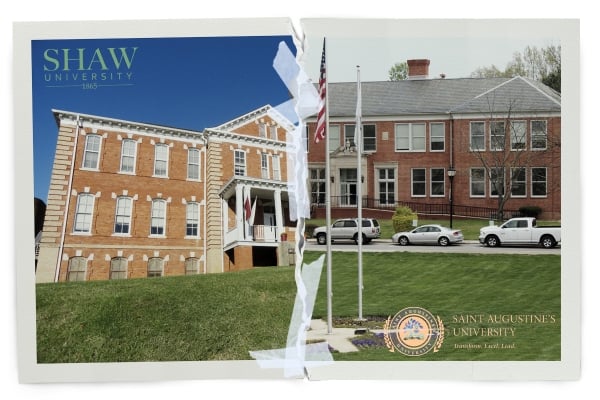

As embattled Saint Augustine’s University fights for its survival amid severe financial issues, accreditation challenges and multiple lawsuits, Board of Trustees chairman Brian Boulware is alleging that local power players are trying to force a merger between SAU and Shaw University.

The proposal would unite two historically Black universities in Raleigh, N.C., each with a history stretching back over 150 years.

Prominent local community members are reportedly driving the idea, which Boulware and Saint Augustine’s current president oppose—even as the university faces an uncertain future. Shaw officials, meanwhile, have remained quiet on the potential merger.

An Explosive Letter

Details of the alleged merger effort came in a sprawling four-page letter Boulware wrote in response to a lawsuit filed by the Save SAU Coalition, a group of alumni and other supporters calling for the Board of Trustees to step down over the university’s fiscal issues. The plaintiffs also blame the board for SAU’s loss of accreditation, which was stripped last year, though the university remains accredited while it mounts a legal challenge to that decision.

The Save SAU lawsuit alleges that Saint Augustine’s has been “brought to its knees by the misfeasance, malfeasance, and utter neglect of its Board of Trustees, and especially its two most recent chairmen,” Boulware and former chair James Perry. Plaintiffs allege that the board is “led by a dictatorial and vindictive chairman who is more concerned with lining his own pockets than leading the university.” They also accuse the board of squashing criticism and dissent, calling it “a corrupt echo chamber.”

The university is also being sued by former president Christine McPhail, who was fired in December—a move she alleges came after she filed a gender-based discrimination complaint against the mostly male board, which she accused of creating a hostile work environment.

In his letter to the university community, Boulware largely brushed off the concerns raised by the Save SAU Coalition, denying that he had financially benefited from his service on the Board of Trustees. He also shared details about the merger effort, describing a “business meeting” held over dinner with local leaders. Though he did not cite a date, other attendees have confirmed the dinner took place on Feb. 24.

At the meeting, Boulware wrote, he spoke with an unnamed television station owner who allegedly told him, “Raleigh doesn’t need two black universities. We need the two to merge. I don’t care what you call it. However, we need them both on SAU’s property because we need downtown land to expand the development footprint.” (The television executive, later identified as Jim Goodmon, has disputed this account.)

According to the letter, Shaw University president Paulette Dillard allegedly told Boulware she would “reserve judgment” on the proposal. But Boulware alleged that the merger had also been pitched to his predecessor, Perry, who resigned from his leadership role in January—a move Boulware attributed to health issues. He wrote that Shaw’s board chairman “had floated the idea of a ‘merger’ to the former SAU Chairman three or four weeks before the dinner, which he didn’t take seriously.”

Boulware also recounted a conversation with a local developer who allegedly told him, “You have no leverage in this situation. You need to consider this [merger] as an option.” The developer indicated the Raleigh business community largely shared that sentiment. A day after rejecting the proposal, Boulware noted, a news report on financial challenges at Saint Augustine’s and other state HBCUs was published.

“Shortly after that, a targeted campaign against SAU ensued,” Boulware wrote.

Though Boulware’s letter did not list the business leaders in attendance, local TV Station WRAL did. Of the business leaders named, only Goodmon responded to a request for comment from Inside Higher Ed.

Goodmon, president and chief operating officer of Capitol Broadcasting Company, which owns WRAL, told Inside Higher Ed in an emailed statement that “the dinner has been widely misrepresented.”

Goodmon said the aim of those in attendance “was to create a neutral space to encourage open and honest dialogue about these two Raleigh-based HBCUs’ futures and to explore ways they might cooperate.”

Goodmon noted both universities face financial challenges.

“A merger, while complex, could potentially allow these schools to pool resources, strengthen academic offerings, and ensure their legacies continue for generations to come. It was not an original idea by any means as it has been proposed for many years by people who care deeply about both institutions. We offered to hire a consultant to evaluate the prospects of a merger, along with other ideas. That offer is still on the table,” Goodmon wrote in the statement.

Would a Merger Work?

Except for Boulware, no SAU officials have publicly weighed in on the merger proposal. Neither has anyone from Shaw. Saint Augustine’s interim president, Marcus Burgess, opposes the merger, Boulware wrote.

Officials from SAU and Shaw did not respond to requests for comment from Inside Higher Ed.

Beyond the question of interest is the matter of feasibility. Is Shaw strong enough to absorb SAU as it navigates declining enrollment, months of payroll delays, multiple lawsuits, accreditation issues currently in litigation and a $7.9 million tax lien?

Though Shaw has managed to avoid the accreditation and administrative issues plaguing Saint Augustine’s, it’s faced its own enrollment and business challenges. Student head count at Shaw was 1,067 in fall 2022, a decline of more than half since fall 2012, when enrollment stood at nearly 2,200 students, according to federal data.

SAU has also seen enrollment declines, but they have been less severe than Shaw’s. While Saint Augustine’s enrolled 1,442 students in fall 2012, that number slipped to 1,044 by fall 2022, according to the most recent federal data. Enrollment at SAU fell as low as 767 in fall 2018 before it began to rebound the next year.

Shaw’s limited financial resources also raise concerns about whether the university is strong enough to absorb its struggling neighbor. Public financial documents show that Shaw operated at a loss in four of the last 10 fiscal years. Its endowment was valued at $14 million in June 2022.

By comparison, SAU has operated at a loss in six of the last 10 available fiscal years and had an endowment valued at $8.9 million as of June 2021, according to SAU’s latest published filings.

Since Boulware’s letter was published, officials at both universities and the local business leaders who allegedly pushed the merger idea have remained silent. Alumni and community members featured in local news have largely spoken against the idea. Some expressed concern about the loss of identity for SAU, which was founded in 1867; others see a sinister land grab.

Some in the HBCU sphere are also skeptical.

“The public conversation seems to really be a conversation about an acquisition rather than a merger. A merger would be about a coming together in true partnership, and that does not appear to be the thrust of the public conversations. The public discourse seems to be about Shaw acquiring St. Aug’s to save St. Aug’s,” said a leader of another in-state HBCU by email, speaking anonymously.

The anonymous HBCU leader noted that a key question driving such mergers in higher ed is whether the institution to be acquired has value to the one absorbing it. And is that value worth taking on debt and grappling with other issues that can come with an acquisition?

“A merger or acquisition doesn’t solve problems overnight. Is there a tolerance and readiness for the journey? Does the acquiring president have the interest, skills and capacity to lead through the merger or acquisition? Same questions for the board of the acquiring institution? Is the acquired board willing to give up power?” the anonymous HBCU leader told Inside Higher Ed.

For such a merger or acquisition to be successful, both parties must be patient, the leader said, noting that officials at both Shaw and Saint Augustine’s need to be willing and able “to go on a slow and messy journey” through a complicated process with a “clear value proposition” defined.