[ad_1]

Byju’s, India’s most valuable start-up, is coming under intense scrutiny from the government, investors and creditors over repeated failures to publish its accounts, as funding and revenues dry up for the once-booming educational technology sector.

The online tutoring company had benefited from stay-at-home Covid restrictions and is valued at $22bn, after raising nearly $6bn from investors over several rounds, including from leading private equity firms General Atlantic and Tiger Global. It has also taken out $1.8bn in loans.

However, the Bangalore-headquartered start-up has yet to receive at least $250mn in funding from two investors, according to people with knowledge of the matter.

It has also failed to meet its own deadlines to file results for its financial year ending in March 2021. India’s Ministry of Corporate Affairs last month asked the company to explain the nearly 18-month delay. The ministry did not respond to a request for comment on Byju’s non-compliance.

Byju’s has repeatedly said its auditor, Deloitte, has not signed off on its accounts because of the complexity of reporting the more than $1.1bn in acquisitions it made during the 2021 financial year. Two investors contacted by the Financial Times have questioned its rapid international expansion and aggressive acquisition strategy.

The edtech sector is being hit particularly hard as India and other countries emerge from the pandemic and students return to physical schools. Byju’s has cut staff and budgets this year in many areas, former and current employees said, although the company said it continued to be a “net hirer”.

“It is not just Byju’s, other [edtech] players such as Unacademy and Whitehat Jr have felt the impact as we open up and people return to offline schools,” said Neha Singh, co-founder of Indian data provider Tracxn. Whitehat Jr was acquired by Byju’s in July 2020.

As late as last December, Byju’s was reported to be in talks to go public in the US by combining with a blank cheque company, or Spac, led by Michael Klein’s Churchill Capital, in a deal that would have valued the business at more than $40bn.

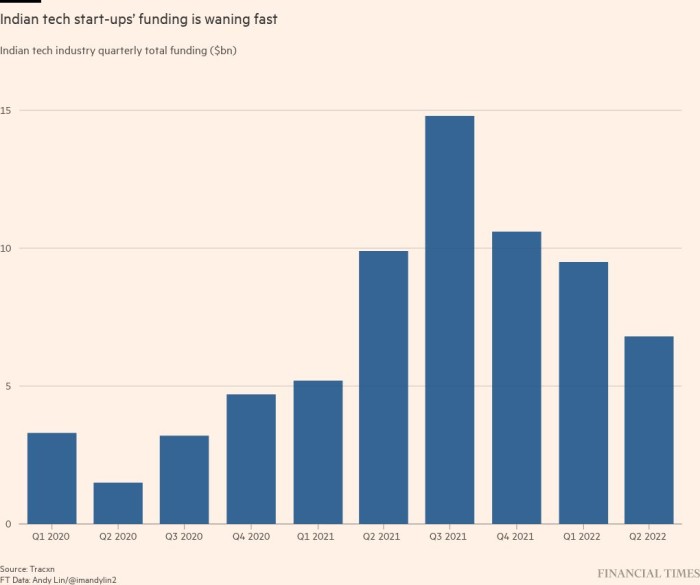

Sentiment on Spacs, and start-ups, has changed markedly since then. Tracxn data show funding for Indian start-ups hit a record high of $14.8bn in the third quarter of 2021. But three quarters of decline have followed as economic conditions have worsened, with the second quarter of 2022 seeing just $6.8bn in funding — a 31 per cent fall compared to a year earlier.

In an unusual move, co-founder Byju Raveendran led financing of his company’s most recent funding round with a personal investment.

Like many start-ups, Byju’s parent company, Think & Learn Private Limited, is failing to turn a profit. Its most recent available accounts, for the financial year which ended in March 2020, put losses at Rs2.6bn ($32.5mn). Its main revenue source was “sale of educational tablets and SD cards”, worth Rs16.8bn.

Markets and creditors are becoming concerned at the lack of an update on its performance. A $1.2bn loan, raised by the company in November, was trading at just 69 cents on the dollar on Wednesday after a sell-off which started in April but quickened this week, according to Bloomberg data.

Raveendran, a charismatic former teacher, became one of India’s youngest billionaires as the valuation of the company he started in 2011 rocketed. Byju’s started out offering pre-recorded English lessons in India and then quickly expanded across south-east Asia, the US and Latin America, while acquiring 20 Indian and foreign edtech start-ups, according to Tracxn.

The pursuit of hypergrowth paid off in terms of increasing the company’s value, with the latest funding round in March putting it at $22bn, compared to just $5.5bn before the pandemic in mid-2019.

However, two investors have expressed concerns over the number of acquisitions, speculating that Byju’s was attempting to “buy revenues” to justify its high valuation as the pandemic wave eased and demand dropped.

“I am not sure why they need to make so many acquisitions. I think the core business can do well in India, I am not sure if their model works overseas,” said one investor of several years who asked for anonymity to discuss a portfolio company.

“‘Build or Buy’ is a question that a company of our scale must evaluate when we enter a new segment or geography,” Byju’s told the Financial Times. It said revenues at Osmo, an educational games company it acquired, had grown five times since the acquisition three years ago.

But after Byju’s funding did not materialise in full this year, a former operations executive said budgets were slashed by more than 50 per cent in some cases and the international expansion scaled back — with dozens of staff working on the initiative in India laid off with little warning.

Byju’s said the claims of mass lay-offs were “inaccurate”. “While there have been some cutbacks in a few departments, there also have been massive increases in hiring in many others,” it said, adding that it had recruited 3,000 people in the past year.

The start-up said it expected to publish “annual financial results next week” and first-quarter revenues for the current financial year had grown 50 per cent year-on-year. It argued it had insulated itself from the online downturn by diversifying into in-person classes and courses through its subsidiary Aakash.

“While pure-play edtech players are seeing a correction after the pandemic boost, whole-spectrum education majors such as Byju’s are experiencing continued growth,” it said.

Additional reporting by Jyotsna Singh in New Delhi and Robert Smith in London.

[ad_2]

Source link