PIERRE, S.D. (KELO) — A panel assigned to search for possible improvements in the way South Dakota counties set property-tax values wanted the public’s ideas.

But state lawmakers on the Legislature’s Study Committee on Property Tax Assessment Methodology heard instead on Wednesday quite a bit of exactly what they didn’t want.

That is, property taxes are simply too high, especially on residential housing.

“I’m not sure there is an answer to this,” said Republican Rep. Marty Overweg, an agriculture businessman and farmer.

Republican Sen. Randy Deibert, a professional land surveyor who chairs the committee, opened the meeting by telling testifiers they would each have five minutes to present information.

“This is a vital issue. It is one piece of the pie on property tax concerns. We’re trying to take bites of this,” Deibert said.

Republican Rep. Kirk Chaffee, who chairs the Legislature’s Ag Land Assessment Task Force, told the panel that the soil-production approach to setting agricultural property values is working.

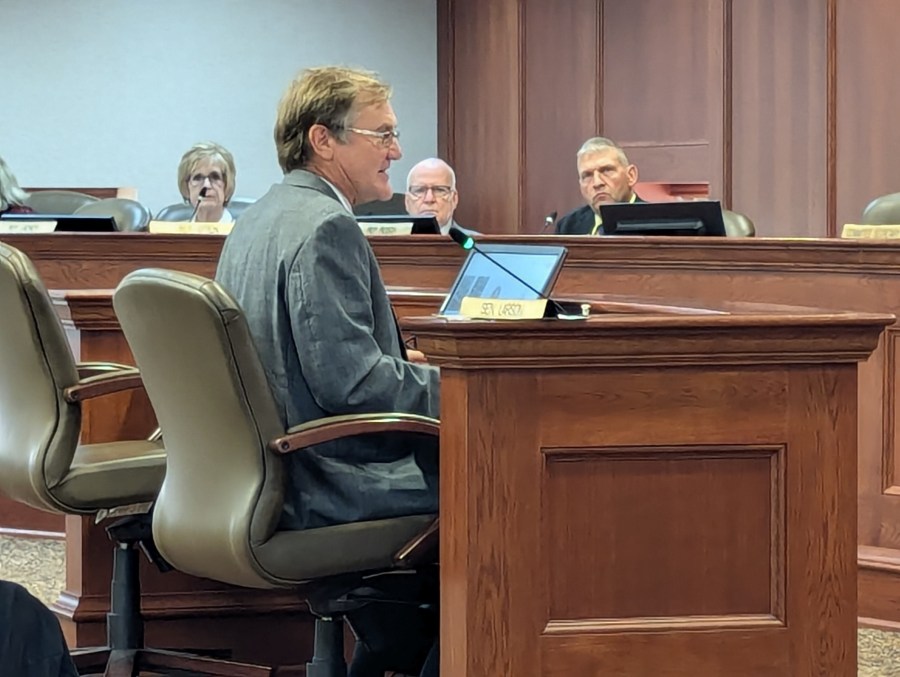

Next came Republican Sen. Jack Kolbeck, who had brought legislation in the 2024 session that sought to limit annual valuation increases on owner-occupied single-family dwellings.

Kolbeck gave the committee a variety of ideas, such as having counties work under a single assessment system statewide rather than the half-dozen now used, and letting counties take a regional approach to setting values. He also suggested borrowing a page from the agricultural assessment system and using an Olympic-averaging approach for setting the value of a residence, with the highest and lowest values set aside.

According to Kolbeck, the number-one campaign slogan he saw during the legislative primary elections earlier this year was, “I will fight for lower property taxes.” He noted that the property taxes ranked among the top choices that legislators wanted to study this year. “We as elected officials are the representatives to our constituents,” he said.

Tim Goodwin, a Republican former legislator who’s running again, used the hearing to lay out his idea for eliminating residential property taxes by raising the state 4.2% sales tax up to 9.2% and spreading the additional revenue back to local governments and school districts.

Goodwin, who said, “People are getting taxed out of their houses,” claimed the additional five cents of sales tax could eventually be cut back to two cents because it would cause “the economy to explode” and that the idea could expand nationwide. “We would be the first state to do it,” he said.

Currently South Dakota has four categories of property for taxation: Agricultural, owner-occupied residential, centrally-assessed utilities and other, which is anything that isn’t agricultural, owner-occupied or utilities.

Dean Krogman of Brookings, a former lawmaker who now lobbies for the South Dakota Association of Realtors and the South Dakota Multi Family Housing Association, asked the committee to create another property-tax category specifically for leased multi-family housing. Legislation that would do that failed several times in recent years.

Whether the production method for assessing ag land is working depends on the person paying the taxes. Mitch Richter, a former legislator who now lobbies for South Dakota Farmers Union, and Taya Runyon, executive director for the South Dakota Cattlemen’s Association, liked it.

But AJ Lundgren, a farmer who’s part of the South Dakota Grasslands Initiative, said agricultural property should be valued on its actual use, rather than its potential production. He said South Dakota’s tax system and the federal government’s farm programs have helped drive the conversion of grasslands into crop production.

The committee plans to meet for a fourth and likely final time on October 9, likely in room 362 at the state Capitol. Deibert encouraged people to submit ideas

“A lot of conversations are going to be had in that next month as we come to that final meeting,” said Republican Rep. Drew Peterson, a farmer who co-chairs the committee. He encouraged emails and phone calls. “We’re happy to hear every idea.”