Global growth has proven “surprisingly resilient” and most countries will now avoid a recession this year, the IMF said, as it upgraded its forecasts and hailed a possible turning point for the world economy.

In estimates that reflect the possible consequences of China’s decision to scrap its zero-Covid policy, the fund now says it expects the global economy to grow 3.2 per cent between the end of the final quarter of 2022 and the end of the last quarter of this year.

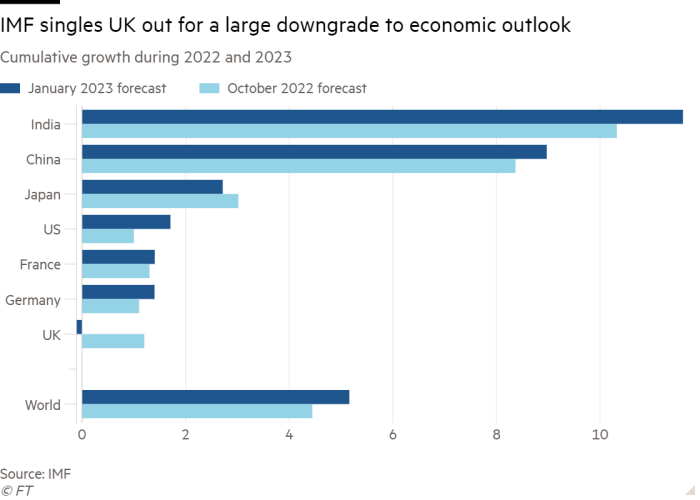

Such a level of growth would mark a significant improvement on 2022, when the IMF estimates the global economy grew by 1.9 per cent. The 3.2 per cent projected growth is also 0.5 percentage points higher than the IMF’s last forecast, issued in October.

Pierre-Olivier Gourinchas, the IMF’s chief economist, said 2023 “could well represent a turning point”, with economic conditions improving in subsequent years.

“We are well away from any [sign of] global recession,” Gourinchas said, in comments that contrast sharply with remarks by managing director Kristalina Georgieva this month that recession would hit more than a third of the global economy.

The IMF said its improved outlook reflected not just the opening up of the Chinese economy but also an improvement in European prospects following the fall in energy prices.

It forecast that on average the global economy would be 2.9 per cent bigger in 2023 than in 2022 — a different basis of calculation than the comparisons of the fourth quarters of this and last year. That is a step down from the 3.4 per cent pace estimated for 2022.

But the IMF has not yet become as optimistic as investors. With the MSCI world index of equities up 7 per cent since the start of the year and bond markets expecting interest rate cuts before 2024, traders have priced for a soft landing and pain-free reduction in inflation.

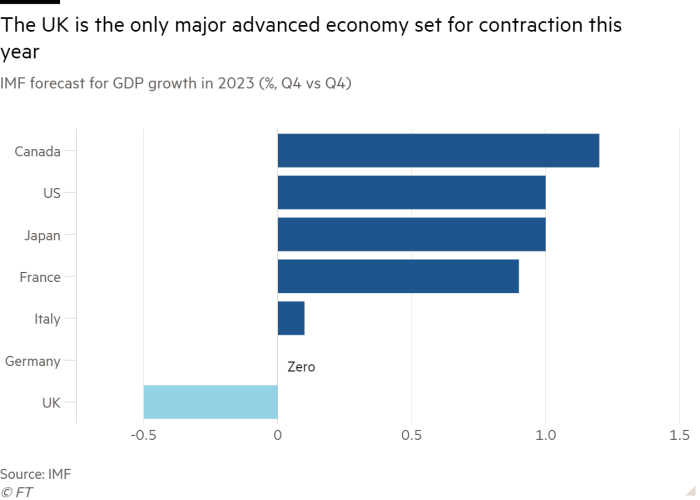

The fund now expects the UK to be the only leading economy to shrink in 2023, with GDP forecast to be 0.5 per cent smaller in the fourth quarter of the year than in the same period of 2022. According to its estimates, even Russia’s economy is now likely to outpace the UK’s, growing 1 per cent over the same period.

Chinese growth, at 5.9 per cent, is now forecast to be more than double the fund’s October estimate, while India is expected to be the world’s fastest growing large economy this year, with output 7 per cent higher at the final quarter of 2023 than a year earlier.

By the end of the year, the US economy is expected to be 1 per cent larger than a year earlier, unchanged from October’s forecast. But the IMF says the country’s 2022 performance was stronger than expected.

Gourinchas said there was “a possibility” a US recession could be avoided but that this was a “narrow path”, adding that higher interest rates were “certainly going to cool off the economy and bring down inflation”.

The US Federal Reserve is expected to raise rates by a quarter point later this week, setting a new target range of between 4.5 per cent and 4.75 per cent.

Tobias Adrian, the director of the IMF’s monetary and capital markets department, warned that interest rates could rise more than markets expect and take longer to come down, particularly in the US.

“There’s certainly a wedge in between what policymakers are communicating and what’s priced into markets,” he said. “There is still a lot of upside risk to inflation . . . Until it is very clear that inflation is coming down in a durable fashion . . . it is still necessary to continue to tighten monetary policy.”

Most officials argue the US federal funds rate will need to go above 5 per cent and for that level to be maintained at least through the end of the year. Traders in futures markets, however, bet the Fed will stop short of 5 per cent and deliver half a percentage point worth of cuts by year-end.

“There’s still a risk of repricing,” said Adrian. “Data can disappoint.”