Rep. Steven Horsford (D-NV) unveiled the “Tipped Income Protection and Support (TIPS) Act” Tuesday, an effort to put a progressive stamp on the policy effort to end taxation on tips popularized by former President Donald Trump.

Horsford’s plan, unlike Republican-led proposals to solely exempt tips from federal taxation, includes eliminating the federal tipped subminimum wage, aiming to improve tipped workers’ pay by raising their baseline earnings and easing their tax burden.

The subminimum wage, currently set at $2.13, permits employers to pay employees an hourly wage below the federal minimum of $7.25 if they work in tipped industries or have disabilities, among other qualifications. Rules vary by state; Nevada is one of seven states that has eliminated the subminimum wage for tip earners, with all employers required to guarantee the statewide minimum wage of $12 per hour.

In 15 states, the subminimum wage is $2.13. Employers are required to make up the difference between the federal and subminimum wage when tips don’t cover it, but in practice, this may not occur.

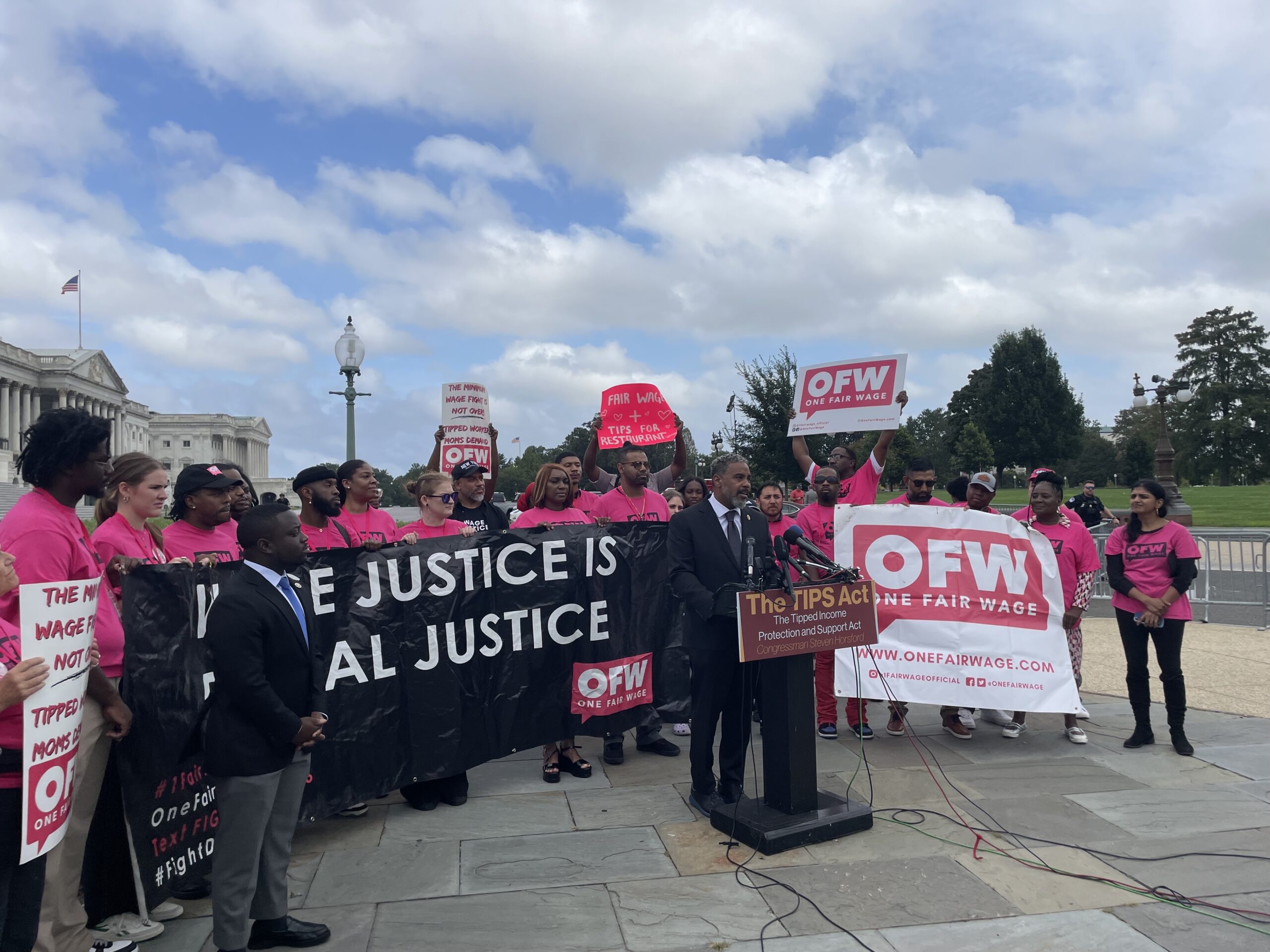

Horsford, speaking at a press conference at the Capitol on Tuesday surrounded by restaurant workers affiliated with advocacy group One Fair Wage, positioned his bill as part of a larger fight.

“The TIPS Act isn’t just about wages or taxes,” he said. “It’s about economic justice. It’s about recognizing that service workers are the backbone of our economy.”

Ending taxes on tips became a key issue in the presidential race when Trump proposed it at a June rally in Las Vegas. His Democratic opponent, Vice President Kamala Harris, soon followed with a similar pledge to end taxes on tips, and later committed to ending the subminimum wage and raising the federal minimum wage as well.

Trump, who touted the idea again during another event in Las Vegas in August, has been light on details, including whether the exemption would apply to income and payroll taxes or if there will be an income cap. Harris is reportedly considering a $75,000 income cap to qualify for the benefit, which would only apply to federal income tax.

Read More: Will Trump’s Las Vegas idea to end taxation on tips catch on?

Horsford’s proposal addresses concerns that the no tax on tips policy could be abused by corporate executives not paying tax on their bonuses by only applying to industries where tipping is customary.

Saru Jarayaman, the president of One Fair Wage, noted that while tax relief — the predominant policy discussion in the presidential election pertaining to restaurant workers — would be welcome, raising base wages, as Horsford’s bill does, is more important.

“Yes, it’s great — let’s have a little bit of extra money around tax season,” said Jarayaman, noting that two-thirds of tipped workers don’t earn enough to pay federal income tax. “But what we really need is a raise.”

Horsford’s bill was also immediately endorsed by the Culinary Workers Union Local 226, which represents 60,000 service workers in Nevada and is closely allied with Nevada’s Democratic representatives in Congress. In a statement, union Secretary-Treasurer Ted Pappageorge said that by eliminating the subminimum wage, Horsford’s bill would benefit service workers earning less than $37,000 per year around the country.

“Now, it’s time for the entire nation to follow Nevada’s lead to eliminate the subminimum wage, ensure that workers receive a fair wage, and end taxes on tips so one job is enough for workers to support their families,” he said.

Horsford’s TIPS Act caps eligibility for tax exemptions at $112,500 in gross income.

The existence of a cap varies across Republican proposals — legislation from Sen. Ted Cruz (R-TX) in the Senate, co-sponsored by Nevada’s two Democratic senators, has no such cap and structures the policy as a deduction. Horsford’s, by contrast, has an income cap and is structured as an exemption. It applies only to federal income tax, rather than including payroll taxes for Social Security and Medicare.

“Those other bills don’t address the subminimum wage, which is the crux of the problem,” Horsford said. “Who is supposed to live off of $2.13 an hour?”

“[Republicans] didn’t write any legislation,” he continued. “They just took an idea from somebody else that told them to do it. They had no details or provisions … The TIPS Act is thoughtful. It’s comprehensive. It has the guardrails that are necessary.”

One Republican proposal from Rep. Don Bacon (R-NE) provides a tax exemption for as much as $20,000 in tips. But Las Vegas is home to several top-earning professions within the hospitality industry where workers earn far more than that — high-end servers and cocktail waitresses can make six figure incomes due to large tips.

Horsford said he chose a cap of $112,500 based on the structure of prior tax provisions — the 2021 child tax credit expansion, authored by Democrats, began to phase out the full benefit at $112,500 for heads of household.

Economists have criticized proposals to end taxes on tips because of their potential to add hundreds of billions of dollars to the federal deficit. Raising the minimum wage would likely generate additional tax revenue, but when asked about potential pay-fors, Horsford argued that service workers deserve relief and redirected the question back to Trump.

“Ask Donald Trump, does he have a pay-for for his tax cuts to the 1 percent?” Horsford said. “Once he gives you an answer, then I’ll talk to you.”