything for human consumption will have widespread tremendous negative consequences and could set South Dakota up for an income tax. An income tax is the wrong approach for South Dakota, so we urge voters to oppose IM-28.”

Sioux Falls Mayor Paul TenHaken says current state law (SDCL 10-52-2) says towns can only charge a sales tax as long as the “tax conforms in all respects to the state tax on such items with the exception of the rate.” He says if the state can’t charge sales taxes on “anything sold for human consumption,” neither can towns.

“Eliminating the sales tax for cities and towns will leave a huge hole in city budgets. In Sioux Falls, we would see major cuts to funding for law enforcement, road repairs, pools and parks. Unlike the state, cities don’t have the ability to impose a local income tax, meaning property taxes on seniors and working families would have to increase or city services would drastically be reduced. A sales tax based on consumption levels and also paid for by non-South Dakotans is fairer to the pocketbooks of South Dakotans. IM-28 should be rejected and we should avoid its consequences.”

The Vote No on IM28 coalition believes the proposed change would eliminate more than $176 million annually in state revenues and millions more from city budgets.

According to Wallet Hub, South Dakota has the seventh lowest tax burden in the nation at a rate below neighboring states Iowa, Minnesota, Nebraska and North Dakota.

Find more information at nosdincometax.com.

Founding members of the coalition opposing IM-28 include:

-

South Dakotans Against A State Income Tax

-

Coalition for Responsible Taxation

-

Greater Sioux Falls Chamber of Commerce

-

SD Association of Cooperatives

-

SD Bankers Association

-

SD Cattlemen’s Association

-

SD Chamber of Commerce & Industry

-

SD Economic Development Professionals Association

-

SD Education Association

-

SD Farm Bureau

-

SD Hotel & Lodging Association

-

SD Licensed Beverage Dealers & Gaming Association

-

SD Municipal League

-

SD Music & Vending Association

-

SD Petroleum & Propane Marketers Association

-

SD Retailers Association

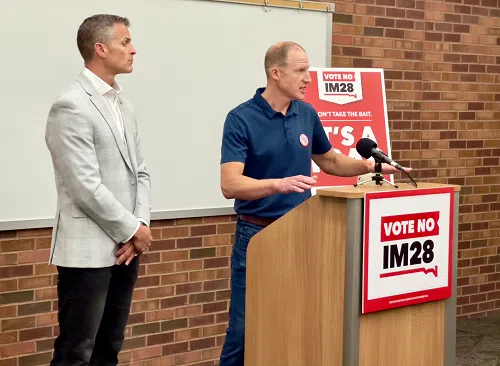

Rapid City businesswoman Erin Krueger.

Courtesy photo.