At one point in Giant, the epic 1956 film about the wealthy Benedict ranching dynasty in far West Texas, the family’s youngest daughter, Luz Benedict II, vows to fly to Dallas and go to Neiman Marcus to buy a “starlight-white evening dress” that’s “very plain and simple and deadly.”

So when Vicki Chapman chaired Dallas’s Cattle Baron’s Ball—a lavish annual fundraiser for the American Cancer Society—on the occasion of the movie’s fortieth anniversary, she thought it only fitting that Neiman’s agreed to cohost the world premiere of a newly restored version of the film as the kickoff to the Western-themed event.

On the Friday night before Saturday’s hoedown at a ranch in Kaufman County, Giant cast members, including Jane Withers (who played Vashti Snythe) and Earl Holliman (“Bob” Dace), attended the screening at NorthPark Center’s cinema. Afterward, guests walked a red carpet to the mall’s Neiman Marcus store for a late-night champagne party.

Thanks in part to the generosity of Neiman’s, Chapman says, the Cattle Baron’s Ball that year raised more than $1 million for the first time. “I became a lifelong customer of Neiman Marcus in 1996,” she says. “It makes you want to be a customer and be loyal to them, because of their generosity to you and to the city of Dallas and to the charities.”

For decades, the retailer—founded in 1907 in downtown Dallas by Herbert Marcus Sr., his sister Carrie Marcus Neiman, and Carrie’s husband, Al Neiman—has been integral to the city’s self-perception as an innovative capital of commerce. Under Herbert’s son, Stanley Marcus—an exacting master salesman known locally as Mr. Stanley—the store established a global reputation in the fashion world. It also became known for its Christmas catalog of outrageous his-and-hers gifts and its ultrapersonalized customer service, faithfully adhering to Herbert’s dictum, “No sale is a good sale for Neiman Marcus unless it is a good buy for the customer.”

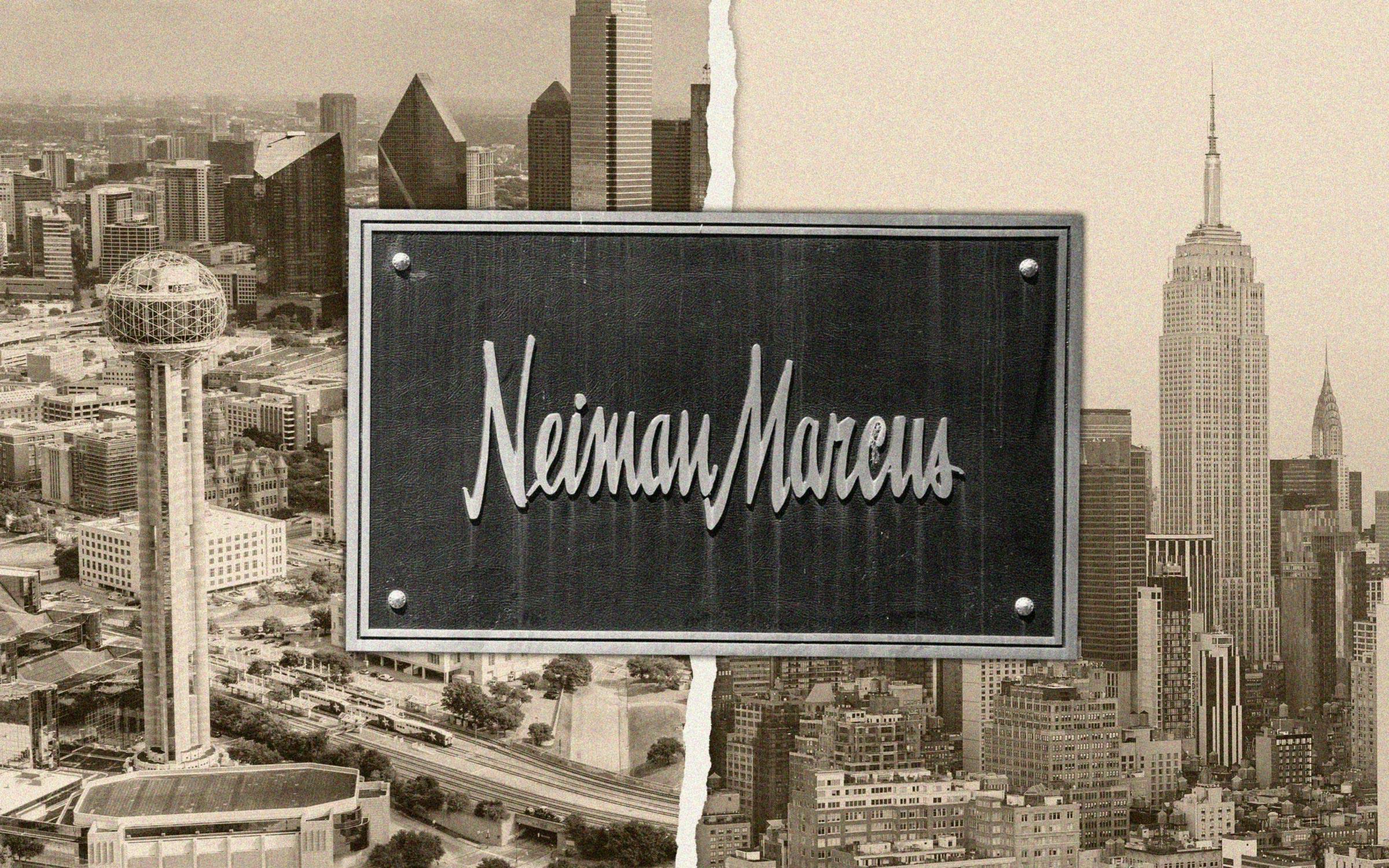

In recent months, though, there’s been an undercurrent of unease among the social set about the luxury retailer’s continued role in the community. Early in July, the parent company of competitor Saks Fifth Avenue announced it had signed a deal to snap up Neiman Marcus Group for $2.65 billion. Neiman’s days as a Dallas-based company appear to be numbered.

“We’re all Texans, whether we were born here or got here, and Neiman’s has been one of our bragging things,” says Terry Van Willson, a veteran Dallas publicist and former Neiman Marcus employee. “We feel like we’re losing a rich aunt.”

The purchase by Saks, which includes minority investments from Amazon and software giant Salesforce, still needs the approval of the Federal Trade Commission. One regulatory hurdle was cleared in August, but analysts believe the government remains likely to make a so-called “second request” for more detailed information about the deal. It could take at least eight months before regulators decide whether to approve or challenge the merger.

Under the terms of the purchase, Saks parent HBC—with headquarters in New York and Toronto—would form a new entity. Called Saks Global, it would operate 38 Saks Fifth Avenue stores and 95 Saks Off 5th outlets, as well as NMG’s 36 Neiman Marcus department stores (7 of them in Texas), two Bergdorf Goodman locations, and five Neiman Marcus Last Call outlets.

Marc Metrick, now chief executive of Saks, would become CEO of Saks Global. The stores would continue operating under their respective brand names, and the combined companies could dominate the nation’s high-end department store market, with estimated annual sales of roughly $10 billion.

Richard Baker, HBC’s executive chairman and CEO, told The New York Times that acquiring Neiman Marcus’s customer-centric “world-class sales force” was a key motivator for the deal, adding that Saks Global was “not planning on closing any stores . . . or reducing services in any way.” Some find that last statement hard to swallow.

Department stores such as Macy’s and Plano-based J. C. Penney have been struggling in recent years, partly because more shoppers have turned to online shopping. The upscale likes of Neiman’s and Saks have also found themselves increasingly competing with boutiques opened by some of the very luxury brands in which they’ve long trafficked. Neiman’s, hobbled by the COVID-19 pandemic and billions of dollars in debt from leveraged buyouts in 2005 and 2013, when NMG was valued at $6 billion, underwent a bankruptcy reorganization four years ago.

Though NMG was able to shed about $4 billion of its $5 billion in debt in the reorganization, it has continued to face challenges. It has laid off staff and moved its corporate headquarters out of its downtown Dallas store as a cost-cutting measure, securing $5.25 million in incentives from the city government in the process. CEO Geoffroy van Raemdonck relocated with his family to the company’s New York City hub at the same time.

As a private company, Neiman’s isn’t required to publicly report detailed financial information, but it touted sales of $5 billion in gross merchandise value—a metric including goods sold for others—in both its fiscal years 2022 and 2023. Baker told Women’s Wear Daily that NMG does about $4 billion in sales annually, representing a decrease from 2013. NMG and HBC declined to make anyone available for an interview with Texas Monthly.

Steve Dennis, president of retail consulting firm SageBerry Consulting and a former Neiman Marcus senior vice president, says that neither Neiman’s nor Saks has had a “great growth story” in recent years, and that both had basically “run out of options.” The deal is “sort of typical,” he says. “Put two struggling companies together, find some ways to take costs out, try to leverage your supplier power to get better margins, and use the control of having both brands to kind of lessen the competitiveness.”

Warren Shoulberg, a business journalist and former Forbes contributor who’s long covered the retail industry for trade publications such as The Robin Report, expects that after the purchase by HBC, NMG will take a back seat to its East Coast rival. “Saks will call all the shots,” he says, noting that layoffs seem likely after the companies merge their corporate staffs. “It’s quite probable that any of those functions that currently happen in Dallas are going to get moved to New York to Saks’ offices.” NMG today has about 10,000 employees, according to its website, one-fifth of whom reportedly work in North Texas. It’s too soon to say which, if any, Dallas jobs—or which top executive positions—might go on the chopping block.

Shoulberg isn’t convinced there won’t also be store closures, despite Baker’s public pronouncement to the contrary, since there are eight U.S. shopping centers that include both Saks and Neiman’s locations, including the Houston Galleria. “They could continue to run both of them [at each mall], but history suggests they will probably close eight of those stores, and it will probably be some combination of Neiman’s and Saks, depending on which is the stronger operation at that location,” he says.

Dennis agrees that layoffs and perhaps some store closures can be expected over time. “If Saks is smart, they will try to keep the idea alive of Neiman’s being a Dallas-based company,” he says. “That’s got some brand equity.”

The Cattle Baron’s Ball is hardly the only Dallas institution hoping that Saks heeds Dennis’s advice and allows Neiman’s to maintain its roots in North Texas. Among these is the Crystal Charity Ball, which for more than fifty years has supported children’s charities in Dallas County. The organization raises about $1 million annually through its Ten Best Dressed Women of Dallas Luncheon and Fashion Show. Since 1975, Neiman Marcus has been the “presenting sponsor” of the event, which features ten philanthropic women walking the runway in clothes by a designer selected by Neiman’s. (At this year’s show, on September 12, the women wore Oscar de la Renta.)

“It’s been a great partnership,” says Van Willson, the publicist, who represents the Crystal Charity Ball. “Nothing in Dallas compares to the fashion show, where there’s such an investment by both parties. The designer has trunk shows at Neiman’s and sells tons of clothes. Crystal Charity is able to deliver the customers they’re looking for.”

Neiman’s stereotypical Dallas customer lives in the affluent Park Cities or Preston Hollow area, Willson says, and prefers to shop at the company’s nine-story, 110-year-old flagship store downtown. There, the charmingly retro Zodiac restaurant on the sixth floor—famed for its popovers with strawberry butter and demitasse cups of chicken broth—persists in attracting multiple generations of shoppers. “She’s going to have significant income,” Willson says of the stereotypical customer. “She’s going to think nothing about paying thirty thousand dollars for a dress for her daughter’s wedding. She thinks nothing about going to a trunk show for Oscar de la Renta and ordering twenty-five thousand dollars worth of clothes. However wounded, Neiman’s is still the lone soldier for that particular customer.”

Highland Park resident Jennifer Dix, a Little Rock native, says she sometimes patronized Neiman Marcus while living in Houston, but she became a “more serious customer” after she and her husband moved to North Texas around 2000. A personal shopper at the downtown store—where Dix buys most of her clothes and accessories—is always keeping an eye out for items she might need. “Sometimes she’ll send me things and say, ‘I thought of you with this dress,’ or, ‘I think you need a new black pant, and this one just came in, and it’s a perfect fit for your body,’ ” Dix says. “They do a really nice job of curating great options every year.”

Shoulberg believes that even as Neiman’s and Saks maintain separate brand identities after the deal, it’s possible that because their customers are similar, they could unify their buying and merchandising teams. While it’s unclear how that might alter NMG’s offerings, Shoulberg says, decisions would almost certainly be made in New York. “So whatever kind of esoteric, ephemeral sensibilities exist in Dallas and Texas, and the South for that matter, would get lost in translation. And that indefinable Neiman’s touch would go away,” he says. “I don’t know that that manifests in what you’d see in the stores, but Neiman’s knows its customers, and Saks may not know them as well.”

Would Dix be less inclined to shop at Neiman’s if it were no longer a Dallas-run organization? “I don’t think so,” she says. “Assuming, you know, that there’s still beautiful product and beautiful and wonderful people. Part of what Saks is acquiring is a great culture that is engaged in the community, and that’s been positive for them. So, we’ll just have to see what happens.”

Chapman, too, is withholding judgment for now. “I like Saks Fifth Avenue,” she says. “My daughter and I were in New York this summer, and we shopped at Saks Fifth Avenue along with Bergdorf Goodman. I hope that Neiman’s is still a part of the community that we live in. But if it doesn’t work out that way, I guess some things have to change. As long as there is a Neiman Marcus in downtown Dallas, though, I will be shopping there.”

Of course, the future of that store—and of Neiman’s itself—now seems more uncertain than ever.