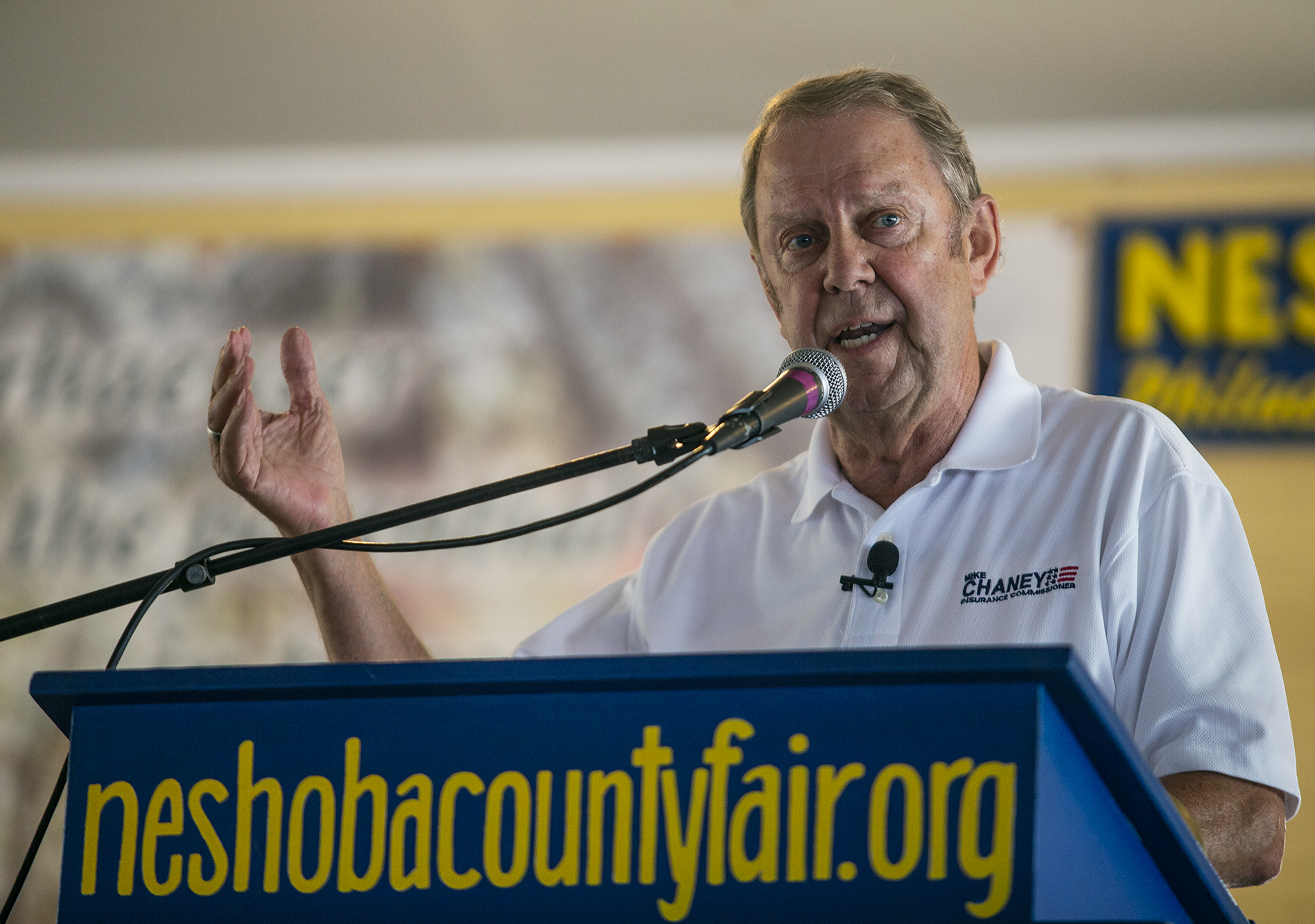

Mississippi Insurance Commissioner Mike Chaney says he is hopeful that the homeowner insurance rates that have spiked in recent years are now beginning to stabilize.

Chaney said he is hopeful that legislation passed during the 2024 session that provides grants to help homeowners put more wind resistant roofs on their homes will help lower the cost of premiums. He said the Legislature placed $5 million in the program.

“While this will help launch the program, the Legislature will need to provide additional annual funding well above this amount so that the program can provide the necessary benefits to reach a significant number of policyholders across our state,” Chaney said via email.

While homeowners’ insurance rates in Mississippi have risen significantly, the increases have been less than in many surrounding states, according to various studies.

Chaney said his agency, which regulates the insurance industry in Mississippi, has received requests for double digit increases.

“We worked with companies to consider less than what their indicated need was … We feel that rate pressures will begin to stabilize along with inflation. Some companies that requested rates over 15% last year are now seeing a much lesser need – many are now in single digits,” Chaney said.

Inflation and the frequency of severe weather causing insurance claims are the two primary reasons for the increases in the homeowners’ insurance rates, according to Chaney.

Earlier this year the U.S. Senate issued a report addressing the rising costs of homeowners insurance premiums. The Democratic majority cited weather associated with climate change as the primary reason for the increase. Republicans discounted climate change and blamed the increase on inflation.

According to data compiled by Insurance.com and updated this month, the average cost of a policy for a $300,000 home in Mississippi is $3,380 per year, which is $779 or 30% above the national average.

The cost in Mississippi, though, is lower than many other Southern states. For instance, the cost in Louisiana is 38% above the national average and 52% above the national average in Arkansas. Florida is 70% above the national average while Texas is 48%. Other Southern states — Georgia, Alabama, Tennessee and Kentucky — are below the national average.

Realtor Magazine in May cited a report from Insurify, a virtual insurance company, saying, “The states with the highest home insurance costs are prone to severe weather events. Florida, Louisiana, Texas, Arkansas and Mississippi are vulnerable to hurricanes. Texas, Colorado and Nebraska face a growing wildfire risk. Nebraska, Texas and Kansas are at high risk for tornadoes, being located in an area nicknamed ‘Tornado Alley.’”

Chaney said there are two types of processes for how insurance companies get rate increases. He said Mississippi is “a prior approval” state where the companies must receive approval from the regulator before an increase can be enacted. Other states –file and use states – allow the company to enact the increase before receiving approval.