The U.S. power grid is at a critical crossroads. Electricity generation, like every other industry, needs to rid itself of fossil fuels if the country is to play its role in combating the climate crisis — a transition that will have to happen even as energy providers scramble to meet what they claim is an unprecedented spike in electricity demand, attributed to the rise of AI.

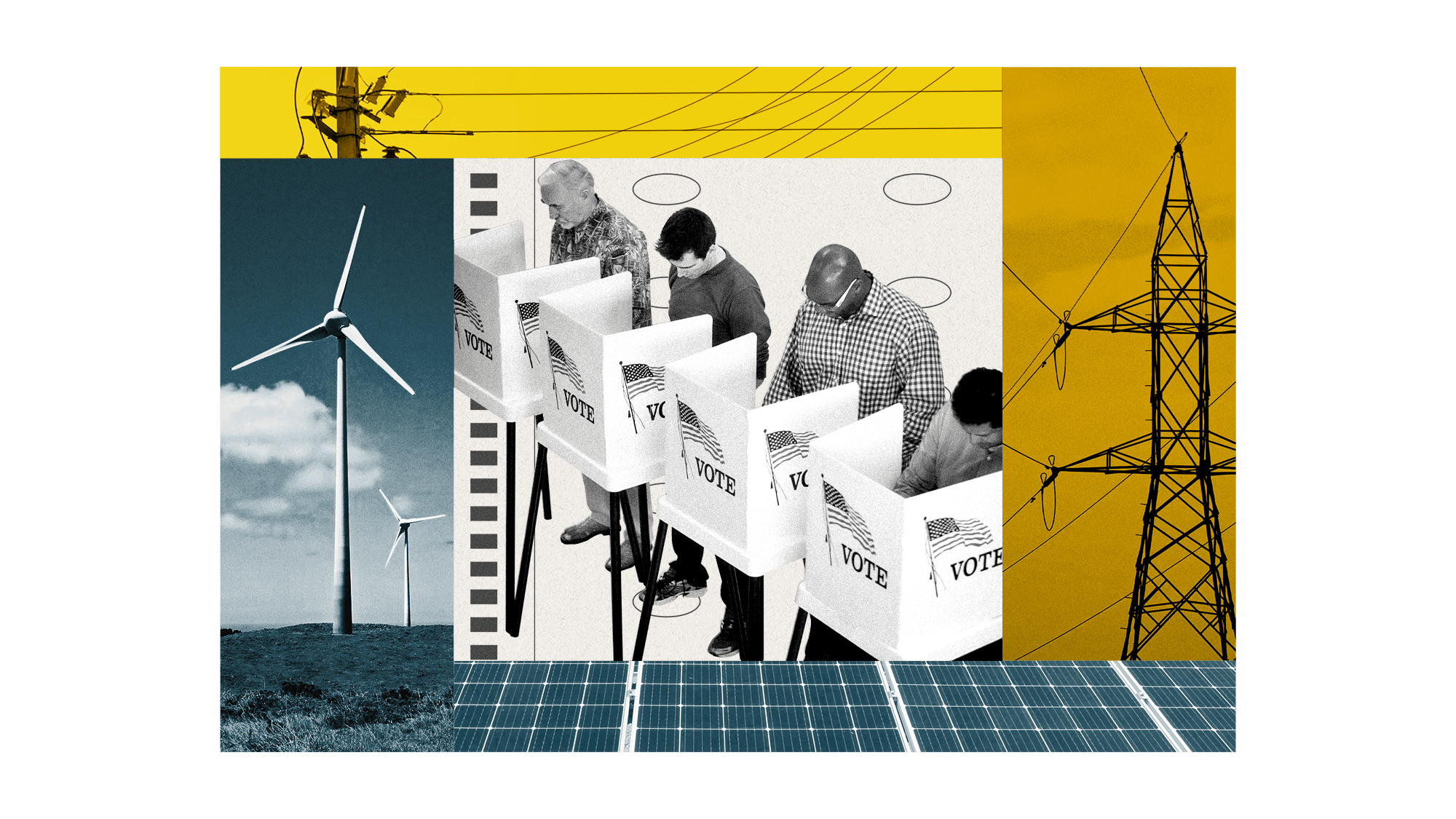

Considered as a physical object, the North American grid is the world’s largest machine; in its political form in the United States, however, it’s a mess of overlapping jurisdictions. So whether the country meets this newly rising demand for electricity in a climate-friendly way or by prolonging the fossil fuel industry’s dominance will largely be up to the 200 or so regulators who sit on state utility commissions. No single person or body of government is in the driver’s seat — the humble, arcane, and largely out-of-sight utility commissions are in control of the grid and its future. Their mandate is to approve or deny the utility companies’ expenditures and the rates they collect from their customers to pay for them. This means federal policymakers can implement all the incentives they want for clean energy, but these efforts will amount to nothing if state-level regulators don’t require utilities to build it.

Every state has a regulatory panel known variously as a public utilities commission, public service commission, corporation commission, or even railroad commission. Most are appointed, typically by the governor. In 10 states, utility regulators are directly elected by voters. Eight of those states are holding elections for at least one seat on November 5.

States voting for utility commissioners in 2024

Three seats on Arizona’s utility commission (known as the Arizona Corporation Commission) are up for grabs. In the short time that body has had a 4-1 Republican majority, it’s gone on a spree of approving the construction of new gas plants, alongside rate hikes and new fees for rooftop solar installations. In Louisiana, a Republican commissioner is retiring, and the choice of his replacement is pivotal because he has been the commission’s lone swing vote. And on the Montana Public Service Commission, which is currently entirely Republican, Tuesday’s election will prove a test of voters’ dissatisfaction with the 28 percent rate hike approved for customers of the state’s largest energy company last year. The results of these elections — and the makeup of commissions across the country, elected and appointed — will quite literally determine whether states add more fossil fuel capacity or transition to clean fuel sources over the next several years, driving how quickly the U.S. cuts emissions nationwide.

How did state utility commissions get so much power? And what can they do with it in this pivotal moment?

For decades after General Electric — the company at the leading edge of electrifying society — was founded in 1892, electricity remained a high-cost luxury. Most people who could afford electricity service, in urban centers like New York City and Boston, were customers of utilities owned by their local municipality. Samuel Insull, an enterprising Brit who started his career as Thomas Edison’s secretary, sought to change that by distributing electricity more widely and selling it more cheaply. In 1912, Insull founded the Middle West Utilities Company, a holding company based in Chicago; because Middle West owned and controlled smaller and more local subsidiaries throughout the region, it gave Insull the reach, and capital, to pioneer centralized power plants that operated nonstop.

In order to advance his own dominance, Insull was a forceful advocate for an agreement between the privately owned utility companies and state regulators that recognized the utilities’ “natural monopoly” over electricity. It doesn’t make sense, the argument went, for power companies to compete over who serves a given customer; it would be “wasteful duplication” for multiple transmission lines to power the same cities and try to outbid one another on rates. In exchange for legal protection of their monopoly, the companies would submit to the oversight of public utility commissions, or PUCs. It was a transference of the regulatory structure that had already been instituted in response to the construction of the railroad industry that accelerated the settlement of the West in the second half of the 19th century. (The public utilities commission in Texas is still called the Texas Railroad Commission, even though it’s been decades since it had anything to do with trains.) Insull’s vision came to dominate the regulatory landscape for electricity in the first two decades of the 20th century, and a handful of large holding companies took control over power generation and distribution nationwide.

In practice, the model was imperfect. The commissions were susceptible to corruption (the concept of “regulatory capture,” a phenomenon in which agencies become influenced by the industries they regulate, was first applied to utility regulation). In a series of Federal Trade Commission investigations beginning in the late 1920s, the electricity industry was revealed to be rife with financial fraud. In 1935, President Franklin D. Roosevelt signed the Public Utility Holding Company Act, a law restricting utility holding companies from exercising monopolies across multiple states and authorizing the Securities and Exchange Commission to break up utility monopolies as it saw fit. Middle West collapsed in the wake of greater government scrutiny and the Great Depression, and the political fortunes of the monopoly model waned.

Still, the structure of vertically integrated monopoly utilities generally persisted until liberalizing reforms in the 1990s prohibited one company from controlling the generation, transmission, and distribution of power, and created wholesale electricity markets where power is auctioned from power plants to customers. In areas with wholesale markets — called regional transmission organizations, known as RTOs, or independent system operators — economic forces and real-time price auctions combine with the priorities of utility commissions to influence both what types of power generation get built and how much energy costs for customers. The specifics of each market vary: Some areas allow consumers to choose their electricity operator from an array of options, for instance, while others allow utilities to maintain their territorial monopolies and participate in regional marketplaces with the energy they make. But utility commissions still play a critical role in approving those utilities’ rates, construction of power plants and transmission lines, and long-term plans. The commissions can also require the utilities in their jurisdiction to take critical steps toward improving equity or expanding renewable energy.

Such markets exist in almost all of the country, save the Southeast, where the makers and sellers of electricity operate with legally protected monopolies in their service territories. If you live in Georgia, Alabama, or Mississippi, for instance, your location within the state determines which power company is available to you, and the utility commission is the primary check on its rates and operations. Because of these utilities’ unique financial structure, with a fixed return on any capital investment guaranteed to their shareholders by the local utility commission, they are better incentivized to build large, capital-intensive energy infrastructure like nuclear plants and offshore wind turbines. That’s put these protected monopolies in the spotlight as they figure out how to respond to the demands of the moment: “The decisions that Southeastern PUC commissioners make over the next three years will make or break whether the U.S. meets the energy transition objectives and, by extension, the world,” said Charles Hua, founder of the organization PowerLines, which is seeking to modernize utility regulation in the U.S. But utility commissions are not only consequential in that region.

While people in those three states deal directly with their respective power company, some of the largest utilities in those states — Georgia Power, Alabama Power, and Mississippi Power — are actually owned by the same company, the Southern Company. In 2005, Congress passed the Energy Policy Act, which repealed Roosevelt’s Public Utility Holding Company Act and, as the journalist Kate Aronoff has written, “helped to clear the way for the reemergence of the type of holding companies that inspired it in the first place, with entities like Southern Company having spawned new arms that exist in something of a regulatory gray area.”

Electricity generation is responsible for a quarter of America’s greenhouse gas emissions, and undergirds much of the rest; decarbonizing energy is an essential component of any serious climate plan. If the country’s grid is ever weaned off of fossil fuels, federal policy will no doubt play a crucial role. But the federal government’s ability to make that happen with the tools it is using — primarily, under the Biden administration, subsidies intended to make low-carbon electricity profitable — is limited. The decision to actually build renewable energy generation occurs at the state level.

“We need to make sure that we do this right,” said Hua, of the current moment in energy transition. “And by that, what we mean is to center the public interest so that the public and consumers come out of this transition better off.”

While utilities are typically the ones who put forward plans for their regulators to approve, deny, or amend, the commissioners often have substantial latitude to make changes — or even outright order utilities to pursue certain types of energy. In Georgia, for instance, individual commissioners have directed the state’s largest utility, Georgia Power, to add solar and biomass to its portfolio; the former has helped the state climb to seventh in the country for utility-scale solar, while the latter led to the controversial approval of a new biomass plant expected to increase customers’ bills. Minnesota’s commission issued an order directing utilities to maximize their use of benefits from the Inflation Reduction Act, the landmark climate law that contains subsidies for utilities who add renewable energy.

Utility commissions have a substantial influence even on renewable energy that’s owned by individuals — that is, rooftop solar. It’s impossible for most homeowners or businesses to go fully off the grid, because those systems typically generate more power than the owner needs when it’s sunny, and the user still needs energy at night. Batteries can help, but rooftop solar users typically need to both buy and sell electricity — a contract with their utility that the state’s commission oversees. The terms of these deals have far-reaching implications for how much rooftop solar costs and, by extension, how many people use it. When California’s utility commission cut the rate utilities pay customers for their solar energy, rooftop installations plummeted.

An alternate model is in place in the areas served by the Tennessee Valley Authority, a federal agency created during the New Deal. The TVA provides power to customers in seven Southern states, including most of Tennessee, and is overseen by a board nominated by the U.S. president. Its lack of a profit motive has enabled it to respond somewhat differently to the recent growth in projected electricity demand spikes caused by new data centers.

Like its neighbors in the Southeast, the TVA is “building an insane amount of gas — but they’re spending more money on energy efficiency and demand response than any other utility” in the region, said Daniel Tait, a researcher at the Energy and Policy Institute, a nonprofit utility watchdog. For the TVA, unlike utilities that primarily profit off of the construction of new infrastructure, “a kilowatt-hour from a gas plant versus from energy efficiency should be no different to them, because they make no money,” Tait said. Clean energy advocates have long been pushing for utility commissions to consider energy efficiency in the same way, with mixed results.

Ron Buskirk / UCG / Universal Images Group via Getty Images

One point analysts agree on is that no regulatory structure is completely winning the energy transition — the grass, it seems, is often greener in someone else’s service territory. Advocates working with vertically integrated monopolies, for instance, argue the lack of a competitive market keeps newer technologies, especially renewables, from thriving because growth is limited to what the individual utility agrees to build.

Energy analysts working on RTOs worry that the more liberalized markets don’t do enough centralized, concerted planning, which can create reliability issues. Critics also contend that RTOs often face less public accountability than monopoly utilities, which are more fully subject to elected or appointed utility commissions that hold public meetings — provided, of course, that ratepayers and stakeholders hold their utilities and commissions accountable.

“If we could wave a magic wand and tomorrow everybody knew that three or five or seven people determine their energy bills, we think that would be a good thing,” Hua said.

How exactly to get people engaged with their utility commission in the absence of a magic wand is a persistent challenge for clean energy and consumer advocates. Mostly, they try to educate their supporters with blog posts and newsletters highlighting a commission’s actions or votes, or the group’s own advocacy work. Some states have even established advisory councils and launched public engagement initiatives. The Federal Energy Regulatory Commission, or FERC, created an Office of Public Participation in 2021 to help educate the public and encourage engagement; while it’s focused on FERC proceedings, the office’s materials also provide basic information and terminology to understand the complicated world of energy regulation.

Beyond getting involved in the process, individuals can also influence the makeup of the commissions themselves. While that opportunity is most obvious in the states that directly elect their commissioners, elections and public pressure can drive change in states with appointed commissions too. In Massachusetts, Democratic Governor Maura Healy replaced commissioners on her state’s utility commission soon after she took office. The new commission has since opened a docket on low-income energy burdens, taken steps to improve equitable access to solar energy, and overseen utilities’ clean energy roadmaps required by a 2022 state law. And last year, in Maryland, a gas industry executive nominated by the governor withdrew his candidacy for the state’s public service commission after outcry from environmental groups.

Stuart Cahill / MediaNews Group / Boston Herald via Getty Images

Commissioners themselves also have some ability to reimagine their roles.

“In this time and moment we should be asking ourselves, ‘How can we be innovative?’ instead of doubling down and doing what we’ve done the last hundred years every time there’s load growth,” said Davante Lewis, a progressive utility commissioner in Louisiana who was elected in 2022.

Primarily, Lewis suggests that regulators take “environmental concerns and the ecosystem” into consideration. “Typically the regulatory compact has been solely decided based on whether or not a utility is justified in building something,” Lewis said. “We need a more comprehensive, holistic view: Not only was this the most prudent decision financially; is it the most prudent decision environmentally?”

Utility commissions often have enough latitude under state law to examine factors beyond price and reliability, according to a University of Michigan Law School analysis, but many are hesitant to do so. That’s where a state legislature can step in to expand the commission’s scope. Colorado, for instance, has broadened its utility commission’s authority to explicitly include equity, including minimizing the negative impacts of its decisions and addressing historic inequalities — a change the commission’s staff called a “new decision-making paradigm.” The staff’s report on how to implement the new rule recommends requiring utilities to develop equity plans and creating a new type of proceeding to consider the equity impact of electric and gas issues. Since a major critique of gas and coal plants is the negative effects of their pollution on the often-marginalized communities nearby, the process, if implemented, could significantly influence decisions about such power plants.

Other states have tried to even the playing field between electric utilities and the other stakeholders who weigh in on their plans before utility commissions. Large, investor-owned utilities employ large staffs of lawyers and experts who can testify on their behalf. Environmental and consumer advocates, meanwhile, are typically nonprofits with much smaller budgets, which can make it difficult for them to hire or contract with experts to make their case for renewable energy, lower rates, and other policies against a mountain of testimony and data from the utility.

“There can be an extreme imbalance between the different parties who might be participating in these proceedings,” said Oliver Tully, the director of utility innovation and reform for the Acadia Center, a nonprofit advocating for clean energy across New England.

So some states, including California, Idaho, and Michigan, have implemented programs to compensate individuals and nonprofits who take part in regulatory proceedings by cross-examining the utilities and bringing in experts to testify.

In Connecticut, one of the states where Tully works, it took a natural disaster to usher in change. Hurricane Isaias left some 750,000 people without power in August 2020, some for more than a week. The state’s utility commission, the Public Utilities Regulatory Authority, or PURA, ultimately issued millions of dollars in fines over utilities’ slow response or lack of preparation. The storm, Tully said, got state leaders thinking seriously about how those utilities are governed.

“That was the catalyst that got a lot of legislators talking about the need for change within the world of utility regulation,” he said.

Connecticut had already established an advisory council to help bring the needs of low-income residents before energy regulators. But in the wake of the storm, officials took reforms further. The governor, who appoints the three members to PURA, established an additional advisory board focused on equity and energy justice, which advocates said is helping their efforts to get more people and groups interested in clean energy and environmental justice involved with the complicated and difficult process of energy regulation. The Regulatory Authority has subsequently opened a proceeding focused on equity and stakeholder engagement.

The state legislature, meanwhile, passed laws directing PURA to implement two key changes: stakeholder compensation and performance-based regulation. The state’s stakeholder compensation program covers attorneys’ fees, expert witness fees, and other costs for intervening groups. Performance-based regulation lets the commission tie utilities’ profits to how they perform in certain areas, like keeping rates affordable or cutting emissions. Because investor-owned utilities receive a profit range set by their regulators and are allowed to pass costs like construction and fuel on to their customers, critics argue they don’t have much incentive to keep those costs low or pursue programs like rooftop solar and energy efficiency that might lower emissions but also cut into profits. This approach aims to flip those incentives around, pushing electric companies to change their practices.

It’s not a shift utilities are often fond of, and their powerful lobbying efforts can be a major obstacle. The resistance in Connecticut was so vehement, Tully said, that lawmakers in Maine abandoned a similar bill.

“This is a perennial risk of these kinds of proceedings,” he said. “It represents a threat to the status quo of how utilities have been operating for many, many years.”

Some utilities argue that changing their profit structure in this way could hurt their ability to finance major, necessary energy projects — one of the primary strengths of large utility companies. But that doesn’t seem to be the case in the long run. Although the increased uncertainty while regulators are hashing out the details can make creditors wary, in Hawaiʻi, the performance-based regulation framework actually improved utilities’ credit rating. Some consumer groups, meanwhile, have raised concerns about performance-based regulation because they argue that utilities could easily misrepresent their performance to regulators.

The Connecticut commission is still working on how it will implement performance-based regulation, and the other changes are relatively new as well, so their impact is still “to be determined,” Tully said. But he and his colleagues were encouraged that the advisory councils have pushed PURA to consider equity.

Getting utility commissions to run differently, advocates said, can be a steep uphill battle, especially in the face of strong resistance from utilities. But it can work. Other states have implemented policies like Connecticut’s, and taken other steps, sometimes at the behest of state legislatures and sometimes because commissioners decided to take action.

While a hurricane kickstarted change for Connecticut, it also took a lot of advocacy — both “up and out,” said Jayson Velazquez, one of Tully’s colleagues based in Hartford. The group and its allies lobby “up,” working to get lawmakers and commissioners on board with passing reforms. And they also work “out,” communicating their findings and the issues before the commission to the public and engaging environmental justice groups and community members.

“A lot of the work that we’re doing is bridging that gap between environmental justice groups and our regulators,” Velazquez said. “You kind of have to raise the collective consciousness of the groups before you can really get into effecting change.”