China’s booming electric vehicle industry is forecast to further cement its global dominance this year, shrugging off US and European efforts to catch up and posing a threat to foreign groups reliant on the world’s biggest car market.

Chinese consumers will buy about 8mn to 10mn EVs in 2023, up from record sales of 6.5mn vehicles last year and 3.5mn in 2021, according to company and analyst forecasts. This compares with nearly 3mn in Europe and 2mn in the US.

“China is expected to have the largest overall sales with 35 per cent year-on-year growth in 2023, after two years of extremely rapid growth [ . . . ] To put this in perspective seven out of every 10 electric vehicles are now sold in China,” said Neil Beveridge, an analyst with Bernstein in Hong Kong.

The biggest winners from what is becoming a new golden age for China’s auto industry, analysts say, are a clutch of fast-growing local companies that are outperforming foreign carmakers.

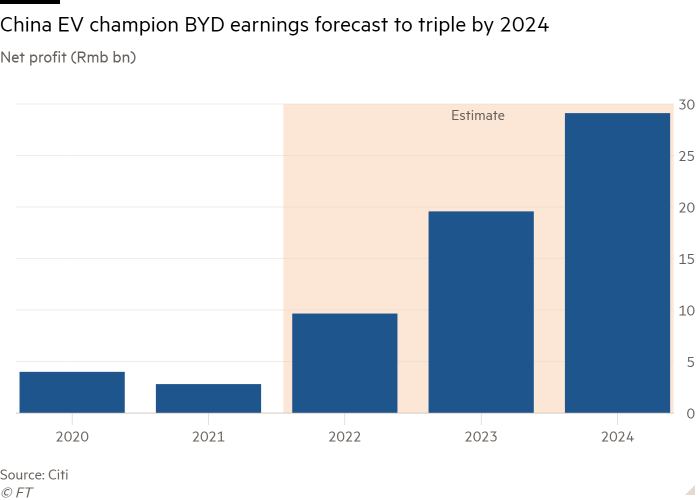

BYD, the Warren Buffett-backed Tesla rival and widely considered China’s brightest EV star, expects sales of plug-in vehicles to reach 3mn units this year after selling more than 1.85mn last year, according to a management discussion with Citi bank. Citi analysts said the estimate was “conservative”. BYD declined to comment on the sales forecasts.

China remains one of the largest profit contributors for many international carmakers, leaving them particularly exposed if they cannot regain ground lost to domestic brands as the market rapidly shifts towards electric vehicles.

But groups such as BYD, XPeng, Li Auto and Nio, are now increasingly favoured by Chinese consumers. The market share of Chinese brands in the domestic EV segment edged higher from a staggering 78 per cent to 81 per cent last year. That compares with foreign groups enjoying 70 per cent market share about 10 years ago, before the massive surge in EVs and just after car sales in China overtook those in the US.

The pace of growth means China is on the cusp of hitting 50 per cent of car sales to be EVs by the end of 2025, becoming the first major economy to do so, according to Bernstein forecasts. BYD told Citi that the milestone, which compares with Beijing’s target of 40 per cent by 2030, could be hit this year.

This would also be far ahead of Europe, the next most advanced market for EVs, where the market share for battery cars is rising slowly. About a third of sales in the region were fully electric or plug-in hybrid — which China counts as electric “new energy vehicles” — in the final months of 2022.

EV sales in the US are lagging behind, with about 12 per cent of sales being electric, but growth is gaining pace following the introduction of huge subsidies under the Biden administration’s Inflation Reduction Act.

There have been some expectations of a slowdown in Chinese EV sales after a key subsidy delivering a discount of up to Rmb12,600 ($1,870) per vehicle expired at the end of 2022.

While carmakers raised prices in response, Raymond Tsang, a China auto expert with Bain, a consultancy, said Chinese companies still produced better and more competitively priced cars, and leveraged the benefits of China’s battery and resources sectors. Jing Daily, which tracks the Chinese luxury market, notes that even after Elon Musk’s Tesla slashed prices in China, bringing the price on its Model 3 down to about $33,515, BYD’s rival Seal sedan is still cheaper at $31,000.

“The Chinese homegrown EV players are really getting better in terms of their performance and the product portfolio [ . . . ] You are seeing not only that the Chinese products are cheaper, but they’re actually better in the eyes of many customers,” Tsang said.

Shenzhen-based BYD is also spearheading a wave of overseas expansion from Chinese companies. BYD told Citi that exports were forecast to grow as much as sixfold, to 300,000 units this year, with plans to build new factories in Asia, Europe and South America.

Against this backdrop, some foreign companies, including South Korea’s Hyundai and Japan’s Honda are quietly slimming their presence in China as sales fall, or are exiting the country completely, Tsang said.

Others, including Volkswagen and GM, are doubling down on decades of investment by spending billions of dollars to secure local partners for new technologies and resources they see as critical to compete.

In October, the German carmaker inked a €2.4bn investment in a new joint venture with Horizon Robotics, one of China’s leading designers of artificial intelligence chips.

The investment came days after the US unveiled new restrictions to stop American companies selling technology to China. It also followed the introduction of sweeping state support — largely mirroring Beijing’s EV-focused policies over the past decade — in the US and Europe to support local industry and counter China’s rise.

Despite foreign carmakers being caught squarely in geopolitical crosshairs, Tu Le, of Sino Auto Insights, an advisory company, said the VW deal showed that size and growth potential of the Chinese market still made “financial sense” for some of the biggest automakers — especially with economic growth forecast to slow in many other regions.

“It is like an addiction that is too hard to walk away from, even with the continued risk of IP sharing,” he said.

For China, investments in auto sector technology and resources have also been an important bright spot in the economy.

According to data provided to the Financial Times by Dealogic, despite last year’s lockdowns, M&A activity related to the EV sector held steady from the year prior at above $10bn across almost 50 deals. Outbound investment from Chinese EV-related groups has also remained steady.

In the wake of the removal of subsidies and a push to expand production capacity, Shi Ji, an analyst with CMBI, expected competition to become only more “bloody”.

Additional reporting by Cheng Leng and Gloria Li in Hong Kong