PIERRE, S.D. (KELO) — South Dakota voters are deciding this fall whether to prohibit state taxes on any items purchased for human consumption. Beyond their decision at the ballot box on if IM28 passes or fails is how South Dakota’s economy is actually faring — and results for the first two months of the 2025 fiscal year haven’t looked good.

The state Bureau of Finance and Management reports that the state treasury overall received more money in July and August than the Legislature had estimated last winter. But there’s a not so glowing reality inside that message.

The main reason that state receipts to the general fund were up a total of about $14.5 million through July and August was that money in the state’s cash-flow fund had earned nearly $22.5 million more than expected, according to BFM’s latest report.

The Legislature had estimated $73,369,932 in interest earnings through two months, while the actual earnings totaled $95,856,809. However, take away that boost, and receipts would have been about $8 million below the legislative estimate.

In an accompanying note, BFM cautioned, “Higher interest rates resulted in greater returns for our invested cash. This revenue is receipted to the general fund in August. There will not be continual significant monthly increases in this category for the remainder of FY2025.”

(The Federal Reserve last month “decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent” in a move that will reduce interest rates that many banks charge and pay.)

In BFM’s latest monthly summary, the bad news was shown in red numbers appearing next to other important revenue categories that were running behind the Legislature’s estimates. Through July and August, state sales and use tax collections were off nearly $13.2 million ($269,761,129 adopted vs. $256,565,904 actual) while contractor excise tax collections were down more than $2.8 million ($41,720,479 adopted vs. $38,874,761 actual.)

SO WHAT HAPPENED? Flush with the feeling of good economic times continuing, at least for a while, the Legislature in 2023 decided to reduce the state sales and use tax rate on a temporary basis to 4.2%. The rate will return to 4.5% on July 1, 2027, unless the Legislature decides otherwise. The estimated impact of the temporary tax cut was $100 million or more per fiscal year.

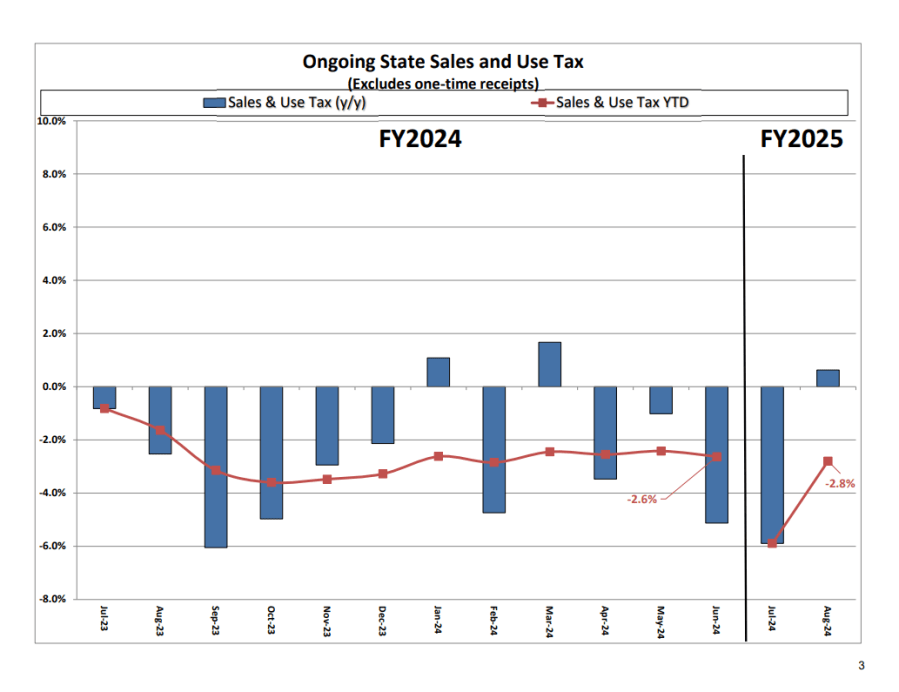

State fiscal years run July 1 through June 30. State sales and use tax collections grew a whopping 12.2% in fiscal 2022, and another 9.1% in fiscal 2023, helped by hundreds of millions of dollars flowing into South Dakota from federal COVID-19 recovery aid. But in fiscal 2024, with the temporary tax cut in effect, state sales and use tax collections slipped and finished 2.6% lower than in fiscal 2023.

Numbers for the past two months don’t look much better. In July, the first month of fiscal 2025, state sales-tax receipts dropped 5.9% below the prior July. There was a bit of a rebound in August, when the month-to-month comparison showed that they finished 0.6% above the prior August. Through July and August, state sales-tax receipts in total were down 2.8%.

Pam Roberts of Pierre is a member of the state Board of Regents that oversees South Dakota’s public universities and special schools. She shared with other regents last week that she had recently attended a meeting where BFM Commissioner Jim Terwilliger talked about the 2026 budget planning under way for state government.

Roberts gave this take-away: “Sales tax and excise tax revenues were down, and just kind of a word of caution that the economic outlook and the look for additional funds for the Board of Regents is not great at this point.”

LEGISLATIVE INTERNSHIPS: There’s an October 18 application deadline for college and university students who want to serve as interns for the 100th session of the South Dakota Legislature this winter. More information on the paid positions can be found here.

October 18 is also the application deadline for high-school pages to serve during 100th session. That information can be found here.

The Legislative Research Council meanwhile is seeking committee secretaries and an office assistant for the 100th session and needs temporary housing in the Pierre and Fort Pierre area for legislators, interns and pages to live while working this winter at the South Dakota Capitol. Click on the links for more information.

NEW LEADERS: The state Board of Medical and Osteopathic Examiners on Monday chose Chris Dietrich of Rapid City as its new vice president.

The position opened through a series of circumstances.

In 2019, the governor had appointed Aaron Shives of Watertown to the board, succeeding Elmo Rosario of Rapid City. Shives eventually rose to board president in June 2023. The board in December voted to opt-out of moving into the Sioux Falls one-stop building. Shives was re-elected as president at the board’s June 20, 2024, meeting.

In August, the governor appointed Brittany Azure Bearstail of Spearfish to replace Shives. That left the presidency vacant. So, under board tradition, the new vice president Jennifer Tegethoff of Mitchell moved up to president. That opened the v.p. slot, to which Dietrich was elected.

NAMES AND PLACES: Recent appointments by the governor to state government boards and commissions feature more new faces.

Krystal G. Stuwe of Hoven succeeds Elaine Fritz of Baltic on the Board of Service to the Blind and Visually Impaired.

Bradley J. Konechne of Brookings succeeds Tasha Jones of Pierre on the Independent Living Council.

Rebecca A. Jensen of Wagner and Amanda R. Roberson of Piedmont succeed Tina Two Crow-Slow Bear of Kyle and Julie Nelson of Rapid City on the Planning Council on Developmental Disabilities.

You can reach KELOLAND Capitol Bureau reporter Bob Mercer with news tips, questions, complaints and story ideas by calling 605-280-7580. He also can be reached via digital messages at [email protected] or @pierremercer on X, or through U.S. mail at 1810 Camden Court, Pierre, SD, 57501.