Manufacturing companies looking to build a presence in the West have increasingly eyed Southern Nevada because of its business-friendly tax system, international airport and proximity to Southern California.

But while the industry has grown, there’s a problem.

Not enough land.

There are only 5,000 acres — out of more than 5 million acres in Clark County — of the most optimal land available in the county for “employment” purposes, a state-commissioned study found earlier this year. Land is particularly limited for manufacturing development, which tends to require more acreage, economic officials added.

That’s led some companies to lose interest. Of the businesses that tell officials why they are no longer interested in moving operations to Southern Nevada, up to half cite a lack of land as the reason, said Bill Arent, senior vice president of the Las Vegas Global Economic Alliance, the region’s economic development agency.

“We’re a great place to land. But there’s no place for companies to land,” said Bob Potts, deputy director of the Governor’s Office of Economic Development (GOED).

That reality has forced state and local officials to reconsider how to best continue growing the state’s manufacturing industry. Building up that sector could bolster the area’s economic resiliency because the hospitality industry — which dominates the area’s economy — suffers more during economic downturns, state officials said. The manufacturing industry has grown exponentially in Northern Nevada, where it makes up a much larger portion of the area’s economy.

Since December 2019, manufacturing industry jobs have grown by nearly 14 percent across the state, the highest rate in the country, according to data compiled by the state Department of Employment, Training and Rehabilitation (DETR). In the past decade, the sector’s share of the entire Nevada economy has grown by nearly 1 percent, also first in the country.

The study and state officials have urged Congress to pass the Southern Nevada Economic Development and Conservation Act, sponsored by Sen. Catherine Cortez Masto (D-NV). This lands bill would preserve 2 million acres in Clark County for conservation, while freeing up 41,000 acres of public land along the Interstate 15 corridor for residential and commercial use.

The bill stalled in the last Congress and has not been reintroduced this year, but Cortez Masto is expected to do so in this Congress, The Nevada Independent reported.

State officials said opening up access to public land owned and managed by the federal government is essential to keep up with the region’s expected job growth. The state-commissioned study found that without sufficient land, the region’s economic growth could slow by at least 1 percent annually.

But environmental groups have long favored conservation of Southern Nevada’s public lands over development. They argue increased urban sprawl could further drain the region’s water supply, and that the carbon emissions generated by new developments could outweigh the benefits of the conservation provisions in congressional bills.

“Southern Nevada needs to live within its means, and its means are, to some degree, limited by the available land,” said Patrick Donnelly, the Great Basin director for the environmental nonprofit Center of Biological Diversity.

Where is the land?

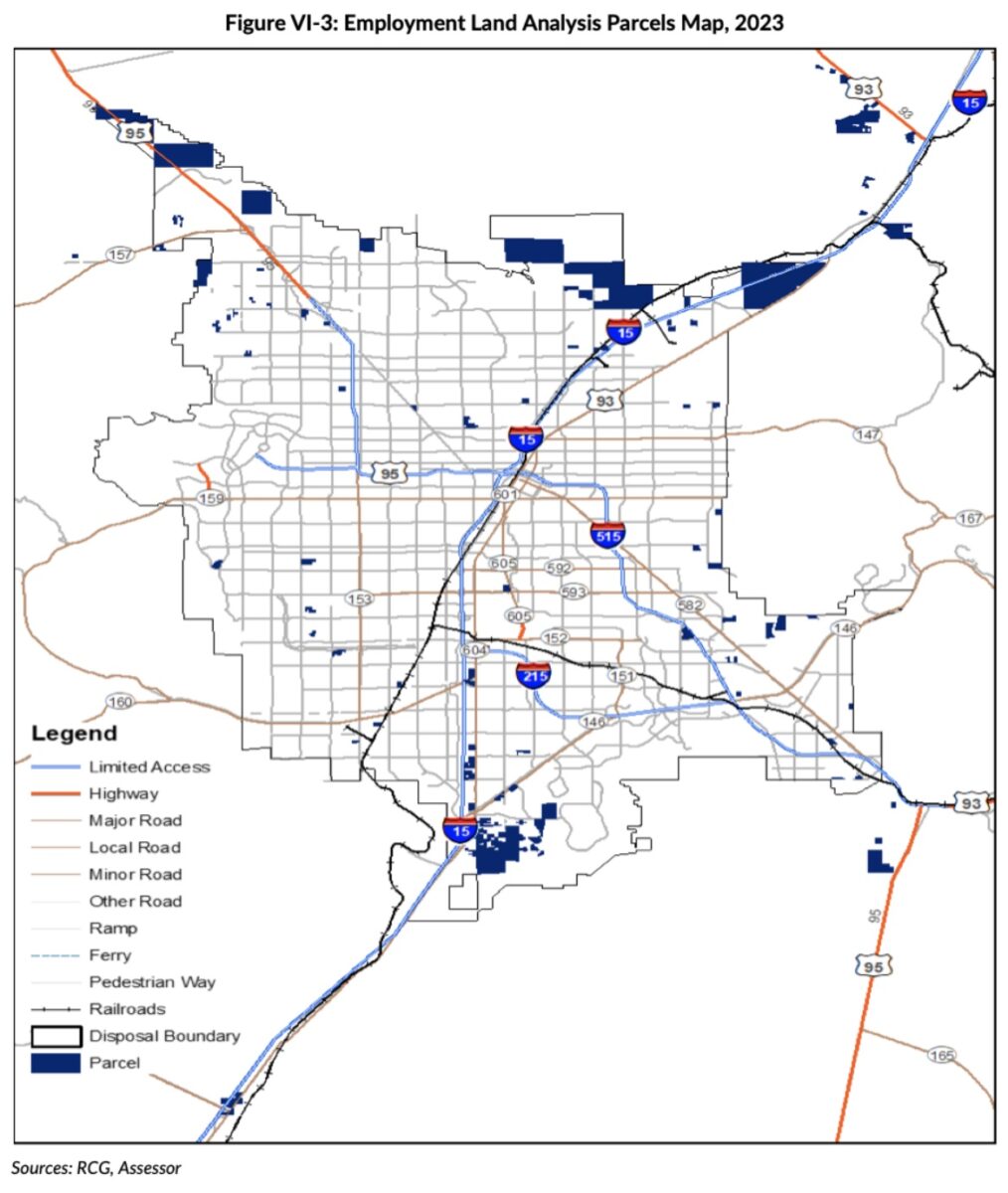

As of May, there are more than 16,000 acres of land in Clark County that’s developable for employment purposes, according to the state-commissioned study conducted by RCG Economics, a Las Vegas-based economic consulting group.

But less than a third of that land is considered the most optimal for development, according to the study. Factors such as the cost of development, the slope of the land and proximity to roadways make the remaining land less viable.

Jim Renzas, BCI Global’s senior director of North America, helps manufacturing companies across the country find suitable land for development. Last fall, one of his clients — a manufacturing company looking to build a 30,000-square-foot building — couldn’t find an appropriate site in Southern Nevada because of a lack of land, he said.

“We could not find anything that was usable,” he said.

Nearly 90 percent of the land in Nevada is owned by the federal government, most of which is managed by the Bureau of Land Management. The remaining percentage is owned by the state government, local municipalities or private parties.

Much of the potential for development in Southern Nevada exists in the northern Las Vegas Valley. That’s because of the Apex Industrial Park, a massive patch of land that has 7,000 acres of developable land that local officials hope to turn into a manufacturing hub. Utilities are going into the southern and central parts of the area, but utilities in some parts of the northern section of the park are two to four years away from completion, said Paul Sweetland, the industrial executive vice president for Colliers, a commercial real estate group.

It takes time to build out the power, water, sewage and transportation systems for new developments, economic officials said. This can be a deterrent for companies seeking to expand their operations, Renzas added.

“We’re usually looking for a site that is ready to go, and we can start construction almost immediately or within a few months,” Renzas said.

The Eldorado Valley, an area south of Henderson, is among the more appealing options for the manufacturing industry. The cities of Henderson and Boulder City share jurisdiction over the area.

The Boulder City Council last week rezoned more than 1,500 acres west of the Eldorado Valley from government-owned land to land for renewable energy manufacturing. The city plans to obtain an appraisal this fall so that the land can be leased, but other parts of the area under the city’s jurisdiction will not be developed.

A map showing where the most optimal land is for employment purposes. (Map courtesy of RCG Economics)

The City of Henderson has identified more than 800 acres of developable land in the Eldorado Valley, and it is in the process of building up the infrastructure there, said Jared Smith, the city’s director of economic development.

Western Henderson has land available with infrastructure already in place. The parcels of land there are smaller, Smith said, which could deter manufacturing companies that need larger acreage. The City of Henderson and College of Southern Nevada opened a new manufacturing training center last week.

But with most of the surrounding land controlled by the federal government, it’s mostly a waiting game of when local officials can ramp up development.

Opening up federal land is a long process. Even if Congress passes lands bills, parcels of land still must be auctioned off by BLM, as outlined in the 1998 Southern Nevada Public Lands Management Act (SNPLMA). The land that the state-commissioned study identified as most optimal included areas that had not yet been released by SNPLMA.

But environmental groups say these developments shouldn’t be happening at all. The manufacturing industry may need to tap into the water supply from the Colorado River, further draining the region of an already scarce natural resource, Donnelly said.

“There is no water available in these areas south of Las Vegas,” he said.

Sweetland, the Colliers executive vice president, said manufacturing companies that are heavy water and power users face greater obstacles in Southern Nevada. He said he had a recycling group client that began looking in multiple other markets because of the lack of optimal land and natural resource constraints in Southern Nevada. Distributing facilities and light manufacturers that don’t use as much water and power — such as those that make souvenirs for the Las Vegas Strip — have greater potential in the area, Sweetland said.

A manufacturing boom

The manufacturing sector has taken off in recent years across the state, especially as companies bolster their online presence to easily reach consumers across the country.

Public attention on the state’s manufacturing industry has focused on Northern Nevada, where the sector makes up nearly 13 percent of the economy, due in part to the massive Tesla Gigafactory that opened in 2014 and other large entities operating in the the Tahoe Reno Industrial Center.

But the industry has also taken off in Southern Nevada, where it makes up about 3 percent of the Las Vegas economy. Its recent growth there has been faster than Northern Nevada, according to data from the U.S. Bureau of Labor Statistics (BLS). Its pandemic job recovery has also been stronger than almost all other industries in Las Vegas.

That comes as former hospitality workers have increasingly switched industries after becoming unemployed during the pandemic, said Marchele Sneed, who works on employee recruitment in Southern Nevada for DETR.

“It was kind of a wake-up call for a lot of people,” Sneed said about the pandemic. “We’ve seen a lot of people enter into different trainings and acquire different certifications.”

Southern Nevada is home to nearly 1,100 manufacturing companies, Sneed said. Employees in the manufacturing industry in Clark County make more than $1,300 weekly on average, according to BLS data. That’s hundreds of dollars more weekly than workers in the leisure and hospitality industry make on average, but lower than salaries offered by manufacturers in most of the northern counties.

But no matter the growth of the industry in recent years, limited land and water availability could cap the potential of the sector in the south, officials warn.

Still, they remain optimistic that the industry will keep growing.

“As economies develop, the private sector will find a way,” Potts from GOED said.

Disclosure: John Restrepo co-publishes the Stat Pack, a client of the communications consulting firm owned by The Nevada Independent’s editor, Elizabeth Thompson. Thompson did not participate in the editing of this piece.