Milles Studio // Shutterstock

How Fed rate cuts may impact consumers

Creative illustration of a guy daydreaming about a house and car as an effect of lending rate cuts.

The Federal Reserve cut its key lending rate by 0.5% on Sept. 18. While it remains to be seen how many more rate cuts will occur, the consensus appears to be additional quarter-point cuts by the end of the year. These cuts are more likely to affect prices on Wall Street than on Main Street.

To understand why, consider that the next few interest rate cuts will effectively reverse only three of the 11 rate hikes that have been issued since early 2022. Additional rate cuts may come when the Fed reassesses employment and monetary conditions once again in the new year. But as summer comes to a close, it’s far from certain what monetary policy decisions will be made in 2025.

In this analysis, Experian explores the impact rate cuts could have on consumers, especially as current record-level rates continue to be felt in the form of borrowing rates and returns on investments.

Experian

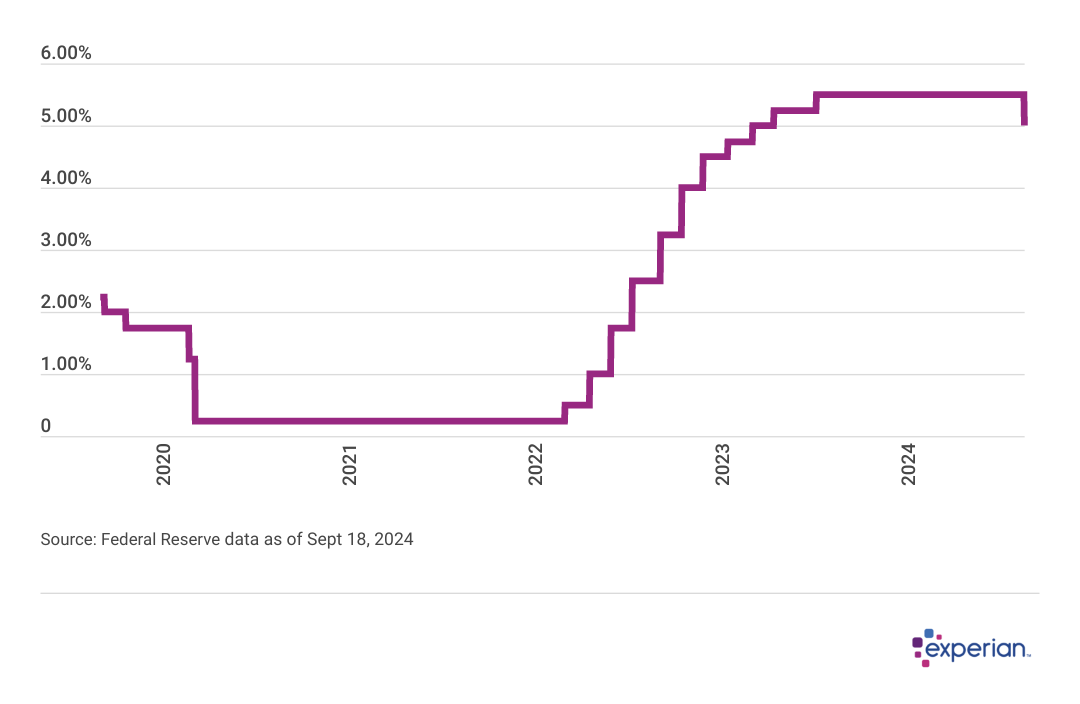

Fed Rate Remains at 17-Year High, Impact of First Cuts Likely Minimal

Line graph showing data on “Federal Funds Rate 2019-2024”.

Compared to the rate increases totalling five percentage points in less than two years, a possible 0.75 percentage point reversal by year end isn’t likely to have a big effect on consumers, at least at first.

One reason should be obvious: A three-quarter point cut is inarguably puny compared to the five percentage points of increases that accelerated the interest charged to consumers over that period, particularly for credit card borrowers.

Second, interest rate changes take time to transmit through the economy. Chances are that in 2022, consumers didn’t immediately notice those first Fed increases. Indeed, if low interest rates were noticed at all, it was probably in the rock-bottom mortgage rates millions of homeowners were securing. One survey in early 2022 found that mortgage purchasing confidence was at an all-time high, primarily due to refinancing rates around 3%.

While far from a precise measure, previous economic studies suggest that it takes between one and two years for changes in key monetary interest rates to affect participants on the ground—in both the prices consumers see for goods and services, and changes in economic activity.

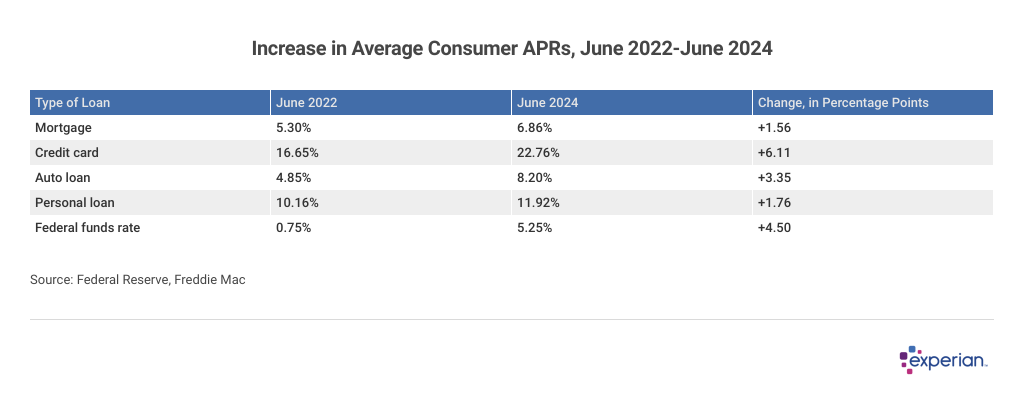

The Ghost of Interest Rates Present

For many consumers, elevated interest rates have made their presence known through credit card interest payments on prior purchases, or by the increase in auto loan and mortgage rates that either limit the amount of house or car one can buy or price buyers out altogether. Even rates on personal loans that are often used to consolidate higher interest payments have increased more than a percentage point.

As seen with the first rate increases in mid-2022, lenders don’t always wait for a bevy of bankers in Washington to take action before changing rates on their own, at least for some types of loans. For example, mortgage rates had already increased by more than two percentage points to an average annual percentage rate (APR) of 5.30% for a 30-year fixed mortgage, even before the Fed began raising rates—as both lenders and debt markets already anticipated interest rate hikes. And average auto loan rates were driven as much by inventory fluctuations increasing automobile costs as by monetary policy in Washington.

Experian

Credit Card Rates Rise With Fed Moves, Squeezing Consumers

Table showing data for “Increase in Average Consumer APRs, June 2022-June 2024.

Credit card interest is more closely tied to Fed policy decisions, more or less moving up with each incremental quarter or half percentage point increase. Most credit cards track the prime rate, which usually moves in lockstep with the federal funds rate.

Credit card users, already hot from higher prices on just about everything, may not have noticed the first increases of their monthly interest payments, but increases totalling an average of more than six percentage points in interest rates eventually got their attention as much as the cost of seemingly everything else going up in price at the same time.

Will Rates Return to Pandemic-Era Levels Anytime Soon?

So how will the first interest rate cuts by the Federal Reserve impact consumers, most of whom finance something—a car, home, education, and more—with credit? Although rate changes often go hand-in-hand with unrestrained urgency from some markets in the financial services industry, in reality you’ll likely need to wait at least a few months for many rates to begin to take their bite. Even the most lockstep moves in rates, from variable-rate credit card issuers, take at least one or two billing cycles before a rate reduction takes effect.

Perhaps the primary reason these rate cuts may not be an immediate tonic is that the size of the cuts expected won’t likely even begin to reverse the multi-percentage point increases in mortgages, auto loans and credit card borrowings. Three rate cuts essentially brings us back to the beginning of 2023—and consumers were far from content at that point.

Average credit card APRs, assuming three quarter-point rate cuts, will still mean an average 22% APRs to carry balances on credit cards. As for other major types of consumer loans, while loosening interest rates may make financing less expensive, that doesn’t necessarily mean the supply and demand laws for homes and automobiles are suddenly brought back into equilibrium.

It may not be financing costs that imperil housing and auto markets, however, but the costs of ownership themselves. Belatedly, ownership costs of housing (such as insurance and homeowner association fees) as well as for automobiles (insurance rates appreciated rapidly following the pandemic, and have yet to subside) may make these purchases difficult for consumers, no matter where interest rates ultimately settle.

We’ll still be facing a housing shortage, which may continue to increase homebuying costs, although homebuilding costs may decline. Auto inventories have stabilized enough for consumers to have some choices at the dealership, though as of now they’re not likely to be less expensive.

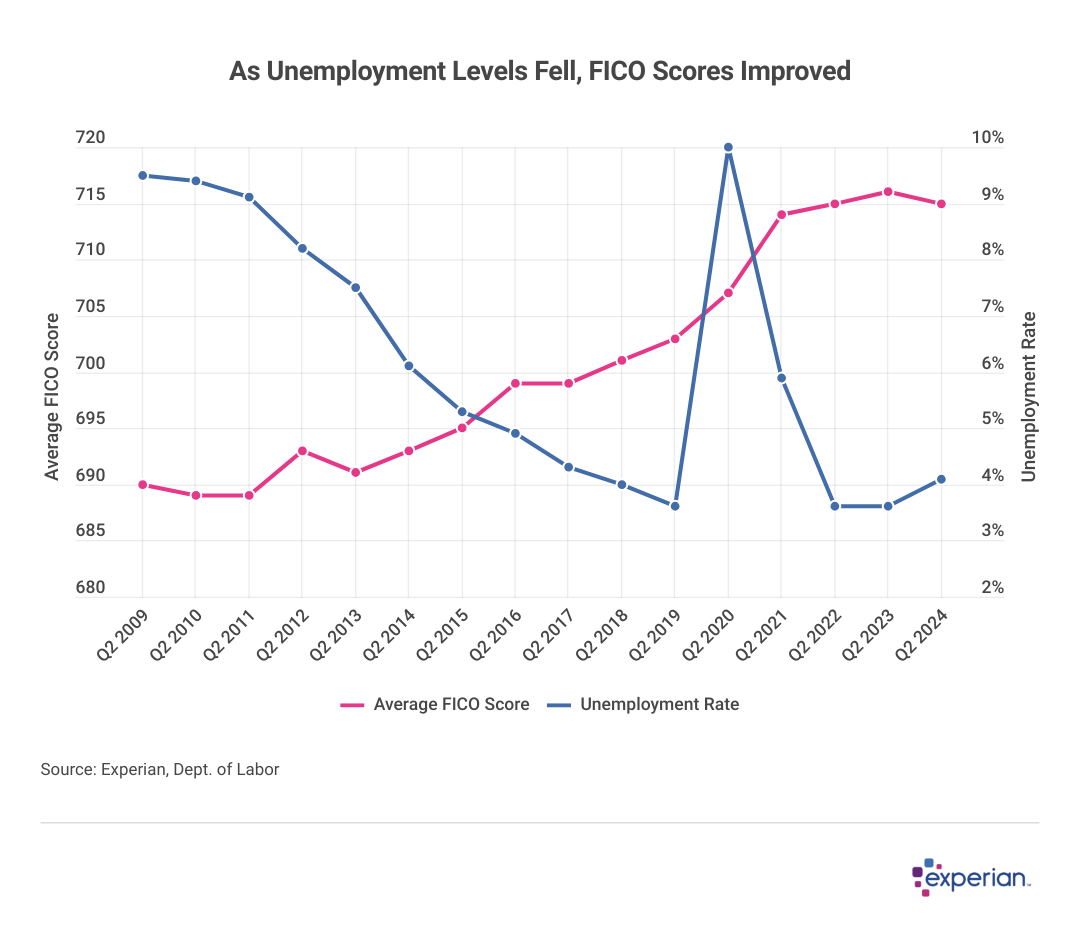

Do Interest Rate Cuts Impact Credit Scores?

Broadly, consumer credit score trends appear more closely correlated with employment levels than other macroeconomic barometers used to observe economic conditions, such as the rate of inflation, interest rate levels and even GDP growth.

Since 2009, there have been two recessions, two series of interest rate hikes and inflation rates that have ranged from 0% to 9%—sharp changes that most would feel in their everyday life one way or another. But throughout all the economic tumult, credit scores remained not only steady, but also improved.

If credit card APRs come down in the near future, consumers may find some small relief in the form of reduced interest charges. This may make it easier for them to pay down their debt and better avoid missing payments, which could have positive effects on their credit scores.

Experian

Falling Employment Lead to Rising Credit Scores Over 15 Years

Line graph showing data on “As Unemployment Levels Fell, FICO Scores Improved”.

Employment, shown here as the general unemployment rate, is the only major macroeconomic indicator that somewhat mirrors consumers’ overall credit score improvement over the past 15 years. As employment rates fell, credit scores broadly improved, as workers had the income to service their credit payments. During the pandemic, when many workers were sidelined, expanded unemployment benefits and various loan repayment suspension schemes kept many consumers’ credit out of delinquency.

This story was produced by Experian and reviewed and distributed by Stacker Media.