Just because something is useful doesn’t mean it can be a business

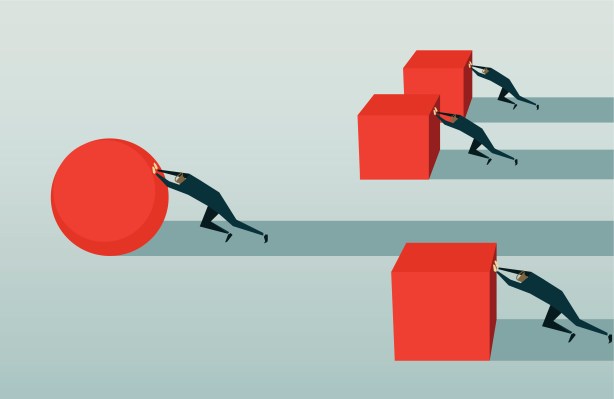

A lot of entrepreneurs are incredible idea generators and hackers; they have a knack for seeing something that’s broken or something that could be better and creating a solution around that. The problem is this: It’s rare that even very good features make good companies.

It’s rarer still that companies built on a feature make for VC-investable companies with the potential for VC-scale returns. A lot of no-code products fall into this category.

So do you have a company or merely a feature? Let’s explore the red flags investors will look for to determine which bucket your startup falls into.

Startups often fall into the trap of writing off incumbents as too big to act, too clueless to know what customers want and too incompetent to deliver good products. That’s a convenient story, but it often isn’t completely true.

A nontrivial percentage of the companies that come to me for advice about how to make their pitch decks better have a problem far bigger than a subpar deck. Fundamentally, the idea doesn’t work as a VC-scale startup; and if that is true, it doesn’t really matter how good your idea is. You will never raise money because ultimately, the risk your would-be investors are taking is higher than the reward that is available for them to reap.

The red flags fall into three categories:

- Your company is 100% dependent on another product or company.

- Your company could very easily be put out of business if an incumbent adds your product as a feature of theirs.

- The market size for this feature is too small.

Let’s take a closer look at all three scenarios, as well as how you can evaluate whether these conditions are true for your company.