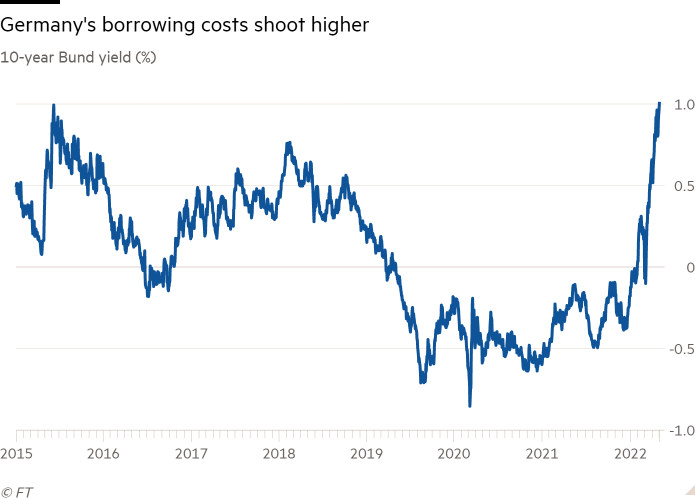

Bond markets were hit with a fresh wave of selling on Tuesday, pushing Germany’s 10-year borrowing costs to 1 per cent, after Australia kicked off a busy week for central banks with a bigger-than-expected rate rise.

Australia’s debt market was the hardest-hit, but the selling also ricocheted across major European markets.

The yield on Australia’s 10-year bond hit 3.4 per cent, a level not reached since 2014, while its more policy-sensitive two-year yield rose by more than 0.19 percentage points to 2.77 per cent.

In Europe, Germany’s 10-year bond yield rose 0.05 percentage points to exceed 1 per cent for the first time in seven years, while the UK equivalent jumped around 0.1 percentage points to 2 per cent. Germany’s 10-year borrowing costs started the year in negative territory.

The Reserve Bank of Australia increased interest rates for the first time in more than a decade, citing the country’s “very resilient” economy and inflation that has “picked up more quickly, and to a higher level, than was expected”. The increase of 0.25 percentage points was larger than the 0.1 percentage points markets had expected, highlighting how policymakers across the world are responding to intense inflation by rapidly unwinding stimulus measures put in place at the height of the pandemic.

“After having given the impression over a long time that it is not in a particular rush to start monetary policy normalisation, the significant rise in inflation rates now made it implement a reversal more quickly after all,” said You-Na Park-Heger, an analyst at Commerzbank.

The US 10-year yield traded roughly flat after exceeding 3 per cent the previous day for the first time since 2018.

The US Federal Reserve, the world’s most influential central bank, is on Wednesday expected to announce an extra-large rate rise of around half a percentage point, with markets pricing in similar half-point rises at the subsequent two meetings, after US consumer price inflation reached a 40-year high of 8.5 per cent in March.

“We do not see much room for dovishness at the May meeting,” Standard Chartered strategist Steve Englander said. “It took a while” for the Fed’s rate setters to “reach a consensus” on the need to tighten monetary conditions to try and quell demand, Englander added. “And we don’t see an incentive for that consensus to break.”

The Bank of England is forecast to follow up on Thursday by raising interest rates to the highest level since 2009.

European equities rose, meanwhile, though trading conditions remained thin ahead of the Fed’s meeting. The regional Stoxx 600 share index rose 0.8 per cent in early dealings, while Germany’s Xetra Dax added 0.2 per cent. The UK’s FTSE 100 fell 0.2 per cent. An index of expected volatility for European large-cap stocks traded at 32, above its long-run average of about 20.

The European stock market moves on Tuesday followed a brief plunge for some indices in the previous session, caused by a major bank’s trading error. The Stoxx slid as much as 3 per cent early on Monday, reflecting short but steep drops for Nordic gauges including Sweden’s benchmark OMX 30. Citigroup said that one of its traders had made an error inputting a transaction.