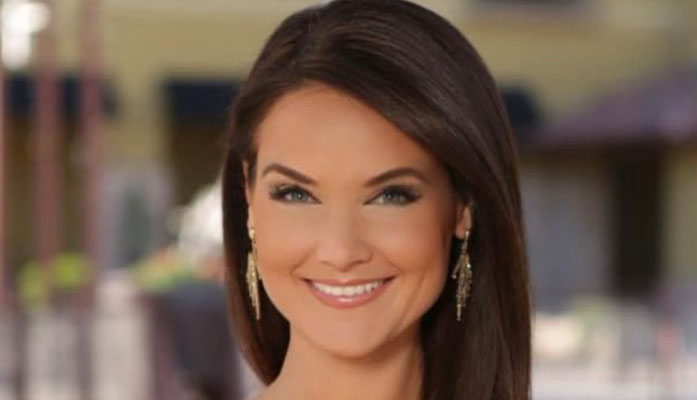

A former ABC15 news anchor, Stephanie Hockridge Reis, and her husband, Nate Reis, have been indicted in a COVID-19 loan fraud case.

If convicted on all charges, the duo could spend the rest of their lives behind bars.

The indictment against the duo was unsealed this week in the Northern District of Texas.

The two co-founders of Blueacorn, a lender service provider, are charged in connection with a scheme to fraudulently obtain COVID-19 relief money guaranteed by the U.S. Small Business Administration (SBA) through the Paycheck Protection Program (PPP) under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

According to court documents, Nathan Reis, age 45, and Stephanie Hockridge, age 41, also known as Stephanie Reis, both of Puerto Rico and previously of Arizona, allegedly submitted false and fraudulent PPP loan applications on behalf of themselves and their businesses, including by fabricating documents that they submitted in their loan applications in order to receive loan funds for which they were not eligible.

The indictment also alleges that Reis and Hockridge, who are married, co-founded Blueacorn in April 2020, purportedly to assist small businesses and individuals in obtaining PPP loans. In order to obtain larger loans for certain PPP applicants, Reis and other co-conspirators allegedly fabricated documents, including payroll records, tax documentation, and bank statements. Reis and Hockridge allegedly charged borrowers illegal kickbacks based on a percentage of the funds received.

As part of the alleged scheme, Reis, Hockridge, and others expanded Blueacorn’s operations through lender service provider agreements (LSPAs) with two lenders. Under the LSPAs, Blueacorn collected and reviewed PPP applications from potential borrowers on behalf of the lenders and worked with the lenders to submit applications to the SBA in exchange for a percentage of the fees that the SBA paid to the lenders for approved PPP loans. Blueacorn also had a program called “VIPPP” in which Hockridge and others offered a personalized service to help potential borrowers complete PPP loan applications. Reis and Hockridge allegedly recruited co-conspirators to work as VIPPP referral agents and coach borrowers on how to submit false PPP loan applications. In order to obtain a greater volume of kickbacks from borrowers and percentage of lender fees from the SBA, Reis, Hockridge, and their co-conspirators submitted PPP loan applications that they knew contained materially false information.

Reis and Hockridge are charged with one count of conspiracy to commit wire fraud and four counts of wire fraud. If convicted, they face a maximum penalty of 20 years in prison on each count.