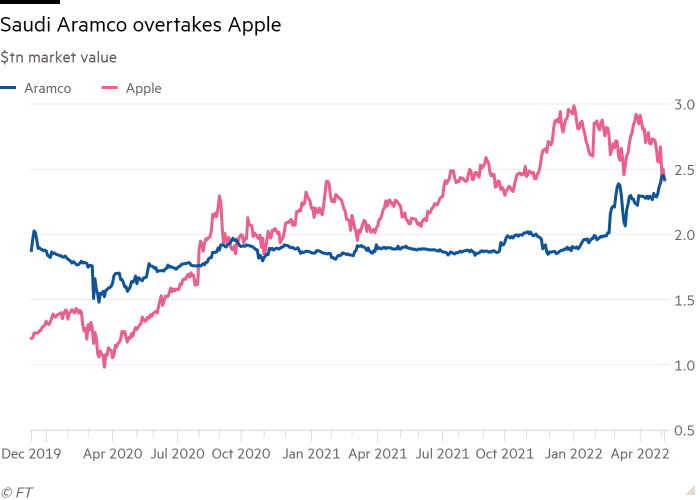

Saudi Aramco has overtaken Apple as the world’s most valuable company after higher oil prices pushed shares of the world’s biggest crude exporter to record levels, while a broader tech stock sell-off weighs on the iPhone maker.

The Saudi Arabian oil company’s market capitalisation on Wednesday was $2.426tn, exceeding Apple’s $2.415tn by just over $10bn.

It is the first time that Saudi Aramco has regained the top spot since 2020 and follows a broader sell-off in technology stocks since the start of the year.

Apple became the first company to hit a $3tn market cap in early January, although its shares have suffered in recent months as investors reassess lofty valuations in the tech sector in light of a reversal in monetary policy and worries that inflation will weaken consumers’ spending habits.

It has held up better than some big tech companies, having fallen back 19 per cent since its January high. Apple shares were down 4.6 per cent at $147.35 on Wednesday afternoon in New York, taking their year-to-date drop to 17.1 per cent and putting the share price at its lowest since November.

While Apple recently recorded its third-best quarter for revenues ever, chief executive Tim Cook said supply shortages and lockdowns in China were expected to cost the company as much as $8 billion this quarter.

Some analysts question the merit of comparing the companies, given that Apple is a public company founded in a garage in California in 1976, while Saudi Aramco is a state-backed giant with only a small amount of freely floated shares.

Saudi Aramco raised a record $25.6bn in 2019 when the state — which still owns 94 per cent of the company — listed 1.5 per cent of its shares in what was then the world’s largest ever initial public offering. In February the government transferred an additional 4 per cent of its shares to Saudi Arabia’s sovereign wealth fund.

Saudi Aramco’s shares, which are listed in Riyadh, have risen 27 per cent since the start of the year to trade at a record 46 riyals ($12.26).

Oil prices, which surged to a 14-year high of $139 a barrel in March following Russia’s invasion of Ukraine, have helped some of the world’s biggest oil and gas companies deliver record profits in the first three months of the year.

Saudi Aramco is also expected to announce bumper profits when it reports first-quarter earnings on Sunday. The company’s net income more than doubled in 2021 to $110bn as resurgent economic activity following the easing of global coronavirus restrictions revived demand for hydrocarbons.

Additional reporting by Peter Wells in New York