This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Apple posted just-OK first-quarter results yesterday, ending Big Tech earnings season with a shrug. But its longer-term stock chart still amazes. While other Big Techs remain down by double-digits from their pandemic highs, Apple is down just 8 per cent (Microsoft only trails slightly, off 11 per cent). Apple, like capitalism, keeps on churning. Email us: [email protected] and [email protected].

Regional banks freakout

A lot of US regional bank stocks are acting very badly lately. Is this because of legitimate questions about the lenders’ business models, or is this a mindless, lemming-like freakout?

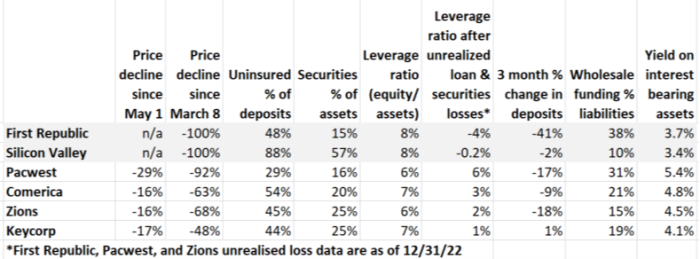

Below is some balance sheet information about four of the most prominent beat-up regionals and, for comparison, about two banks that have failed, First Republic and Silicon Valley. The data on the four is all as of 3/31, except some the data on securities and loan losses, which is from 12/31:

It is very clear that none of the four banks are in as bad a shape as First Republic and Silicon Valley were before they failed.

None of them has Silicon Valley’s staggering concentration of uninsured deposits, or its dependence on securities on the asset side of the balance sheet. None of them, like both of the failed banks, is insolvent if you put their unrealised loan and securities losses on to their balance sheet (though three of them look thinly capitalised on a mark-to-market basis). None of them had deposit flight anywhere near the scale First Republic did in its first quarter.

In the case of both of the failed banks, it looked like they were soon to be “upside down”: paying more for their funding than they earned on their assets. All four of the other banks listed above earn significantly higher yields on their assets than First Republic and Silicon Valley did; those two were doomed in part by big, low-yielding mortgage and mortgage-backed securities portfolios. So if these four banks can avoid big increases in funding costs — which is what a deposit run causes — they have viable businesses (on Wednesday PacWest stated that their deposits have been stable-to-up since the end of the first quarter).

There is, in other words, a lot to be said for the “mindless lemming-like freakout” theory of the recent sell-off. But the freakout is not utterly mindless and lemming-like, for two reasons.

The banks that are getting beat up do have weaknesses: PacWest’s exposure to the venture capital industry, securities and loan losses at Zions and KeyCorp, uninsured deposits at Comerica, and so on. Autonomous Research bank analyst Brian Foran calls what we are seeing “the weakest gazelle problem”: the market is coming after the banks with the most vulnerabilities, even if under normal circumstances those vulnerabilities would not be fatal.

The other problem is that deposits are always vulnerable to flight. It’s always possible to imagine that, even if deposit levels are holding up now, something awful will happen tomorrow. There is just enough reality behind the banking mini-crisis to allow the freakout to persist.

How scary is the freight recession?

The goods side of the US economy might not be collapsing, but it sure isn’t booming. Real consumer goods spending has risen 0.04 per cent in the past six months — virtually no growth at all. Plus, there’s all that inventory still sitting around; businesses’ inventory-to-sales ratio stands 8 per cent higher than in early 2021. Flat demand and excess supply mean less stuff to make and even less to transport. Some are calling it an industrial recession or, equivalently, a freight recession.

Bad signs keep popping up. The latest is in diesel consumption, which is downwind of trucking and rail activity. The FT’s Myles McCormick reports that distillate demand (a category which includes diesel as well as heating oil) fell 6 per cent year-on-year in the first quarter, compared to a 2 per cent demand drop for consumer-sensitive petrol. Other measures such as manufacturing output surveys and electricity sales to factories have also contracted for the past half-year or so.

The question is whether the freight recession is foretelling a broader recession, or if it’s just a temporary reset. Freight markets are usually a leading indicator of economic activity, but at a high level, it wouldn’t be shocking if the market needs a moment to breathe after the supply-chain insanity of the past two years. Global container shipping rates have round-tripped and now sit below 2019 levels (data from Freightos):

Yet some high-ups in the logistics industry think the pandemic hangover won’t be shortlived. On its earnings call yesterday, Maersk’s chief executive said that even though inventories will probably get whittled down by the second half, he expects ocean shipping to contract this year, driven especially by weak imports in North America.

Stateside, the freight recession is most pronounced in trucking, as we noted last week. Some truckers are earning less than their operating costs, forcing people out of the industry a bit at a time. This dynamic was spelt out nicely on Wednesday by Derek Leathers, chief executive at trucking company Werner Enterprises:

If you look at where spot rates are today, they are 15 per cent to 17 per cent, maybe even as high as 20 per cent below carrier operating costs . ..

These spot rates are simply unsustainable. [Small-scale owner-operators] are not going to make it. They bought high-cost equipment during the peak of the market. And if they’re fully exposed to that spot market today with both high driver pay, high-cost equipment, high cost of capital and in many cases, kind of variable lending arrangements that are now becoming much more expensive almost overnight and inclusive of today, it just is going to be a very tough time. So yes, we do believe that it’s only so low it can go. And I said it a quarter ago, the cure for low prices is low prices . . .

Some of the less efficient operators are going to continue to exit and that exit is now 31 straight weeks of net deactivations . . . The question is how long does it drag on the bottom before you see some improvement. And we still have conviction that that happens in the second half.

Lee Klaskow, logistics analyst at Bloomberg Intelligence, argues that the freight downturn will probably persist well into the second half of this year. He notes that end consumer demand isn’t roaring, China’s export machine has been slow to restart and it will take time to work down inventory in the US.

He added: “We’re going through a normalisation of demand and [freight] rates. From a year-over-year comparison, that gives people the feeling the sky is falling, but the reality is we’re coming off unsustainable levels. It seems that we’re getting close to a bottom on the truckload side, though the bottom for [ocean shipping] might be further out.”

Another six-ish months of industrial weakness, however, would put the pressure on the services sector to deliver us from recession. Spending only has to soften a little bit to push us over the edge. (Ethan Wu)

A correction

The second chart in yesterday’s piece on Uber was wrong because of a spreadsheet error. Here is the corrected version:

The correct chart makes the point of the piece even stronger, but still, Rob feels very stupid about this and is sorry.

One good read

This Reuters story shows Elon Musk’s Neuralink moving fast and breaking things, specifically pigs, sheep and monkeys.