This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning and welcome to Europe Express.

Ukraine won the Eurovision Song Contest over the weekend with more votes cast for a single country than ever before, meaning that it will host next year’s pop fest — a message of support from people across Europe and from leaders who cast it as one in many victories for Ukraine in the face of Russian aggression.

Meanwhile, Turkey has raised objections to Nato enlargement in a move similar to Hungary holding up EU’s Russian oil embargo. We’ll run you through what to expect from an events-packed week, not just on foreign policy and defence, but also on economic policy and the first parliamentary moves on the bloc’s climate policies.

Turkey is the new Hungary

EU diplomats have their work cut out for them this week, writes Valentina Pop in Brussels. Their tasks include seeking to overcome Hungary’s opposition to the EU’s long-delayed oil embargo on Russia, and attempting to assuage Turkey’s concerns about letting Finland and Sweden join Nato.

With Ukraine’s foreign minister, Dmytro Kuleba, taking part in the EU foreign affairs council today, diplomats will discuss the oil embargo, even if the key to solving this remains in the hands of prime minister Viktor Orbán and European Commission negotiators.

The Hungarian demands still centre on concrete investment guarantees that alternative infrastructure including oil pipelines will be built. The European Commission is likely to spell out in its REPowerEU package on Wednesday what landlocked countries, Hungary included, will need to do to wean themselves off Russian fossil fuels.

On Turkey’s demands, Nato officials yesterday expressed confidence that they could be met and that both Finland and Sweden would join swiftly. Turkey’s foreign minister Mevlüt Çavuşoğlu suggested that Ankara was also seeking the lifting of an arms embargo imposed by Sweden and Finland on Turkey in response to a military operation in 2019 that targeted US-backed Kurdish militants who led the campaign against Isis jihadis in Syria.

Later this morning, the foreign affairs discussion kicks off with Canada, whose foreign minister Mélanie Joly (fresh from Nato and G7 foreign ministers’ meetings in Germany) will take part in the EU-Canada joint ministerial committee. She will then participate in the discussion about Russia’s war in Ukraine, alongside minister Kuleba.

The meetings are likely to underscore the strength of the partnership with Canada. As one diplomat put it drily, were it not for the geography, the EU would have already asked Canada to join the bloc.

Balkan countries wanting to join, but still blocked for various reasons, are also on the agenda. Ministers will hold a lunch with their six western Balkan counterparts amid a renewed impetus from some capitals to speed up their accession process. The meeting will also be an opportunity for some EU ministers to renew their pressure on Serbia to align itself with the bloc’s sanctions regime if it wants to join.

Defence ministers gather in Brussels tomorrow to discuss more arms supplies and another €500mn from the bloc’s budget for arming Ukraine, which is likely to be approved without issues.

The ministers will be joined by Nato officials and the head of the European defence agency to hold a discussion about an investment gap analysis prepared by the commission. Nato chiefs of defence are also gathering in Brussels on Thursday to discuss logistics relating to beefing up the eastern flank, as well as all things Ukraine and Nato enlargement.

One measure of success from this week’s plethora of meetings would be some evidence of progress towards a deal either on the oil embargo or on Nato enlargement.

Economic policy hand-wringing

The dismal outlook for the EU economy will be set out in detail today when the European Commission sets out its latest growth forecasts, write Sam Fleming in Brussels and Andy Bounds in Paris.

Both the EU and euro area are set to expand by 2.7 per cent this year, well shy of the previous 4 per cent prediction, according to draft forecasts seen by Europe Express. Growth will be 2.3 per cent in 2023.

That tepid picture will be coupled with inflation that surges above 6 per cent in both the EU and euro area this year, with some central and eastern European countries set to experience double-digit inflation in 2022.

Uncomfortably for the European Central Bank, inflation in the eurozone is now tipped to remain above target at 2.7 per cent next year, higher than the IMF’s recent prediction of 2.3 per cent.

The question is how policy should respond. The commission will agree on its economic and fiscal policy recommendations for member states later this week, but alongside that is ongoing debate on when the EU’s Stability and Growth Pact should be reimposed.

The budget rules were suspended via a so-called general escape clause in 2020 in the teeth of the Covid-induced crash, and the commission has long signalled that it expects to reimpose the rules next year.

The Netherlands, normally known as one of the frugal member states, has said it will not object to another extension of the general escape clause until the end of 2023. And in (at least some parts of) the German government, a similar, conciliatory position is forming.

But the commission growth forecasts, which were reported earlier by Bloomberg, do not give as clear-cut a signal on what to do as predictions back in 2020, when the EU was heading into a full-year economic nosedive.

The 2022 growth rate benefits from favourable statistical comparisons with 2021, which give the figures a slightly ruddier glow than they deserve.

But employment is still forecast to keep growing this year and next. And when inflation is running at such a rampant pace the question of how fiscal policy should respond is not necessarily straightforward.

A decision on the general escape clause has yet to be made in the commission, and an announcement is not expected today. The key players on this — economics commissioner Paolo Gentiloni and executive vice-president Valdis Dombrovskis — have not yet reached an understanding on the matter, and a clearer steer from Berlin may also be needed.

Speaking about the general escape clause on Sunday, Dombrovskis said it would be another week before the decision comes out. “We have been clear in our March fiscal guidance we were expecting to discontinue it, but we would come back to this question in the spring economic cycle,” he said. Growth, he added, is expected to slow, but not “stall”.

Given the formidable downside risks, many in the markets are certainly expecting the commission to keep the budget rules suspended for longer, and it would be a shock if the rules are not held in abeyance.

As the commission will make clear today, things could get a fair bit worse economically if the energy crisis worsens. Higher energy prices, together with a Russian decision to cut off gas supplies, would knock another 2.5 percentage points off the forecast 2022 growth rate, and a percentage point off the 2023 outlook, the commission draft shows. Inflation would, meanwhile, be even higher.

Some member states wonder why Brussels would opt to add the reimposition of the budget rules to EU capitals’ already formidable laundry list of policy challenges.

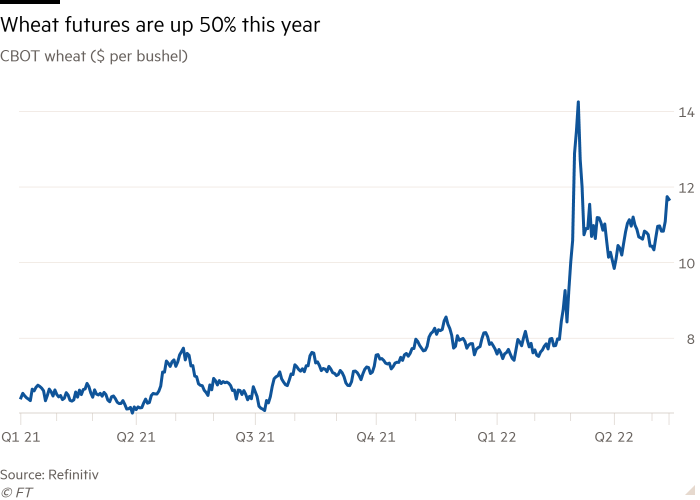

Chart du jour: Costly grains

The issue of food emerged as one of the key issues in the G7 ministers’ weekend deliberations. Their final communiqué said Russia’s war had “generated one of the most severe food and energy crises in recent history, which now threatens those most vulnerable across the globe”.

Adjusting climate measures

It’s a busy start to the week for the European parliament’s environment committee. MEPs will vote on amendments to seven of 14 proposals put forward by the commission last July as part of its ‘Fit for 55’ package that set medium-term targets for the EU on its way to reach net zero emissions by 2050, writes Alice Hancock in London.

The committee vote will set the stage for parliament to agree its final position — probably pushing the commission’s proposals to be far more ambitious — at a plenary meeting in June. It also comes in the same week that the commission is due to present new ideas on energy deployment and resources (REPowerEU, the second iteration).

The backdrop has changed significantly since the commission first presented Fit for 55, which sets an overall target for the bloc of cutting emissions by 55 per cent by 2030. Energy prices have soared as sanctions against Russia bite Europe’s energy supply and went even higher this week after Moscow imposed retaliatory sanctions.

Most controversial among the proposals being voted on is the extension of the emissions trading system, through which polluting industries can buy credits to cover their emissions, to buildings and road transport. The introduction of a border tax on the carbon output of products coming into the EU, the so-called Carbon Border Adjustment Mechanism, is also far from generating consensus.

Pascal Canfin, ENVI committee chair, said that he hoped MEPs had reached a compromise on the new emissions trading system that excluded private cars and homes. “I don’t think it is politically reasonable, even more today with the energy prices we have, to have an ETS on houses.”

For the EU to meet its 55 per cent reduction target, though, the committee is likely to approve more ambitious timelines for the introduction of CBAM and phasing out of free carbon allowances, something that industry bodies are pushing hard against.

What to watch today

-

Canada’s and Ukraine’s foreign ministers join EU counterparts at the foreign affairs council in Brussels

-

European Commission presents its spring economic forecast

-

Final day of the EU-US trade and technology council in Paris

. . . and later this week

-

EU defence ministers meet tomorrow in Brussels

-

European Commission tables second REPowerEU package on Wednesday

-

European parliament’s plenary session Wednesday and Thursday

-

Nato chiefs of defence meet on Thursday in Brussels

-

EU council chief Charles Michel visits Albania and Bosnia over the weekend

Notable, Quotable

-

Nordic ambitions: Finland and Sweden yesterday announced that they will be applying for Nato membership, a historic move that would more than double the defence alliance’s borders with Russia and change the geopolitics of Europe.

-

Regulating crypto: The EU’s upcoming regulatory framework for cryptoassets is flawed and the bloc would have been better applying existing rules for financial instruments to digital currencies and non-fungible tokens, writes Karel Lannoo, head of the Centre for European Policy Studies.

-

Energy infrastructure boom: Europe has started paying attention to long-neglected infrastructure gaps as the continent seeks to wean itself off Russian gas much faster than previously estimated, because of the war in Ukraine.

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe