Public satisfaction with how the Bank of England is tackling inflation fell to the lowest on record as most Britons expect prices to continue to rise steeply over the next five years, according to official data published on Friday.

In May, 28 per cent of the UK population was dissatisfied with how the central bank was handling inflation, its own survey found. In April, UK consumer price growth soared to a 40-year high of 9 per cent, the highest among the G7 countries.

With 25 per cent satisfied with the BoE’s performance, net satisfaction dropped to minus 3 per cent, down from 6 per cent when the question was last asked in February, and the lowest since records began more than two decades ago.

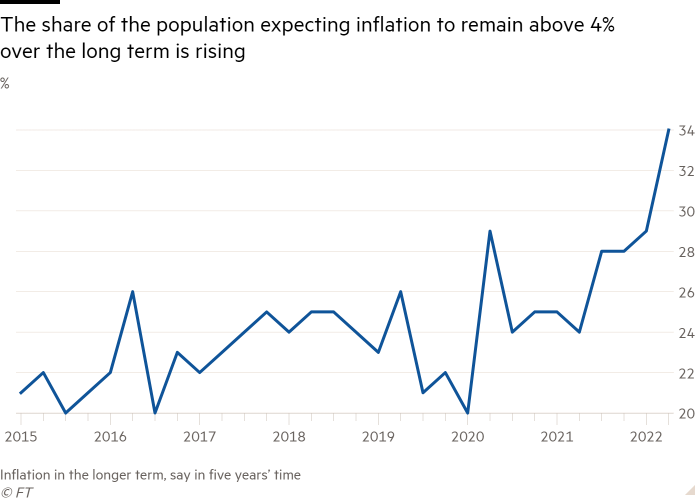

The BoE figures also showed that 59 per cent of the UK population expected inflation to remain above 2 per cent over the long term, with more than one-third expecting longer-term inflation to be above 4 per cent. This is the highest proportion since records began in 2009.

Adrian Lowery, financial analyst at investing platform Bestinvest, said the data meant that “people don’t believe the Bank of England will succeed in its forecast of bringing inflation back down to its 2 per cent target in a couple of years”.

The findings also provide an indicator of how entrenched inflation might become, adding to the case for a further interest rate rise at the BoE monetary policy meeting next week. Markets expect the central bank to raise rates for the fifth consecutive time, by 25 basis points.

This is because elevated inflation expectations among workers can fuel higher wage demands and therefore potentially aggravate the inflationary spiral, especially in a tight labour market. High inflation has already resulted in transport workers announcing strikes and public sector unions threatening action.

The BoE said it was unable to comment because it was in its “quiet period” ahead of the MPC decision. Last month, however, governor Andrew Bailey told MPs he was unable to stop inflation reaching double digits this year. “To forecast 10 per cent inflation and to say there isn’t a lot we can do about it is an extremely difficult place to be,” he said. “This is a bad situation to be in.”

Separate figures published on Friday showed that the vast majority of consumers are worried about the cost of living crisis, resulting in spending cuts and higher levels of anxiety and lower wellbeing.

In the month to May 22, 77 per cent of the UK population reported feeling very or somewhat worried about the rising costs of living, according to data published by the Office for National Statistics on Friday.

The proportion rises to 90 per cent for parents with young children, with similar shares reported among ethnic minorities and house renters.

People worried about the cost of living crisis reported much higher levels of anxiety and generally lower wellbeing, including lower happiness, life satisfaction and feeling that life is worthwhile.

Nearly two in three people said they were cutting back on non-essentials and two in five said they spent less on food, the ONS data showed.

Another 40 per cent had reduced non-essential journeys and the majority of the population said they were using less gas and electricity at home.

This reinforces expectations of a new economic slowdown as forecast by the OECD, which this week slashed its UK growth forecast for 2023 to zero, the lowest in the G20 excluding Russia. Official data to be released on Monday are expected to show that the economy barely grew in April, after stagnating in February and March.