PIERRE, S.D. (KELO) — The early annual results are in for the South Dakota Retirement System. For the third year in a row, earnings appeared to finish less than the 6.5% annual target.

South Dakota Investment Council chair Loren Koepsell of Sioux Falls and state investment officer Matt Clark met on Thursday with the Legislature’s Executive Board. They told lawmakers that, so far, there’s a 5.87% return.

Clark said the final number could be slightly better. “We’re guessing at this point we’ll end up in the six to six and a quarter range,” he said.

By comparison, they said, other public pension funds averaged 13.87% for the fiscal year.

State government and South Dakota’s public universities participate in SDRS, as do many county and municipal governments and many public school districts, along with other specialty units.

The system’s total assets rose to an estimated $14.89 billion, a year-over-year gain of $500 million, according to the report. A year earlier, the return was 5.8%. That came after wide swings of a negative 0.64% and a whopping 22% gain.

Republican Rep. Will Mortenson said the system could have made more during the past 12 months if more risk was taken, but said he was confident about the long term.

Republican Sen. Jim Bolin agreed. “A little bit of short term pain but I’m confident in the long-term gain,” he said.

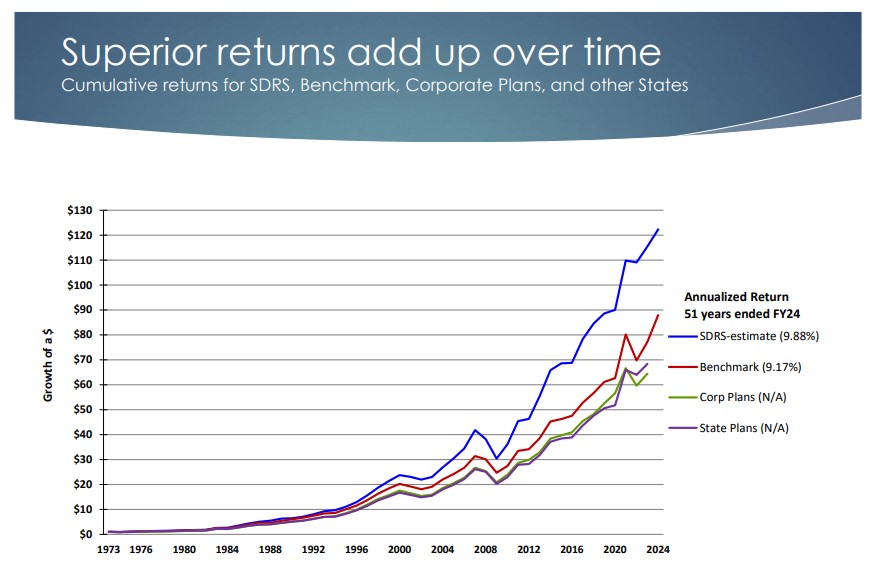

Clark defended the contrarian approach. He said the focus remains on 10 years ahead.

Clark has argued for years that investment markets generally are overpriced. For years, big chunks of money were invested in cash accounts rather than stocks, bonds, real estate and distressed debt.

“If the markets are very expensive, we’ll be very defensive, we’ll have a lot of cash and be patient,” Clark said, adding that he’s never felt more optimistic.

“We plan to stick to our disciplines that have served us so well,” he said.