SIOUX FALLS, S.D. (KELO) — Gov. Kristi Noem’s proposed fiscal year 2026 budget cuts $3 million from programs for tobacco prevention in South Dakota.

Three million may not seem like much in a $7 billion budget but for tobacco prevention in the state, it is a 60% cut from $5 million to $2 million, said Ben Hanson. Hanson is the government relations director of North and South Dakota for the American Cancer Society Cancer Action Network, the advocacy and lobbying arm of the American Cancer Society.

The tobacco tax money helps to fund prevention and education programs such as the Quitline operated by Avera Health.

“This is a terrible time for it,” Hanson said of the proposed 60% cut. Hanson said research shows that “there is a rise in the use of nicotine products in general.”

Data can vary on age of youth and products used by state and by year.

In South Dakota, the state Department of Health (DOH) said in the 2023 youth tobacco report that “Overall, 3.4% of middle school students reported current use of e-cigarettes/vapes in 2023, a decrease from 4.0% in 2021.”

Overall use of e-cigarettes by South Dakota youth is more than double the national average, Hanson said.

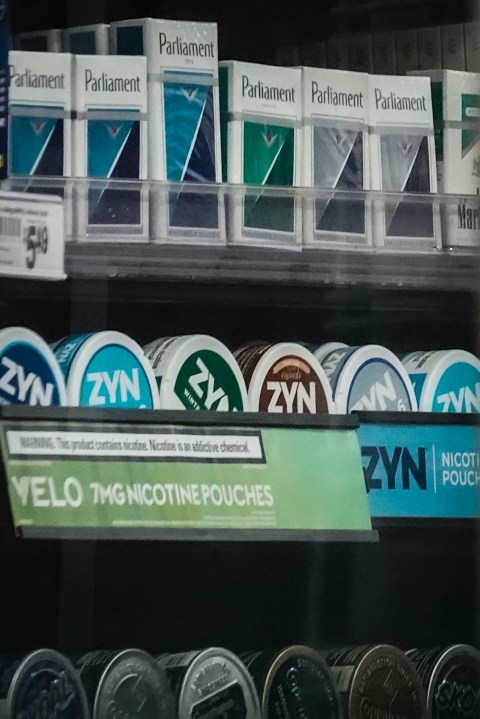

Hanson said the sales of nicotine pouches have “exploded” recently.

Nicotine pouches are smokeless commercial tobacco products. Those products can be snus and tobacco chew made from organic tobacco or synthetic nicotine. They are often fruit flavored and are about the size of chewing gum. Many come in containers that resemble circular mint containers.

Middle school students in South Dakota had heard of nicotine pouches in 2023 but not many had used it, according to the sate Department of Health (DOH) 2023 youth tobacco survey.

The Food and Drug Administration said in December that 8.1% of all U.S. students reported some use of tobacco products and 10% of all high school students reported use. The most popular choices were e-cigarettes at 6% and nicotine pouches at 2%.

“There are so many new products,” Hanson said. The purpose of tobacco tax money is to help inform parents and adults about the new products and potential harm.

The National Association of County and City Health Officials (NACCHO) said nicotine pouches posted a 29% increase in sales as of September 2023. Research for years prior to 2023 showed the pouch growth individual sales had been in the triple digits from 2019 to 2022.

Research shows that nicotine is a stimulant that can lead to addiction, cancer and negatively impact the heart. Yale Medicine said the potential negative effects are not yet fully known as pouches are much newer to the market than e-cigarettes or cigarettes.

“We are going to put all resources in to make sure this cut doesn’t happen,” Hanson said.

The state already dips into the $1.53 tax per cigarette pack approved by voters in 2006.

The first $30 million in the tobacco tax money goes to the state’s general fund. The $30 million came in 2007 when legislators advocated to access the fund for property tax relief, health care and education instead of all going to the tobacco tax trust fund.

Partners such as the American Cancer Society agreed on the 2007 compromise, Hanson said.

Hanson said partners in the tobacco tax fund have held to their responsibilities, now they want the state to do the same.

When the tax passed in 2006, Lt. Gov. Larry Rhoden was a legislator. Rhoden is expected to become governor if Noem resigns to become the federal Secretary of Homeland Security.

Rhoden’s knowledge of the original tax and and his advocacy of a 2007 request to amend the tobacco tax should help with efforts to prevent the $3 million cut, Hanson said.